The energy transition is in full swing, and record investment is flowing into this emerging sector globally (Source: BloombergNEF Energy Transition Investment Trends). While some miners of minerals critical to the clean energy transition, particularly those focused on uranium, have seen considerable gains in 2023, lithium miners have largely underperformed. What does this mean for the energy transition, and are there opportunities for investors?

Lithium In 2023: A Bumpy Patch On A Long Road?

The returns of lithium miners are largely negative year-to-date as of November 30, 2023, but the long-term outlook suggests this may be a bump in the road for an emerging sector with significant upside potential. Lithium is a critical mineral essential to lithium-ion batteries, the predominant battery type favored by electric vehicles (EVs). As EV proliferation intensifies, a lithium supply deficit may likely last through most of the next two to three decades.

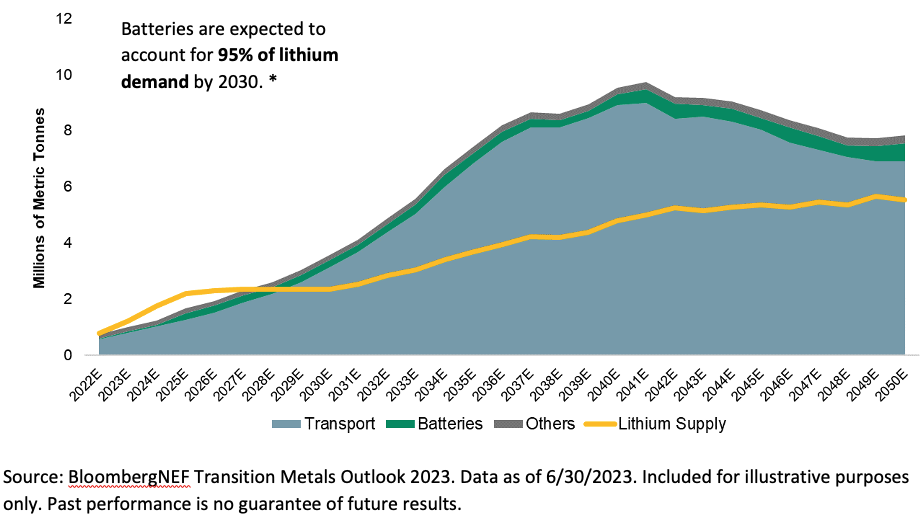

Figure 1. Lithium Supply Unlikely To Keep Up With Demand

(*Source: McKinsey & Company. Lithium Mining: How New Production Technologies Could Fuel the Global EV Revolution, April 12, 2022.)

According to BMI, the lithium supply shortage is forecasted to begin as soon as 2025. There are currently only 101 lithium mines in the world, and even as more mines and exploration projects come online, the added supply may likely not be able to keep up with demand. China alone is expected to drive a 20% yearly increase over the next decade.

