Success can be a self-fulfilling prophecy.

When RIA firms achieve success, their owners continue investing in growth. Some of the nation’s largest firms reinvest nearly 50% of their profits as a principle.

This creates momentum that then attracts talented people, whose ambition will help the firms grow and attract even more client relationships. Increased revenue and profits allow RIA firms to tap even more resources to grow.

There’s more to success, of course, than a firm’s size, but the biggest firms in the RIA space still enjoy a lot of the glamor. You could say they have the same kind of prestige that boxers in the heavyweight division often do. They have the “punching power” and all the Rocky-level drama. While heavyweights can occasionally be “flabby,” they command all the attention.

What It Takes To Be A Heavyweight (In The Top 100)

To be included in Financial Advisor’s list of the top 100 RIAs (what I call the “heavyweights”) a firm had to have more than $5.4 billion in assets under management at the end of 2021. To be ranked in the top 10 required well over $47 billion. Clearly, these RIAs are no longer small organizations operated by a few partners. In fact, the average heavyweight firm had a team of 180 employees servicing a median 1,551 clients.

The barriers into the league of heavyweights keep growing dramatically too. The 2017 version of this list cut off firms at $2.3 billion in assets, half the size needed today. In 2012 the number was $1.1 billion in AUM.

While much of that tremendous growth was created by the financial markets, consolidation has also played a role in reshaping the RIA ecosystem.

Heavyweights Are Consolidators

In fact, M&A may be the most common path to the top of the list in recent years. Helping that trend along now is institutional capital. Forty-one percent of the top 100 firms in Financial Advisor’s RIA survey report having institutional investors.

In contrast, 20% of what we’ll call the “cruiserweights” (firms that ranked from 100 to 200 in size) have institutional investors. Only 7% of the firms ranked from 200 to 500 (“middleweights”) report outside ownership.

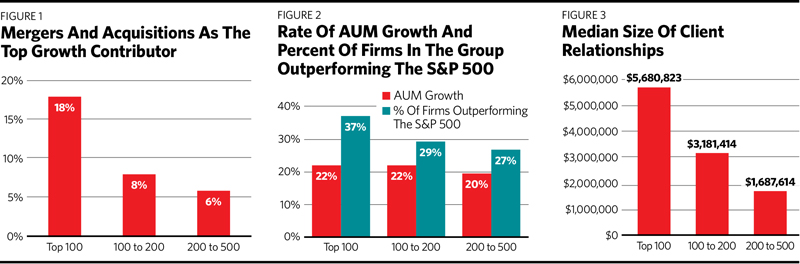

Of the top 100 firms, 18% say that their No. 1 growth driver is mergers and acquisitions. (See Figure 1.)

Heavyweights Are Surprisingly Faster

Canadians like to say you don’t have to be faster than the bear, just faster than the other guy running from the bear. But what happens when the other guys are really fast? Heavyweights grew at a median rate of 22%, the same rate as their cruiserweight counterparts and faster than the middleweights (who grew at 20%). The math suggests that we should be seeing the opposite phenomenon—that the smaller denominator should make it easier for smaller firms to grow at a faster rate. (See Figure 2.)

Clearly acquisitions, combined with bigger marketing budgets, larger reputations and more business developers, create an advantage for the largest firms.

If You Want Larger Clients, Be A Larger Firm

Most advisory firms are looking to increase the amount in assets they have per client. Bigger clients promise more profitability, which also gets firms a reputation for the sophistication of their services. It seems from our data that if you want bigger client relationships, you should strive to make your firm larger. The top 100 firms clearly demonstrate that.

The heavyweights have an average assets under management per client of $5,608,823 while the cruiserweights have $3,181,414 and the middleweights have $1,687,614.

The clients with the most assets frequently prefer the richer resources of bigger firms. (See Figure 3.)

If You Want To Grow Faster, Consider Smaller Clients

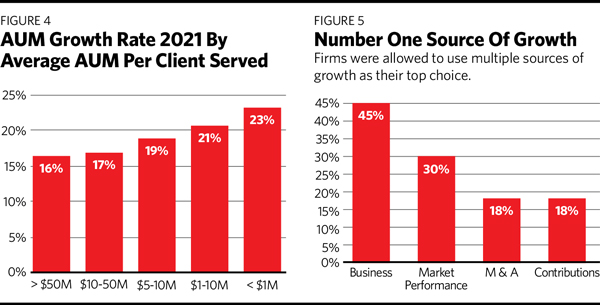

While firms usually want bigger clients, they should consider smaller relationships, too, as a way of accelerating their growth. If we categorize firms according to their average client size, we see that the smaller the target client size, the faster the actual growth.

Those firms whose clients had more than $50 million in assets under management had the slowest growth in 2021 (at 16%). Those firms that work with the smallest clients, on the other hand (people with less than $1 million in AUM) had the fastest growth. That holds true as we progress to the other cohorts. Those firms whose clients have $10 million to $50 million saw 17% growth; those whose clients have $5 million to $10 million grew at 19%. Finally, firms whose clients have $1 million to $5 million grew at 21%. (See Figure 4.)

In other words, as you move from the mass market through the affluent, high-net-worth and finally ultra-high-net-worth markets, the growth slows down very likely because the competition dramatically stiffens.

According to an Ensemble Practice survey of consumers, 66% of those clients with more than $5 million in assets under management already have an advisor, while 52% of those with AUM between $1 million and $5 million have such a relationship and only 35% of the smallest clients work with an advisor.

Forty-five percent of firms consider business development their No. 1 source of growth. Thirty percent of firms consider the market their primary source of growth, and an equal 18% of firms relied on M&A or contribution of assets from existing clients (additional savings or wallet-share). (Firms were allowed to use multiple sources of growth as their top choice.) (See Figure 5.)

If You Want A Faster Career, Consider Joining A Smaller Firm

When an advisory firm succeeds, so do its team members, and successful firms grow faster when they create more opportunities for their employees. They pay more in both bonuses and base compensation. They create more career paths. But small firms offer perhaps a faster way to the top.

Look at the organizational structure of advisory firms, especially the percentage of team members considered “partners” or “top executives.”

In the top 100 advisory firms, 16% (one out of six) of the team members are either partners or executives. This number grows to 18% of the next 100 firms. It’s 24% for the smaller firms ranking from 200 to 500.

So in smaller firms, more team members are partners and perhaps there are many opportunities for advisors at the firms to grow their careers to that level. As the firms grow larger, they create more positions and more diverse paths to advancement, but perhaps the journey is slower and a smaller number of the team members are able to travel it.

Success And Failure

They say, “Success has many parents and failure is an orphan.” There are many people who deserve credit for the success of the top firms. Their advisors deserve kudos for the amazing work they do with clients, continuing to forge wonderful relationships. The marketing teams deliver organic growth. The executives execute complex negotiations to grow the firms through mergers and acquisitions. Other staff members help retain clients. And then there are the markets, which gave us an amazing boost in 2021!

The growth of the community of independent-minded firms is mesmerizing in its speed and scope. It has created a prosperous and evolving ecosystem of enterprises that continue to set records for size but, even more importantly, continue to create opportunities for their teams, care for their clients and provide returns to their investors. Congratulations to the top 100!

Philip Palaveev is the CEO of the Ensemble Practice LLC. He’s an industry consultant, author of the books G2: Building the Next Generation and The Ensemble Practice and the lead faculty member for the G2 Leadership Institute.