Anyone checking out property values on Zillow or similar websites, or buying or selling a home, has probably noticed the hot market for residential real estate in many parts of the country this year. But the recent track record of real estate investment trusts, or REITs, presents a less rosy, more scattered picture.

After delivering a total return of 28.66% last year, the FTSE Nareit All Equity REITs Index fell 12.3% for 2020 through the third quarter. Most real estate sectors in 2019 were up by double digits; so far this year, most of them are down by as much, or more.

The widely disparate impact that the Covid-19 pandemic has had on various corners of real estate is reflected in year-to-date returns through September 30, which ranged from a negative 54% for regional malls to a positive 26% return for data center REITs. Other hard-hit sectors this year include lodging/resorts (which fell 49%), retail (which fell 40%) and offices (which fell 30%). Among the most resilient corners of the REIT market were infrastructure (up 14%), industrial (up 9%) and self-storage (up 6%).

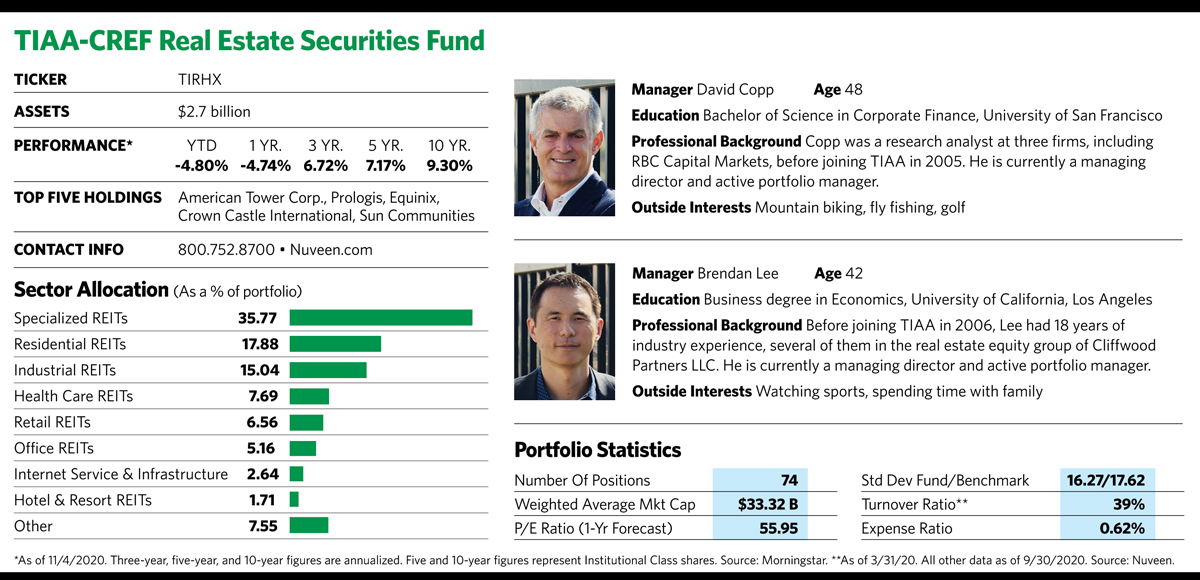

“The pandemic accelerated trends, such as competition from online shopping, that were already in place before this year,” says Brendan Lee, co-manager, with David Copp, of the TIAA-CREF Real Estate Securities Fund. “But there’s always a bull market in real estate somewhere. Our job is to look for it.”

Copp and Lee have been doing that for nearly 25 years, well before they began managing the fund in 2006. Their paths first crossed in the late 1990s, when Copp was an analyst writing research reports on REITs for an investment firm, and Lee used his work to help guide investment decisions at a real estate hedge fund.

The collaboration has worked well thus far. Over the last three, five and 10 years, the portfolio of about 50 to 70 names has performed better than the vast majority of its Morningstar peers, with less risk. It has done well in both boom and bust cycles. In 2019 it was up 31%, beating the index by over 2 percentage points. In 2020, it fell about half as much as the index through the third quarter. The $2.7 billion fund’s reasonable expense ratio of 0.62% for “Advisor” class shares has also taken a below-average bite out of returns.

As they have through most of their tenure, the managers work from their respective homes in Southern California about an hour away from each other, but they are in constant contact through phone, e-mail and texts. “The work- from-home trend is something that has been an investment thesis recently,” says Copp. “But we’ve been doing it for a long time.”

One thing that has changed is travel restrictions, which make it necessary for them to do more virtual property tours rather than physical visits. “Physical inspections are important, but we can still make decisions without them,” he says.

