It's been clear for quite some time from industry data and personal experience that net organic revenue growth of RIA firms is quite low when you, by definition, exclude market movement.

Charles Schwab recently released their 2022 RIA Benchmarking Study and I decided to crunch the numbers and see what the data shows.

I'll go straight to the punch line: The average RIA firm had negative revenue growth over the past five years if you exclude market movement using a traditional 60/40 market portfolio as a proxy for RIA investment allocations.

In other words, essentially all the revenue growth for RIA firms in the Schwab study over the past five years was simply due to growth in the financial markets.

Various assumptions are built into my calculations but there's no doubt net organic revenue growth is almost non-existent.

Why care? Organic growth is the lifeblood of a business and without it, you are at the mercy of volatile financial markets.

Crunch The Numbers

Here’s how I crunched the data.

The S&P 500 total return for the five years ending December 2021 was 112.9%. The total U.S. Government Bond market total return for the five years ending December 2021 was 19.5%. With a traditional 60/40 allocation, this portfolio would have grown about 75.5% over the past five years for a CAGR of about 11.9%.

Now, let’s take two cuts at the growth performance of advisory firms in the 2022 RIA Benchmarking Study from Charles Schwab relative to what the markets did.

AUM Growth

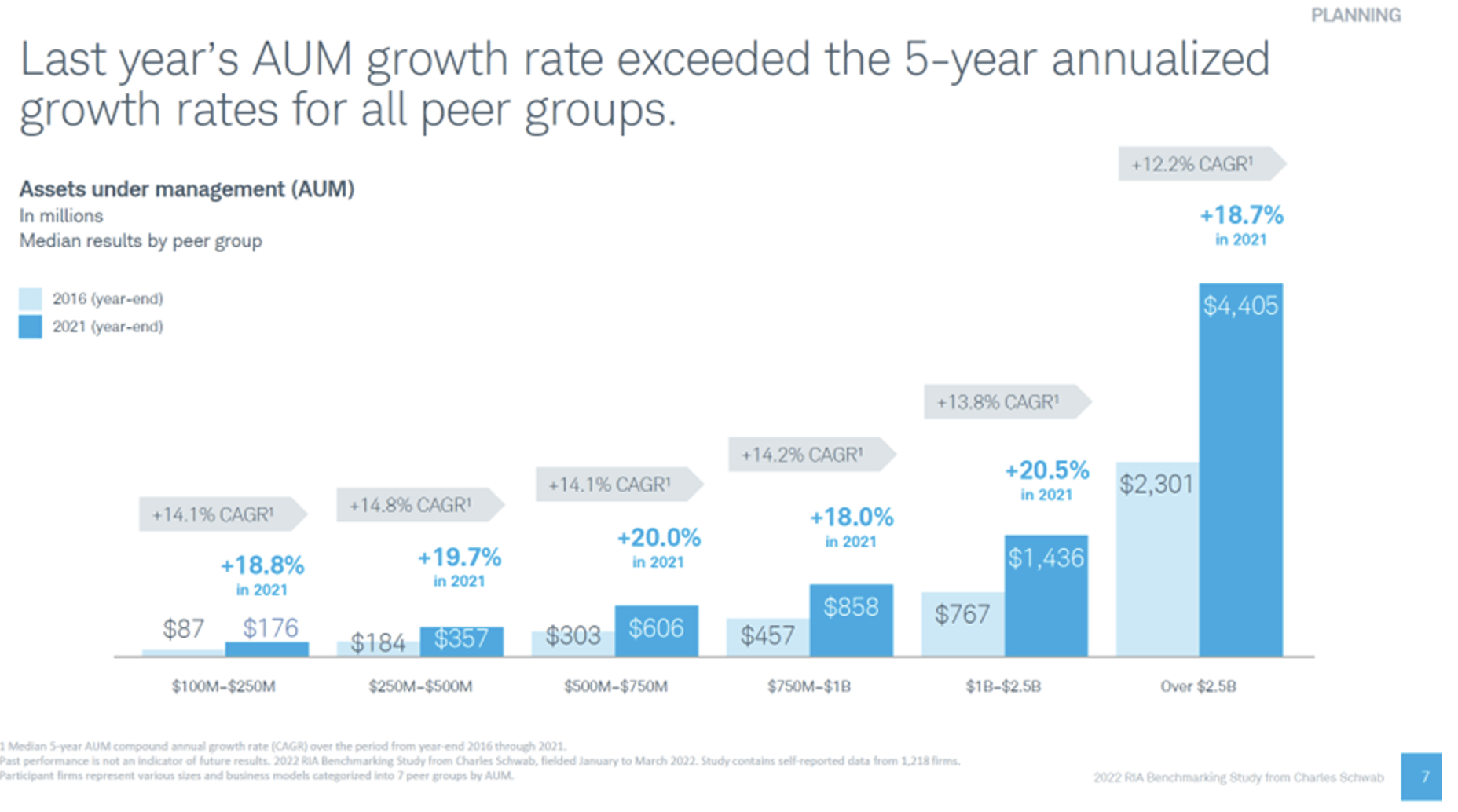

Schwab’s Benchmarking Study breaks out its results in six peer groups based on AUM as you can see in the chart below.

