When the coronavirus came to the U.S. shores and the economy was suddenly forcibly shut down in March, Americans came to grips with a number of philosophical questions: What are your goals in life, really, when your life might suddenly be taken from you, or your loved ones? What does money mean to you—what are your true goals for it?

Financial advisors took a hit in many ways that were likely as emotional as they were financial. Suddenly, work colleagues were robbed of the daily camaraderie that keep people engaged, focused and sane. Financial planning is a people business that allows you to meet with clients, look them in the eye, determine their fears, show empathy, give counsel, discover a person’s psychology. What does it mean to do that over a computer monitor? If that feels alienating to you, 2020 likely felt more like 2001: A Space Odyssey.

To view FA's 2020 RIA Ranking and the 50 Fastest Growing RIAs, click here.

“People in financial planning did not come into this business because of bottom lines or money,” says Elissa Buie, the president and CEO of Yeske Buie in Vienna, Va., and San Francisco. “They came into this because they like math, they like financial planning and they like human beings.”

Still, RIAs have faced practical fears this year. When the markets plunged, their asset-based revenues were threatened. That meant the firm owners hoping to sell their businesses in a few years were suddenly worth much less on paper. Bosses had to weigh the possibility of laying off staff, getting rid of team members who were supposed to help them grow or eventually take over the firms.

Some RIAs suffered flashbacks. “When we came into this pandemic, I had some serious post-traumatic stress syndrome reactions from the 2008-2009 time frame,” Buie says. “Someone asked me, ‘Do you really need to keep doing this?’ Not financially I don’t. But I love my clients and there’s no way I’m leaving them in the middle of this.” She thinks many other planners felt the same way.

The market rebounded, of course, mooting a lot of the valuation discussions. But the questions the pandemic raised persist: What business margins did you need to have to avoid calamity? Was your firm overvalued? How do you find new clients remotely? Were you reinvesting in your firm or savoring a high-margin lifestyle practice? Did you already have the technology ready to go to work from home, interacting with both your clients and staff through either Zoom or Microsoft Teams? (Yeske Buie bought 15 laptops for staff to work from home, Buie says.)

Scott Hanson, the founding principal of Allworth, says his firm has 230 employees in 17 offices and, in a 10-day period in March, was forced to make sure all these people were working remotely. “It certainly tested our IT department,” Hanson says. For six weeks, he says, nobody wanted to talk about money at all. Allworth had to cancel its live events, workshops, seminars and symposiums. “We really had to pivot on our marketing. Roughly 35% of our new clients came through live digital events.”