Playing More Defense

Like other equity REITs, those in the fund’s portfolio own and operate income-producing real estate, and shareholders receive that income in the form of dividends. To qualify as REITs, companies must pay out at least 90% of their taxable income, which is why they typically yield more than most stocks.

“The classic reasons for investing in equity REITs still apply now,” says Copp. “They allow investors to have a stake in large commercial properties and assets that they can’t invest in directly. They’re a great diversifier and inflation hedge. And they are more liquid than physical real estate.”

Lee adds that valuation metrics in this area are attractive when you compare them with the rest of the stock market, and he remains optimistic about the future. “Things certainly look negative now in some areas of the real estate market. But we think that in the next 12 to 24 months demand will bounce back.”

Copp and Lee say the portfolio is populated by companies boasting experienced management teams they’re familiar with, as well as above-average earnings and cash flow. The companies also have acceptable levels of debt. After the managers buy a REIT name, they typically wait two to three years for their investment thesis to play out.

They also consider economic cycles and how these will impact different parts of the market when they are making allocation decisions. About three years ago they began migrating out of office, retail and lodging REITs. Those sectors had thrived when the economy was on an upswing, but they had started looking less attractive and become overpriced as the recovery matured.

At the same time, the fund gravitated toward more stable sectors of the market that offered more predictable cash flows, things such as data centers, cell towers and manufactured housing communities. The move, designed to help cushion the impact of an economic slowdown, proved critical in helping the TIAA-CREF fund mitigate losses in 2020.

A number of stocks in the portfolio have been able to maintain stable, growing cash flows in a changing and challenging environment. Cell tower giant American Tower, the fund’s largest holding, is an infrastructure play that stands to benefit from the continued rollout of 5G networks, which Lee views as “a continuing tailwind for the next half decade.” A leading independent owner and operator of telecommunications real estate, American Tower generates almost all its revenue from leasing contracts with telecommunications companies such as AT&T, Verizon and T-Mobile. The company helps ensure earnings growth by raising lease prices year after year.

Another reliable income producer, Sun Communities, owns and operates hundreds of manufactured housing and recreational vehicle communities located in 33 states throughout the United States and Ontario, Canada. Tenants, typically retirees, usually buy the manufactured homes and pay a monthly fee for use of the land they sit on. “These are steady eddy rentals located in desirable neighborhoods,” says Lee. “Most people are long-term tenants. And because amenities are usually limited to a pool and laundry area, expenses are kept to a minimum.”

Another well-positioned name in the portfolio, Rexford Industrial Realty, is a warehouse REIT with facilities centered in and around Los Angeles. Because the company acquired the land that its warehouses sit on years ago, before area prices began to soar, it has a big advantage over newer competitors. “No one is building warehouses in the area because land prices are just too high,” says Copp. “Rexford came into the pandemic with just a 2% vacancy rate, and demand for its facilities is strong.” Warehouses and other REITs in the industrial sector are generally seeing rising rents, he adds.

Top 10 holding Invitation Homes, a single-family rental REIT, manages and leases approximately 80,000 homes in 16 markets across the country, focusing mainly on burgeoning areas in the western U.S. and Florida with major employment centers and good schools. The company has benefited from rising rent collections for single-family rental properties, and appears to be playing out the thesis that individuals and families are more willing to move to the suburbs where space is ample and conducive to a work-from-home environment. Another single-family rental REIT in the portfolio, American Homes 4 Rent, is also benefiting from the work-at-home trend that’s accelerated during the pandemic.

“When companies in high rent areas like New York and San Francisco allow people to live anywhere, many are going to move to lower-cost areas such as Phoenix, Denver or Charlotte,” says Lee. “Someone paying $3,500 a month for a two-bedroom apartment in San Francisco could get a four-bedroom house in Denver for the same price.” The trend has already had an impact on demand and apartment rents in high-cost areas.

While things may look bleak now, the commercial office and apartment market in high-cost locations could bounce back once the pandemic subsides. “At first people thought working in their pajamas from home was cool,” says Lee. “Now, Zoom fatigue has set in, and there’s a challenge of focusing when kids are running around the house. Maybe a balance will be for people to work three days a week from the office and the rest from home. It will be interesting to see what happens six months or a year from now.”

Copp is also taking a wait-and-see attitude. “This isn’t a typical downturn for offices that’s driven solely by the economy. There are more unknowns now. At the same time, high quality real estate assets in New York and San Francisco are hard to replicate.”

Things look less certain for retail stores and mall properties, which have been fighting the headwind of e-commerce and online shopping for years. “They’re going to have problems long after the pandemic subsides,” says Copp.