Let’s assume that you have to invest in bonds. There are obvious reasons why you might not want to do this at present, with historically low yields, but many investors have no choice but to make large allocations to fixed-income. How best to do it? And how to make some sensible decision between bonds without incurring too many costs?

Answering these questions runs afoul of two issues. First, indexed investing doesn’t provide the same simple answer in bonds that it does in stocks. Weighting by market capitalization, in bonds, means allocating the most money to the companies or governments that have borrowed the most which, all else equal, means tending to put more funds into more indebted issues. Second, history is of little help when trying to make decisions, because the trend has been so fixed for the last 40 years. That makes it harder to trust any sensible strategies that might emerge from looking at the last four decades’ data. They might merely be reflecting the conditions of the current regime. As there is good reason to believe that this regime is in the course of changing, the available data might not be helpful.

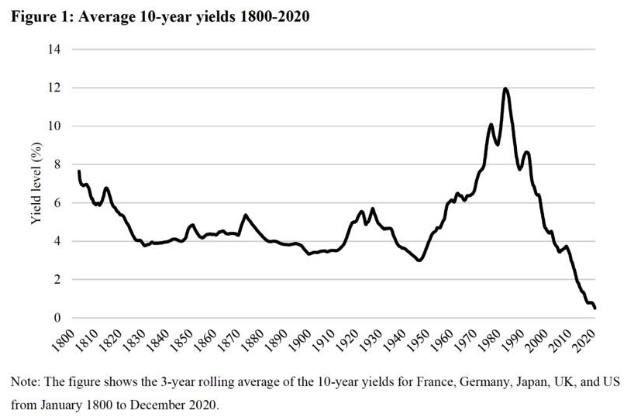

Now a paper from by Guido Baltussen, Martin Martens and Olaf Penninga, all part of the quantitative investment team of Robeco, argues that classic factor investing, of the kind generally known as “smart beta” when applied to equities, can also work for bonds. Crunching data all the way back to 1800, the paper contends it can continue to do so even if the bond market starts a steady upward trajectory after a protracted fall. The authors don’t have good enough information on the embryonic bond markets of 1800 to provide all the number-crunching that is possible on the Bloomberg terminal today, but they had enough data on France, Germany, Japan, the U.K. and the U.S. to put together this chart of the global 10-year yield over 220 years. If possible, the last decade looks even more aberrant than we thought it was:

The Robeco team used their data to test three familiar smart beta factors for bond portfolios over time. As their data set widened, they were able to test more factors. The three they looked at, all familiar from equities, were:

• Momentum — the tendency for winners to keep winning and the losers to keep losing. Robeco looked at momentum over the last 12 months minus momentum over the most recent month, as is common for equities, and applied the same measure to bonds, buying issues with momentum and shorting those that lacked it.

• Value — buying securities that are cheap relative to their fundamentals and waiting for them to catch up. In equities, this can be done with a variety of indicators, such as price-equity multiples, price to book value or dividend yields. For bonds, they applied two measures: bond yields relative to inflation (so high real yields showed up as good value), and comparing the bond yield to T-bill or other short-term yields — a strategy that many would call a carry trade.

• Low-Risk — in equities, this refers to the baffling tendency for low-beta stocks, which are less sensitive to the market, to do better over time (even though the market itself tends to do well). In the paper, the academics tested a strategy of buying bonds that had little sensitivity to the market.

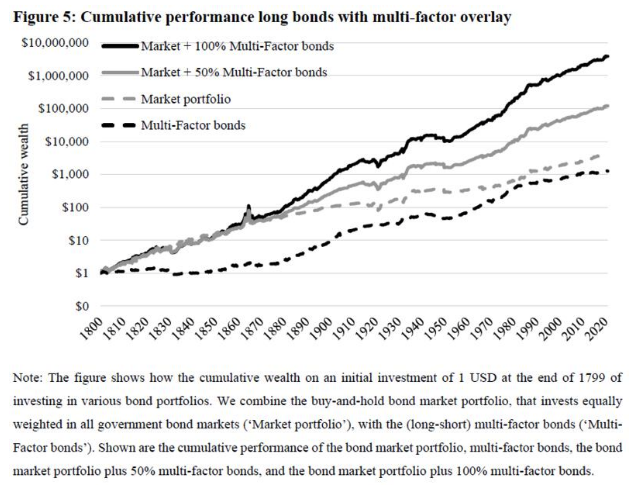

The available data increased as time progressed. The test for momentum goes back to 1800, and includes extra countries later in the sample. In all cases, they found positive returns from choosing bonds using the factor. Also, these factors aren’t greatly correlated with each other. Thus, adding a long/short factor investment to a straightforward market-cap weighted investment in the bond market adds value over time. Having spared you a lot of numbers, which are in the paper, here is the picture:

This looks great. But can it really work regardless of whether yields are rising or falling? Apparently it does. In the following chart, we see the performance of “multi-factor” bonds in years when yields are up, and when they are down. Both have gained much the same over the full 220 years, and neither has had a serious protracted downturn.