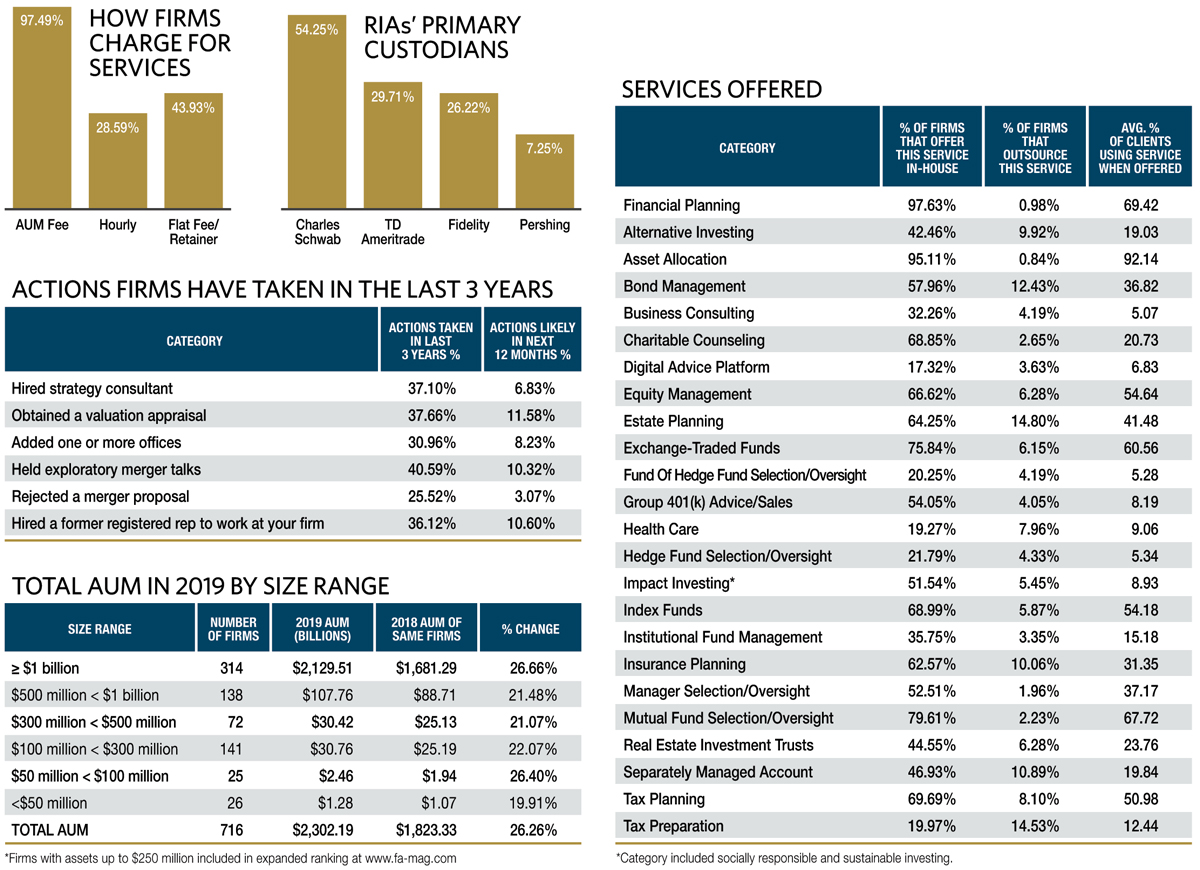

Hanson says that the RIA business model is robust enough to get through a sudden market swoon. “While there [was] margin compression, we weren’t suddenly trying to figure out where’s cash flow coming from. And we all have reoccurring revenues,” he continues. “The quarterly fee happens in good times and in bad times. It’s not like you’re having to go out and resell a bunch of clients every quarter or sell new products or services every quarter.”

But others say that firms without healthy margins, perhaps those that had taken on a lot of cheap debt in the low-interest-rate era, were likely caught with their pants down during the pandemic.

“If you’re a $500 million RIA with no debt, what was there to worry about this year? Big deal,” says Peter Mallouk, president of Creative Planning in Overland Park, Kan. “If you were a $5 billion RIA where you’ve got $100 million of debt and a PE backer and all that, well you’ve got a problem. You can’t make your debt payments if the market stays down 40% for two years. Fortunately, the market did come back.”

Inevitably, some firms will struggle. “What we have seen is that companies that were not healthy financially are really, really struggling,” says Wilson Hoyle, leader of the Advisor Group at CAPTRUST in Raleigh, N.C. “They are laying off people, they are borrowing money. They are doing what they can to survive. And that goes for large RIAs and small.”

CAPTRUST had finished three acquisitions this year as of June. Hoyle adds that the firms best able to withstand painful periods like 2020 are the ones reinvesting in their business, especially technology. “I can assure you that other firms that aren’t as durable are not looking to grow, they’re looking to just sustain.”

Growth is key. “Most RIAs are not growing,” Mallouk agrees. “I think that’s the dirty secret of the industry. Most RIAs are just growing a couple of percent a year and that’s it. And so they have very big margins, because [they] don’t have to invest in growth. When you’re growing, you have to hire out in front of it. You have [to get] real estate out in front of it. Invest in technology out in front of it.”

More profit-taking often signals stagnation, he says.

