It didn’t take long.

New York Governor Andrew Cuomo on Tuesday said that the new cap on SALT deductions was an act of “economic civil war,” and promised to fight back by suing the federal government and by changing the state’s tax code to shelter residents from the loss.

In California, Senate President Pro Tem Kevin de León plans to introduce legislation this week that would allow residents to donate to a state entity called the California Excellence Fund in lieu of paying taxes — a move intended to sidestep the new federal cap.

Under the old federal tax law, most filers could deduct state and local taxes from their federal returns, a benefit that applied to property, income, and other levies. The new law caps the so-called SALT deduction at $10,000, a change that could cost residents of high-tax states billions of dollars.

Crimp Revenue

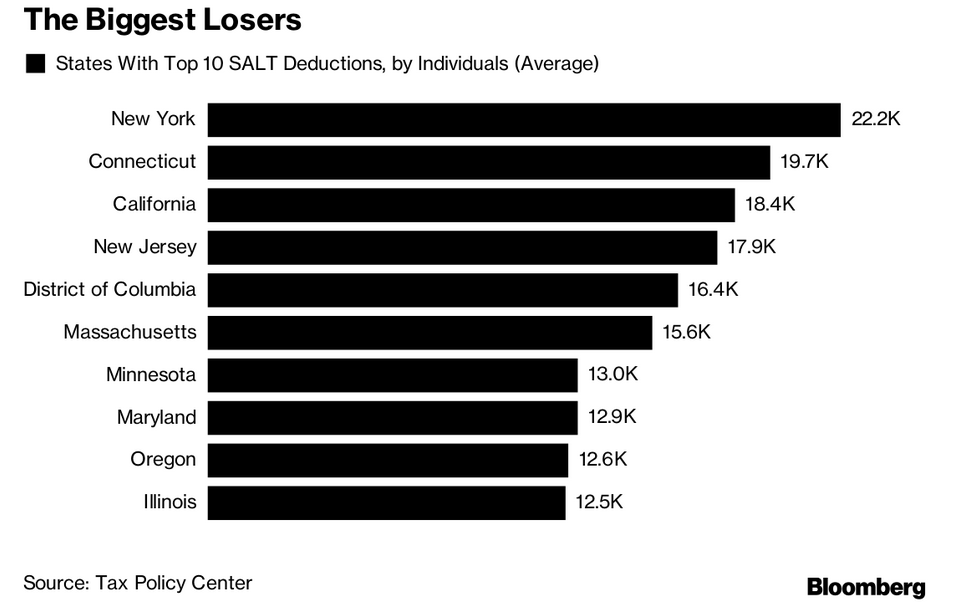

The cap on the SALT deduction hits California and New York hardest, due to their high state taxes and large populations. Connecticut, New Jersey, and the District of Columbia round out the top five jurisdictions where individuals claimed the largest average SALT deductions.

If state lawmakers succeed in working around the new cap on SALT deductions, federal tax collectors would miss out on revenue they’re depending on to fund the corporate tax cuts at the center of the overhaul plan.

The California bill builds on a nascent movement among states to provide full and partial tax credits in return for donations that fund tuition vouchers for private and religious schools. In a memo released in 2011, the Internal Revenue Service gave its blessing for taxpayers to claim federal deductions on those gifts, providing at least some basis for the idea that the strategy could work.

In New York, Cuomo promised to explore whether to use charitable contributions to support public programs, while also pursuing a separate plan to shift the state’s revenue collections from income to payroll taxes, which are levied on employers and remain deductible under the federal law. Before the ink was dry on the Republican tax bill signed into law late last month, experts predicted that state governments would try to shield their residents from tax hikes they’ll suffer from a sharp reduction in state and local deductions.

Before the ink was dry on the Republican tax bill signed into law late last month, experts predicted that state governments would try to shield their residents from tax hikes they’ll suffer from a sharp reduction in state and local deductions.

State Governments Are Already Gaming The Republican Tax Overhaul

January 4, 2018

« Previous Article

| Next Article »

Login in order to post a comment