Schwab's report says the average CAGR of AUM for all firms in the study for the five years ending 2021 was 14.1% (and, interestingly, the slowest growing firms were the largest, the ones with >$2.5B in AUM). The 14.1% CAGR of AUM sounds pretty good until you look at how much of that growth was simply due to market growth.

For comparison, a passive 60/40 bond portfolio, as mentioned above, grew at a CAGR of 11.9%.

Simple math says the CAGR of net new assets (i.e., excluding market movement) for the average RIA firm that custodies at Schwab was only 2.2% over the past five years.

Revenue Growth

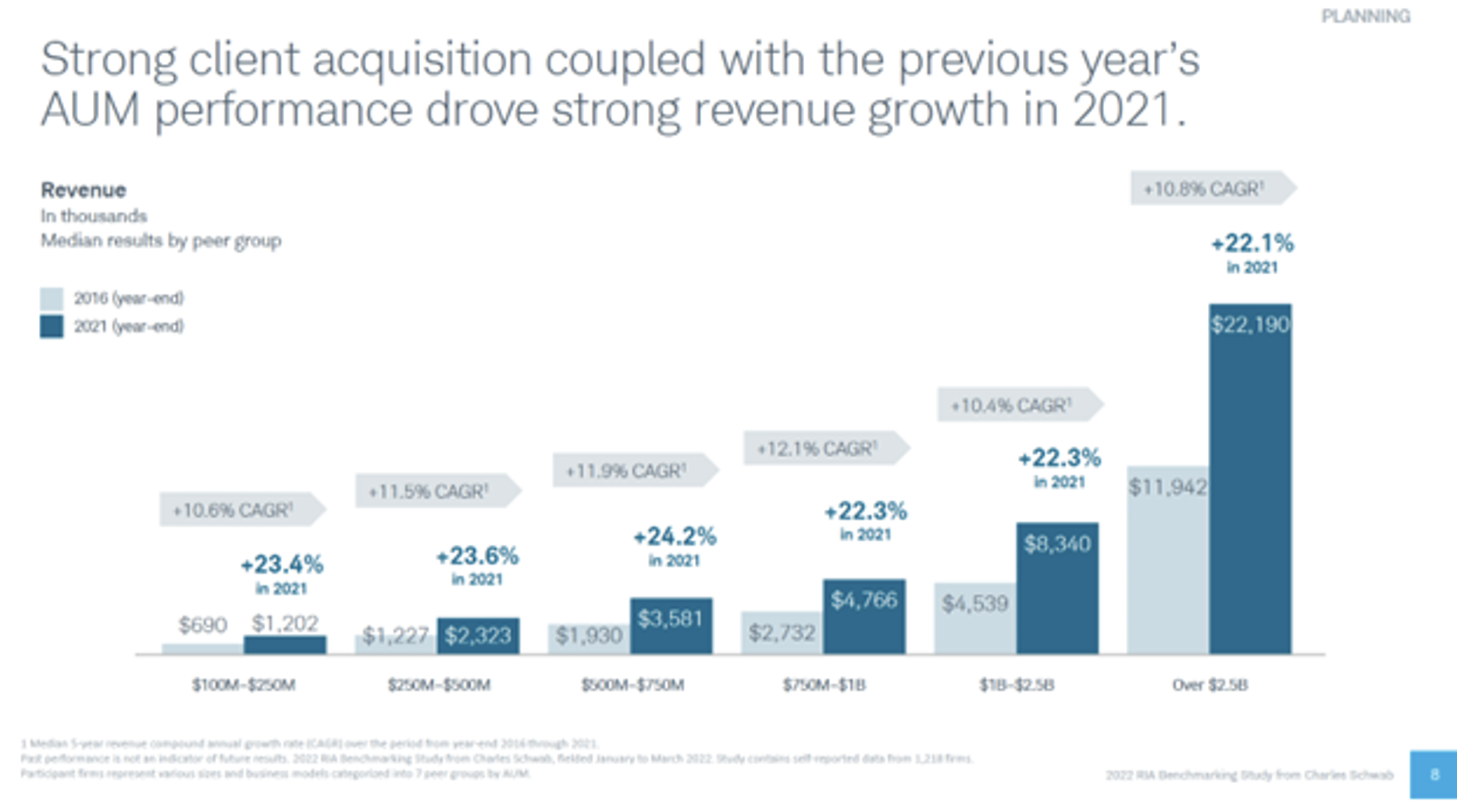

You can’t eat AUM so let’s look at actual revenue.

Schwab's report says the average CAGR of revenue for all firms in the study for the five years ending 2021 was 11.3% (and, interestingly, the fastest growing firms were the $750M to $1B AUM firms—the ones that many industry pundits say are in the "messy middle" where they're too big to be lifestyle and too small to benefit from economies of scale).

So, here's the deal…

A passive 60/40 bond portfolio, as mentioned above, grew at a CAGR of 11.9%. This suggests that the average RIA firm actually had net negative organic revenue growth over the past five years, and the only reason why they showed positive revenue growth was due to market movement.