Margin Compression Vs. Fee Compression

The ranks of the nation’s largest RIAs increasingly are dominated by firms like CAPTRUST and Edelman Financial Engines with huge 401(k) businesses. This gives them two major advantages—they receive continual flows of new assets and they must learn to manage their margins

Hoyle says that CAPTRUST hasn’t seen fee compression yet in the RIA space. “One thing I think we’ve all experienced over the years is maybe some margin compression,” he says. “Because you have to do more services for maybe the same fee than you did 10 years ago or five years ago.” CAPTRUST, which has deep penetration in the DC plan consulting business in a bunch of cities, started pairing its wealth management business in those cities to exploit those existing relationships and enjoy wealth management’s higher margins.

“We have felt forever that it was harder to build a firm that could support three business lines—wealth; the retirement plan consulting business; and endowments and foundations,” Hoyle says. “It was a steeper climb, and it was a more difficult climb, but it would create a more diverse revenue stream, which would insulate us from crisis. … We’re benefiting from that now.”

One of the things the coronavirus market crash did to the advisor industry is threaten the value of firms in a time when their valuations were at peaks. Many advisors approaching retirement were likely thinking of cashing out at those huge multiples.

Michael Tiedemann, CEO of Tiedemann Advisors, says his firm is not in acquisition mode, but he adds that until recently there were too many interested buyers in the market, and this was pushing multiples for advisory firms too high. The coronavirus likely poked a hole in that bubble, he argues.

Dislocations like the one in 2020 have been good for organic growth firms like his. “People re-evaluate their current advisor, mistakes they made, service that wasn’t there when it should have been, etc.” Both clients and talent likely make changes in an environment like this, and he says his firm has been able to hire good staff from competitors and enjoy organic growth.

Lower margins mean problems for junior partners buying into a firm, says Andy Berg, the CEO of $7 billion AUM firm Homrich Berg in Atlanta. He is personally familiar with other firms that have this problem. “Firms that had lower margins—I would say margins less than 25% going into this year—coupled with maybe a too healthy valuation that they used for their buy-ins for junior folks—have [had] problems. It can be exacerbated if those firms have a partner, say a private equity partner or are involved in a roll-up,” Berg explains. “Their partner distributions aren’t as projected, therefore their cash flow to service their debt might be insufficient.” That’s one reason his firm wants to stay independent, he says.

However, debt is still likely attractive to growing RIA firms for other reasons, Berg says. In the past, his firm has done all equity deals when acquiring. But if a firm’s equity has gotten too rich, it’s too rich to pay to new partners the firm is buying up. “We definitely could see using some cash going forward for two reasons. One, our equity is very valuable and interest rates are low. … If we can borrow at 3% or 4%, we’d rather do that because our equity is going to grow faster than that.”

Mallouk maintains that maybe five or 10 really substantive RIAs are going to end up with 80% of the assets in the independent space, and the consolidation of custodians (think of Schwab recently purchasing TD Ameritrade) is going to help that trend along. “I think you’re going to see the power now shift to the custodians,” Mallouk says, “and I think that the custodians are going to begin to squeeze the smaller players. They’re not going to want to have to regulate and keep track of all these relationships. They’re going to start to impose fees on the smaller [RIA] firms, forcing them to get bigger or sell to bigger firms.

“‘You’ve got $300 million under management? We want you to pay us basis points for our services,’” he continues. “It doesn’t sound like a lot of basis points, but as margins continue to get squeezed … three basis points could be 10% of the profits or 20% of the profits.”

Jon Jones, CEO of Brighton Jones in Seattle, says that you’re likely to see more firms add services to make up for compressed margins and fees. “Some firms will need to be comfortable with lower margins due to lower fees,” Jones says. “Or they can add services like accounting. People will pay money to have taxes done. Hiring one tax professional adds overhead and likely no additional revenue—that’s compression. [By] adding four to five tax people, you can add enough value to charge enough to break even. Additional services like real estate and philanthropy can also keep margins neutral or increase margins.”

Benjamin Harrison is the head of the RIA custody business at BNY Mellon Pershing, which works with 750 registered investment advisors. RIAs’ advisor fees for managing money have been unchanged at 75 to 80 basis points for assets under management over the last 10 years, he says. “We have seen, however, they are working harder than ever to retain that fee. So they’ve expanded their services offering significantly,” Harrison says. “What they’re earning is across a much wider spectrum of work that they are doing for those clients, from planning to specialty work to value-added services, etc. So there’s definitely scope-creep.