Options Along The Entire Value Chain

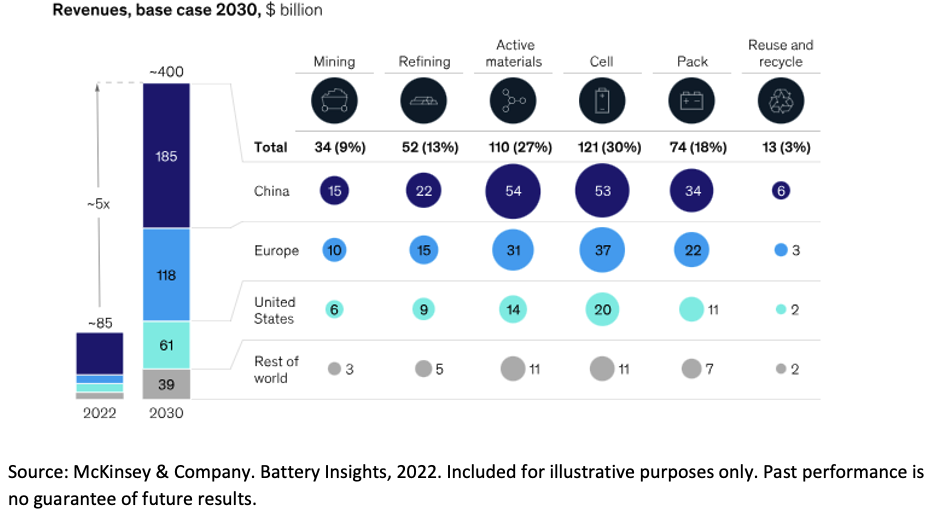

The value of lithium is not limited to the mineral itself. There are opportunities along the entire lithium supply chain, including exploration, mining, processing and compound manufacturing. Lithium miners and companies involved in the processing and refining of raw lithium may likely be poised to benefit as the demand for lithium grows. Recycling will also come into play as batteries begin to reach their end-of-life and recycled elements are reused for new batteries.

The lithium battery industry is projected to create $400 billion in annual revenue opportunities worldwide. The lithium production component of the chain has recorded margins as high as 65%, potentially making it a highly profitable sector.

Figure 2. McKinsey Model Estimates That Lithium-Ion Battery Value Chain May Provide Revenue Opportunities Of >$400 Billion By 2030

Unprecedented Investment from Mining Companies And Auto Manufacturers

The growing demand for lithium is drawing unprecedented investment from the public and private sectors. In pursuit of future growth, specialized lithium miners are investing in their businesses and have a reinvestment ratio* of about 60%, compared to 25% for diversified miners (Source: IEA Critical Minerals Market Review 2023).

Automakers are concerned about the availability of lithium, a mineral essential to their ability to manufacture EVs. In a move that harkens back to the days of Ford setting up rubber plantations to guarantee materials for tires, automakers are investing directly in the lithium mining space. As a result, Tesla, VW Group, General Motors, Stellantis, BMW and Mercedes-Benz are creating long-term offtake agreements with producers to buy lithium that will be mined in the future, while General Motors and Stellantis are investing directly in lithium mining equities (Source: IEA Critical Minerals Market Review 2023).

Figure 3. Demand For Lithium Is Expected To Grow More Than Sevenfold Between 2020 And 2030

Realizing lithium’s role in the energy transition, the U.S., Canada and the European Union have added lithium to their critical minerals lists. This designation makes it easier for companies to apply for grants and subsidies that support the lithium and EV industries.

The Perils Of Market Timing

The S&P 500 Index in 2023 has given a great illustration of the perils of attempting to time the market. Through the first 215 trading sessions of the year, the S&P 500 had positive performance for 113 days while posting a negative return for 102 days. During this period, the S&P 500 returned 14%, and most of the returns can be attributed to just eight trading days.

The same principle applies to energy transition-related investments. Investors should resist the temptation to try and time the market to participate in this growing industry. Companies leading the energy transition are not immune to periods of volatility. We believe, however, that investors may benefit from a long-term allocation to a sector that is underrepresented in major market indexes.

Is There A Short-Term Opportunity?

There may be a short-term opportunity at hand. Despite the long-term investment outlook for lithium miners, many producers of this critical mineral have seen their stock prices drop considerably in 2023. This means that investors who want to add an allocation to lithium miners to their portfolio may have an opportunity to do so at prices significantly lower than they were at the start of 2023.

* The reinvestment ratio compares the cash inflows generated by a company to the cash outflows required for re-investing in the company. It measures how much of the company’s annual cash flow is being reinvested back into the business for future growth.

Steve Schoffstall is director of ETF product management at Sprott Asset Management.

Important Disclosure

This article is intended solely for the use of Sprott Asset Management USA Inc. for use with prospects, investors and interested parties. Investments, commentary and statements are unique and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this presentation are those of the presenter and may vary widely from the opinions of other Sprott-affiliated Portfolio Managers or investment professionals.

The intended use of this material is for information purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances.

Past performance is not indicative of future results.

Generally, natural resources investments are more volatile on a daily basis and have higher headline risk than other sectors as they tend to be more sensitive to economic data, political and regulatory events as well as underlying commodity prices. Natural resource investments are influenced by the price of underlying commodities like oil, gas, metals, coal, etc.

The investments discussed herein are not insured by the FDIC or any other governmental agency and are subject to risks, including a possible loss of the principal amount invested.

© Sprott 2023