While it was once time consuming and complex to start a private foundation, it’s simpler now and can be accomplished in less than a week. And wealthy clients who consider starting one before the end of the year can considerably dampen their tax obligations if they’ve had significant income in 2022.

Besides the philanthropic and family reasons your wealthy clients might have for establishing a private foundation, there are also short- and long-term tax benefits that are well worth considering. Donating to such a foundation allows them four tax advantages:

1. The reduction of income tax liability;

2. The tax-advantaged growth of assets contributed to the foundation;

3. The avoidance of capital gains taxes for appreciated assets; and

4. The reduction or elimination of potential estate taxes.

Income Tax Savings

One of the more immediate tax benefits donors would see is an income tax deduction for any cash amount contributed to a private foundation, a deduction of up to 30% of their adjusted gross income. The deduction is up to 20% of AGI for many non-cash—or securities—contributions.

Let’s take a hypothetical client named Carmen. She works as a healthcare executive in a high-tax state, New York, and earns an adjusted gross income of $1 million each year. Her combined federal and state income tax rate is approximately 47%. She plans to retire in five years but wants to establish a private foundation now and contribute $200,000 to it each year until she retires. Carmen is single and has no children but sees an opportunity to make her retirement productive by spending it managing a private foundation and pursuing her charitable interests.

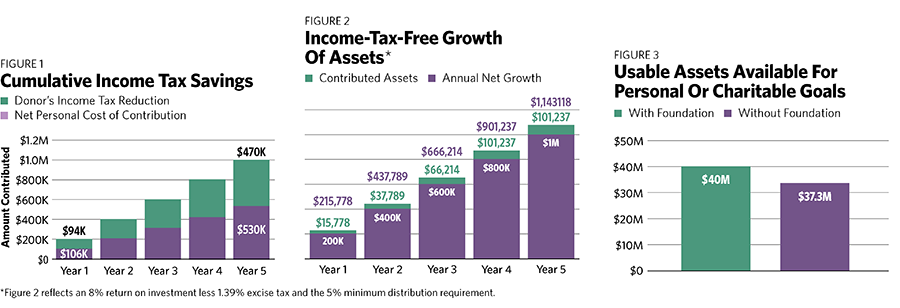

Carmen will owe nearly $470,000 a year in income taxes based on her adjusted gross income. If she establishes a private foundation and contributes $200,000 to it, she will get a tax deduction for the full amount of the contribution (since the deduction is less than 30% of her AGI), reducing her taxable income to $800,000. If her income tax rate remains approximately the same, she will now owe $376,000 a year in taxes.

So by making an annual contribution of $200,000, Carmen will save nearly $94,000 per year in income taxes over a five-year period. After five years, she will have contributed $1 million to her foundation at a net personal cost of $530,000, saving $470,000 in taxes.

Income-Tax-Free Growth Of Assets

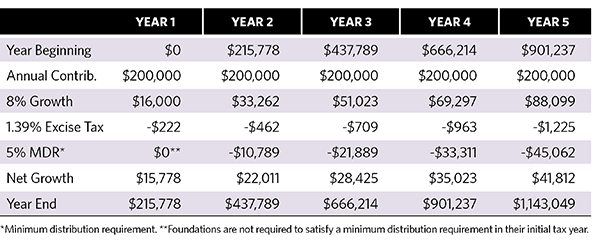

Let’s assume that Carmen follows through with her plan to contribute $200,000 to her private foundation every year over the course of five years. Because her assets will be able to grow in the tax-advantaged environment of the private foundation—after, we assume, there’s been an 8% growth rate and after we take into account a 1.39% excise tax—the private foundation’s endowment will have increased by nearly $150,000 despite having made over $111,000 of charitable grants in satisfaction of the foundation’s minimum distribution requirement during these years. By the time Carmen retires, her foundation will be more than $1.1 million and she can focus on creating a lasting charitable legacy.

Capital Gains Tax Savings

Not only can donors get a deduction for income taxes when they contribute to a private foundation, they can also donate to it appreciated assets and thus avoid paying capital gains taxes on them.

Let’s say Carmen has a sister, Allegra, who has founded a publicly traded technology company on the West Coast and holds a lot of highly appreciated stock. Her adjusted gross income each year is $3 million. Because Allegra lives in a high-tax state, California, her combined federal and state tax rate is 47% (and the combined rate is 29% for capital gains). Allegra has seen Carmen’s personal satisfaction and philanthropic success with her private foundation and is interested in establishing one of her own. She’s particularly interested in instilling philanthropic values in her children and getting them and her husband involved with a worthwhile activity. Instead of making annual gifts to the foundation, Allegra wants to make one initial gift at the outset.

She happens to own $2 million in stock in her company, and the cost basis is $500,000. If Allegra sells the stock, she will owe $435,000 in combined state and federal capital gains taxes (not a tax she wants to incur). But if she establishes a private foundation instead and donates the stock to it, she will receive an income tax deduction for the full fair market value of the stock ($2 million). Although this deduction exceeds 20% of her AGI, she can carry it forward for five years, and over time she will save $940,000 in income taxes and she won’t pay any capital gains taxes.

When the foundation decides to sell the stock in the future, it will pay only the nominal excise tax rate of 1.39% on the net capital gains. In fact, if the foundation uses the appreciated stock to make grants instead of cash, it can avoid the excise tax on the stock’s built-in gain entirely. What’s more, because Allegra can pass the foundation down to her children, they can become stewards of a significant charitable legacy and further her good works well beyond her life span.

Estate Tax Savings

When assets are contributed to a private foundation, they are excluded from the donor’s estate and, as a result, are not subject to either federal or state estate taxes. For high-net-worth individuals who have a strong charitable interest, private foundations offer them an opportunity to avoid paying estate taxes while simultaneously creating a lasting philanthropic legacy.

Consider Carmen and Allegra’s parents, who are proud to see that both of their children have been not only financially successful but have also developed strong charitable interests. The parents have combined assets of $40 million and want to leave a portion of their wealth to their children but are also interested in leaving some of their assets to charity. They are retired and have moved to Florida, which has no state level income tax or estate tax. Their assets are largely tied up in real estate and art, so their adjusted gross income is not large enough to justify a charitable gift simply for income tax reduction.

If the parents decide to pass all of their assets to their family, first they receive a combined federal estate tax exemption of $24.12 million ($12.06 million for each spouse), and their combined estates then owe approximately $6,300,000 in estate taxes. (The tax liability was calculated using 2022 federal tax rates.)

What if instead the parents decided to leave the exempted $24.12 million to their children and the rest of their estate ($15.88 million) to a private foundation, which would be funded when the second spouse dies? If they did, they could entirely avoid paying federal estate taxes. In addition, they would have created a foundation that preserves and promotes the family’s charitable legacy and instills their values in future generations of the family, giving new generations the opportunity to come together over common philanthropic goals. Because their children have already established their own foundations, the parents could instead simply leave the taxable portion of their assets to those foundations.

Jeffrey D. Haskell is chief legal officer for Foundation Source, which provides comprehensive support services for private foundations.