“We see consolidation at the upper end of the marketplace right now. We see it on the custodial landscape with the retail providers consolidating. We see it in the fintech space, in the TAMP space with consolidators coming in and scooping up and doing acquisitions. We see it in the investment section of the value chain around increased pressure on asset management fees, etc. It hasn’t quite made it yet to the advisory fee; however, I would anticipate that the pressure on those businesses is absolutely going to accelerate over the next five years.”

Marty Bicknell, the head of fast-growing Mariner Wealth in Leawood, Kan., says his firm did 11 acquisitions in 2019 and was ready to slow down this year when the pandemic hit. For him, it’s important to mix up revenue streams, buying tax services, for instance. But he thinks the industry isn’t actually seeing fee compression.

“But I have heard lots of people talk about doing more for the same fee. I would tell you absolutely we focus on our client experience and our client value proposition and try to do more for our client,” Bicknell explains. “But when I think about tax services and insurance, we don’t give those away. Those are incremental revenue.” In the past, he says, 100% of the firm’s fees were for wealth management. “Now they’re in the 80% range. Ultimately I’d like to see it at 60%.”

Can You Sleep On Those Three P’s?

One of the most contentious discussions in 2020 is whether people should have taken money from the Paycheck Protection Program, a government program meant for small businesses to take loans from the Small Business Administration and meet payroll to avoid laying off staff during the Covid-19 pandemic. The program has sparked controversy among advisors over who took (and who should have taken) the money, the argument being that advisors should have had emergency funds in place anyway if they practiced what they preached, and that the market rebound made the loans unnecessary when so many other people were in need (the loans were forgivable for companies retaining staff). Among the higher profile RIA names to take the loans were RegentAtlantic, Sequoia Financial Group, Carson Group, Sand Hill Global Advisors, Brighton Jones and Ritholtz Wealth Management (whose CEO Joshua Brown famously defended the loan and said it was nobody’s business). Ritholtz already paid off its loan and others are likely to follow.

Andy Berg said Homrich Berg didn’t take PPP loans and he says he doesn’t know how independent RIAs can justify keeping the money now that the market is rallying. “Most RIAs should be on schedule to have more profits this year than they did last because of the tailwind that existed from 2019.

“The only people that I know that took the money and didn’t pay it back right away within the time frame are keeping it on the sidelines, thinking that things could get very bad again. Or they have an initiative, which I think is misguided, to use it for growth,” Berg adds.

Allworth’s Hanson also has mixed feelings about companies taking PPP money. Allworth chose not to, he says. But the whole point of planning is to design strategies around available programs, benefits and debt, something he thinks is overlooked by the critics.

“Much of what financial planning does is help our clients reduce their tax bill. So how do we keep money from going to Uncle Sam? Then if you look at some of the advanced estate planning, even more so. There’s all these Social Security strategies. How do we maximize those benefits? So when you’ve got a time when the government was handing out free money, it’s hard to come back now, a Monday morning quarterback, and say that wasn’t the right thing to do.”

Like Brown, Elissa Buie not only admits to taking PPP money but says she stands by the decision with full conviction (she says she even went with mask and hand sanitizer to Rep. Nancy Pelosi’s office in San Francisco to lobby for such help). “I will not apologize,” she says. “We don’t run on 50% margins. Firms like ours could charge more and have bigger margins, but we don’t. Because we charge what is the market rate and we hire the appropriate number of skilled people to do the work. Our revenue drop would be really difficult for us to deal with.”

Technology

Tiedemann says that his firm had been spending three years integrating its financial and communication technology for its 10 offices (one of which is in Zurich) and was ready to handle its far-flung talent when the Covid crisis hit.

Mallouk says Creative Planning has just spent millions of dollars, its most ever, on tech in the last 18 months as the firm has invested in everything from planning software to trading software to an app, to CRM, mainly proprietary applications.

