Small caps have had an incredible run since the Russell 2000 Index bottomed on March 18, 2020, returning 119% compared to the S&P 500 Index’s 60% return over the period. Will small cap outperformance continue in 2021? The early stages of this business cycle may help determine the direction for small caps as well as earnings per share, stock valuations, and technical trends.

Favorable Part Of The Cycle

Small cap stocks historically have performed well early in economic cycles. Given that the U.S. economy likely came out of recession late last summer or early fall of 2020, 2021 certainly qualifies as early in this cycle. The tremendous performance by small cap stocks over the past 10 months suggests that a lasting economic expansion has begun in earnest and seems to validate the historical cycle pattern of small caps beating large caps early in cycles.

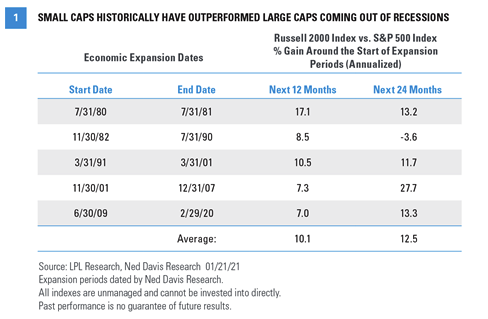

Figure 1 illustrates how the Russell 2000 Index historically has performed relative to the large cap S&P 500 Index during the early stages of prior economic expansions. Almost every time coming out of recession, small caps outperformed large caps over the subsequent 12 and 24 months; they outperformed by an average of 10.1% over the first year and 12.5% over the subsequent two years (on an annualized basis). We think this historical trend bodes well for small caps in 2021, though we acknowledge some excess returns probably have been pulled forward and already achieved with the recent stellar small cap run.

Strong Earnings Rebound

During recessions like the U.S. economy suffered in 2020, smaller companies that generally tend to have weaker balance sheets and more economically sensitive revenue usually are hit harder than their large cap counterparts. That definitely played out in 2020, with FactSet’s consensus estimates calling for a substantial 51% decline in small cap earnings, based on the Russell 2000, compared with only a 15% annual decline in earnings from large cap S&P 500 companies.

The reverse tends to occur coming out of recessions, as small cap earnings typically grow much faster during the initial economic recovery phase. The numbers tell that story too, as small cap earnings in 2021 are expected to surge more than 150%, compared with a still respectable 23% for S&P 500 earnings, which pales in comparison. Remarkably, consensus earnings estimates for 2021 of $166.25 per share for the Russell 2000 are 23% above pre-pandemic 2019 levels. For the S&P 500, 2021 estimates are currently only 4% above 2019 levels.

Small cap earnings also enjoy more momentum right now, with estimates having risen sharply since the start of the fourth quarter of 2020. Russell 2000 earnings estimates for 2021 have been raised by 12% since October 1, 2020, compared to just 2% for the S&P 500.

Expectations of this sharp earnings rebound have helped drive strong small cap performance since the bull market began in March 2020. Small cap stocks are broadly more economically sensitive than large cap stocks, which is helpful when economic growth expectations improve. This helps explain why optimism surrounding the reopening of the economy and prospects for more fiscal stimulus under the new administration have given small caps such a big boost lately.

We think a higher U.S. corporate tax rate—which we expect in 2022—is a key risk to earnings next year and would likely hurt small cap earnings more than their large cap counterparts because small cap companies tend to be more domestically focused.

All earnings data and consensus estimates are sourced from FactSet.

Pricing In Good News

Small cap stocks are trading at a substantial premium valuation to large caps—about 40% based on next 12 months’ price-to-earnings multiples. When looking out to 2022—when earnings will be closer to their full potential—valuations don’t look quite as rich, with the small cap PE about 27% above that of large caps. The strong small cap earnings growth outlook probably deserves a premium valuation at this point. Over the past 10 years, small caps have traded at a 37% higher forward PE than large caps.