· The sudden spread of human-to-human transmission of Severe Acute Respiratory Syndrome (SARS) briefly added to the pressures on global stock markets in March 2003. The S&P 500 Index closed at 1553 on Friday, April 5, the level the current rally first reached a month ago. The stock market’s stalling momentum and increasing volatility, combined with other signs evident in the market’s recent behavior, suggest investors might be looking for new inspiration.

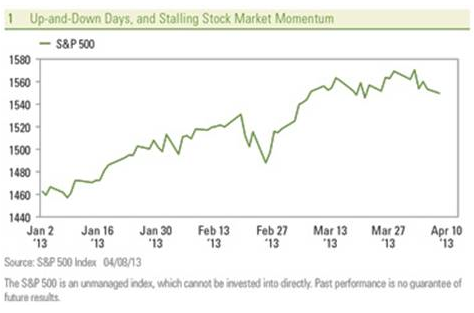

The S&P 500 Index closed at 1553 on Friday, April 5, the level the current rally first reached a month ago. The stock market’s stalling momentum and increasing volatility, combined with other signs evident in the market’s recent behavior, suggest investors might be looking for new inspiration.

· Daily push-and-pull action: The S&P 500 has now reversed direction on a daily basis 12 times in a row—that has never happened before in the 85-year history of the S&P 500 Index. It may be noteworthy that the only time the index had reversed direction daily for 11 days in a row was July 26, 1981, ahead of a 15 percent loss, and the last time it reversed direction 10 days in a row was April 17, 2002, ahead of a 30 percent stock market decline.

· Stronger selling conviction: Over the past month, trading volume for the S&P 500 stocks has been 20% higher on down days than on up days.

· Risk vs. safety battle: Last week, traditional opposites—the S&P 500 Index and gold prices—both traded at the same level (1554). Gold rebounded later in the week while stocks slumped. The last time their paths crossed was May 2010, just before the stock market reversed its trend and began a pullback.

· Defensive leadership: Stocks have recently been led higher by defensive, rather than economically-sensitive, stocks.

These signs suggest that an event in the coming weeks could tip the market trend into a modest pullback or refresh it for another run.

While much of the attention in recent months has been directed toward Europe as a source of potential crisis or breakthrough, global attention has now turned to Asia. The weak U.S. economy and extended stock market run-up may be vulnerable to a shock or due for a recharge. A flu pandemic or an act of war by North Korea could be a shock that results in a setback to the economy and stock market, while the aggressive stimulus in Japan could be a boost that finally gets stocks to break out of their month-long range.

Spreading Bird Flu

An influenza pandemic has the potential to exact a great human and financial toll. The Chinese stock market suffered last week, despite better economic data, from the spreading outbreak of the bird flu, referred to as the H7N9 virus. None of the 21 confirmed cases in China have yet confirmed that the virus has spread from human to human. In the past, it was at that point that it began to impact the markets.

· In May 2006, the strain of avian flu referred to as H5N1, was spread directly between members of an Indonesian family. This first case of human-to-human transmission of the lethal virus garnered much attention and pressured the markets.

· Adding to the stresses of the financial crisis in early 2009 was the fast-spreading swine flu as the World Health Organization (WHO) confirmed human-to-human transmission.

While in each of these cases the U.S. stock market experienced at least a 5–10 percent decline around the time of initial human-to-human transmission, other contributing factors helped to result in a weak environment for stocks.

The market may react negatively to headlines about infections spreading and the potential for limited human-to-human transmission. We will continue to watch these developments closely.

North Korean Aggression

South Korea’s stock market was down each day last week as geopolitical risk escalated. North Korea, angered over recent U.N. sanctions prompted by the North Korean nuclear test in February and routine U.S.-South Korean naval exercises, has threatened to launch a nuclear strike against U.S. territories and a missile strike on South Korea.

While likely inflated, such rhetoric has been followed by action in the recent past with attacks that included the sinking of ships and short-lived artillery barrages. The sinking of the South Korean naval vessel Cheonan, and the resulting deaths of 46 crewmen, took place on March 26, 2010. An investigation concluded a month and a half later that the source of the attack was a North Korean submarine and contributed to global stock market weakness. On November 23, 2010, North Korea launched artillery shells and rockets at South Korean military and civilian targets on Yeonpyeong Island—contributing to a pause in the rally among global stock markets.

Last week, stocks fell on Wednesday, April 3, when the news broke that the Pentagon will deploy a missile defense system to Guam in the coming weeks in response to North Korea’s threat. This may mark a break from much of the past 20 years, when threats and aggressive actions by North Korea typically resulted in high-level meetings, a short-lived agreement, and economic aid. Stocks may react negatively to any escalation. Action could occur ahead of the anniversary of North Korea’s founding President Kim Il-Sung’s birthday on April 15.

Japan’s Shock-and-Awe QE

In contrast to the weakness seen in other major world stock markets, Japan’s Nikkei Index was up 3.5 percent last week, adding to a year-to-date rally of over 20 percent on an aggressive policy move to revive growth by the Japanese central bank.

The Bank of Japan (BoJ) announced it will buy 7.5 trillion yen ($76 billion) of bonds a month. Japan was the first nation to use the now common bond purchases known as quantitative easing (QE) 12 years ago and has had little success to show in combating deflation and a stagnant economy. The[A1] new, bolder approach is intended to achieve a two-year inflation target of 2 percent, a level achieved only briefly over the past 20 years (in 1997 and 2008 as oil prices rose sharply). The BOJ shifted its focus to expanding the amount of cash in circulation and on deposit at the BOJ, intending to grow it in excess of the pace of economic output. The surprisingly bold move weakened the yen, which has fallen over 20 percent in the past six months.

A weaker currency may help promote exports and raise domestic inflation, while higher inflation expectations may encourage consumers to spend now rather than wait. Pushing down bond yields may also encourage banks to stop holding so many government bonds and instead be more eager to make loans. Of course, the ability to pull forward spending among aging consumers and the willingness by businesses to borrow is not assured. Also, there is a risk posed by the longer-term consequences of driving up inflation, resulting in a serious increase in interest costs for a country already using 25 percent of its budget to service debt. In fact, the interest rate on Japan's 10-year government bonds is now less than 0.5 percent—the lowest in the world, despite a very high level of government debt and annual budget deficits. Japan's debt is roughly 230 percent of gross domestic product (GDP) and rising, higher than that of Greece (175 percent of GDP) and nearly twice that of Italy (125 percent). Japan believes the only way to turn this trend around is to drive GDP higher and is pulling out all the stops.

Perhaps this bold move may inspire investors to believe more stimulus may be forthcoming from the European Central Bank or the U.S. Federal Reserve, given the weak manufacturing and jobs reports last week, capable of renewing the stock market’s rally.

Plenty of events—including those listed here—may serve as inspiration for investors to sell and take profits or put more money to work in the coming weeks. Given the market’s recent behavior, we expect a modest pullback is most likely.

Jeffrey Kleintop is Chief Market Strategist and Executive Vice President at LPL Financial. In this role, he leads the development and articulation of LPL Financial Research’s market and investment strategies, leveraging his expertise in the analysis of global financial markets and asset allocation strategy.

Searching For Inspiration

April 9, 2013

« Previous Article

| Next Article »

Login in order to post a comment