Andy Berg says tech spend will continue to eat into margins. He adds that the client technology experience at Homrich Berg is dramatically different from what it was two or three years ago, and gives portfolio management platform Black Diamond credit for that. “It’s really the first time where we’ve been able to have clients have accurate real time data on their entire portfolio including alternative investments in a very easy user-friendly basis on their phone or their iPad. Some firms don’t have it, but I wouldn’t want to be them.”

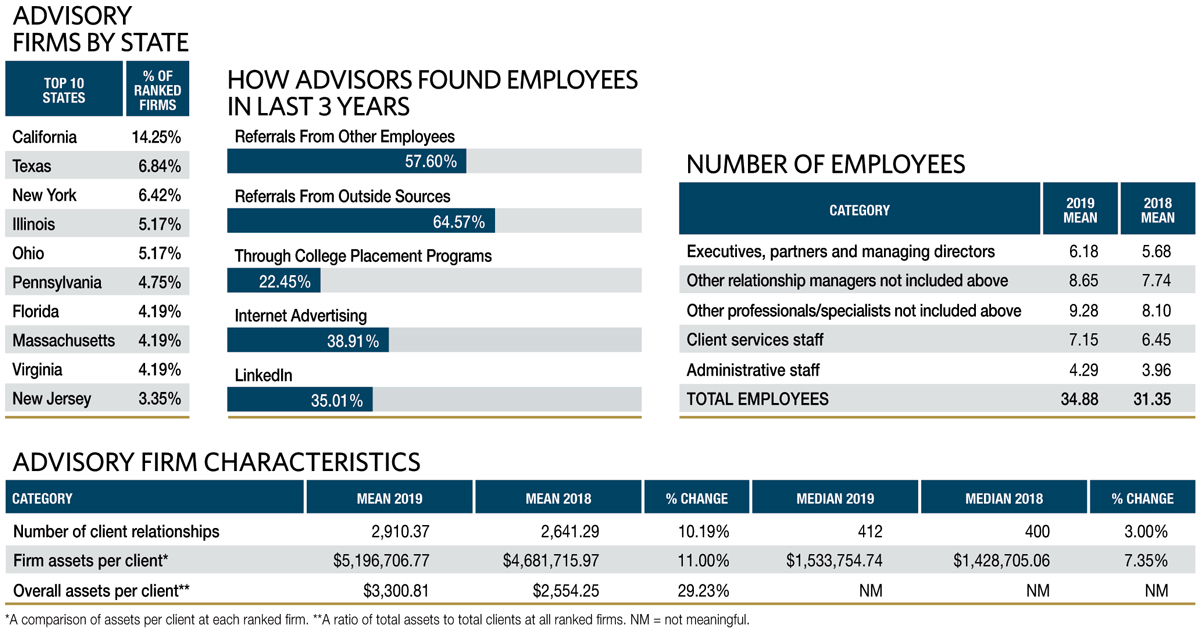

The rising importance of tech likely has advisors rethinking their balance sheets and how they spend. Harrison, at BNY Mellon Pershing, says firms in 2020 are looking at their P&L sheets differently. “Firms are rethinking their real estate footprint,” he says. “We’ve proven in this environment that there’s high productivity for individuals to work from home. … I would expect a drawdown in real estate investment and instead a capex investment in technology and digital tools and more of a virtual-first engagement model.” That goes for business development as well, which will have to be more intentional, digital and dependent on referrals from influential professionals in other industries, he says.

“They can’t use the old playbook, the old model of shaking the bushes for leads,” Harrison says.

Supply And Demand

Matt Cooper, the president of Beacon Pointe Advisors in Newport Beach, Calif., says there’s still a graying problem in the RIA industry and a lack of new blood entering the ranks, and that supply and demand dislocation will help advisors. So will market volatility and general social anxiety, since people are going to turn to advisors more. These things make the RIA world attractive, as does the stickiness of the relationships, which he says is one of the things drawing giants like Goldman Sachs into the mass market RIA world (Goldman famously bought United Capital Financial Advisers last year).

“You’re looking at retention rates of 97% plus on average across the industry,” Cooper says. “So very steady, predictable cash flows.”