Securities-based lending (SBL) continues to grow in popularity as advisors and their clients increasingly recognize its tax efficiency, convenience and flexibility in meeting short-term cash needs while maintaining a well-defined wealth plan. Though selling assets is often considered the only solution to generating liquidity, having access to and the ability to utilize a securities-based line of credit could be a better option for quick short-term cash needs.

The ABCs Of SBL

It is important to understand the basics of securities-based lines of credit. Purpose lines, commonly known as margin lines, are used to acquire investment securities to add to an existing portfolio. In contrast, non-purpose lines can be used for a wide variety of needs, including tax payments, school tuition, automobile buying and home purchases or renovations, or other non-investment securities asset purchases.

The amount of credit available for a non-purpose securities-based line is based on an advance rate against the collateral of the account. This is very similar to a loan-to-value amount that banks are willing to lend when financing a home purchase through a residential mortgage. Advance rates for purpose lines of credit are limited to 50% of the account value, while non-purpose lines can be higher given the credit usage. In both cases, establishing one of these lines of credit is very simple as the required documentation is very minimal. And unlike most other credit types, the credit approval is mainly based on the collateral value of the portfolio.

The other advantage of a securities-based line of credit is the affordability. There is usually not a fee to establish a line of credit, and the only cost the client will likely incur is an interest expense when the line is utilized. As these credits are secured by liquid collateral, the interest rates are typically economical, especially if using the line for truly short-term cash obligations. Most lines of credit have floating interest rates based on an index, such as the prime rate or secured overnight financing rate, with an appropriate spread attached.

Securities-Based Lines Of Credit Versus Asset Sales

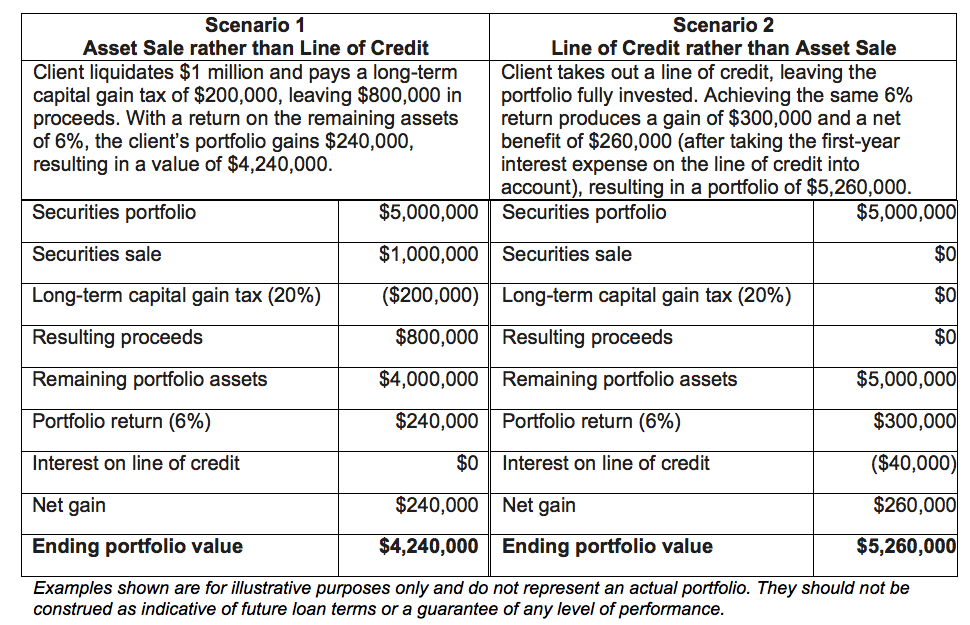

There are many reasons to have a securities-based line of credit available. One example often cited is the option to avoid selling an asset quickly or unnecessarily (and paying the corresponding taxes) in order to have quick access to cash. The timing of selling a security is important to a wealth plan, as is understanding the implications of incurring long-term capital gain taxes, recognizing unnecessary losses, and assessing the cost of long-term capital gains. In addition, there is the opportunity cost. By liquidating assets in the stock market, for example, your client might miss out on greater returns.

The tables below show how these advantages could play out.

Securities-Based Lending Versus Mortgage-Based Financing

An alternative to a securities-based line of credit is a home equity line of credit or a mortgage refinancing. There are pros and cons to these alternative financing options. One benefit of residential mortgage-based lending is that the credit commitment typically is longer. This provides a long-term fixed rate and some interest expense is tax-deductible. On the other hand, the time from application to approval is longer than a securities-based facility. Furthermore, residential lending solutions require a significant amount of documentation such as tax returns, bank statements and paychecks, and the bank performs an appraisal on the home. Alternatively, the largest benefit of a securities-based line of credit is the ease of qualifying and establishing this facility.