In the eternal investor quest for upside participation in rising markets and downside protection in falling markets, Wall Street created structured products—which typically combine debt obligations and derivative products linked to various assets—that aim to provide specified returns and generally have been employed by institutional investors and high-net-worth individuals.

Innovator Capital Management LLC has brought that structured outcome concept to exchange-traded funds with Wednesday’s launch of the risk-managed Innovator S&P 500 Defined Outcome ETFs – July Series, which are designed to provide pre-set upside and downside return potential benchmarked to the S&P 500 Index. This so-called controlled exposure to the S&P 500 uses an options-based strategy built around a defined outcome period of about year.

Two of the three funds in this series began trading today; the other is expected to launch at a later date.

The funds employ FLEX Options with varying strike prices (the price where the option holder may buy or sell the security by a specified expiration date) and the same expiration date of roughly one year. FLEX Options are customizable exchange-traded option contracts guaranteed for settlement by the Options Clearing Corporation.

According to Innovator, layering these FLEX Options with varying strike prices produces a fund’s intended upside cap to the performance of the S&P 500 or downside buffer. The actual cap for each fund will be set at the beginning of the outcome period, and is dependent upon market conditions at that time.

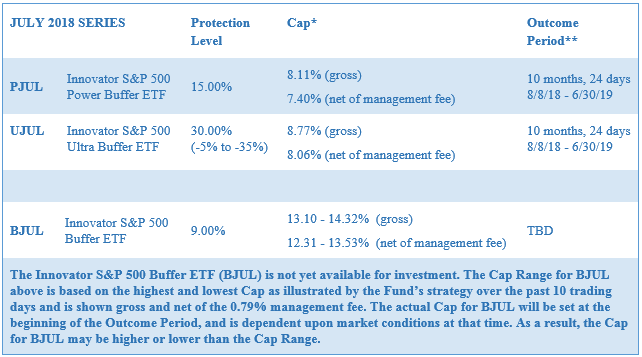

The Innovator S&P 500 Power Buffer ETF (PJUL) buffers against the first 15 percent of losses over the outcome period, while the Innovator S&P 500 Ultra Buffer ETF (UJUL) offers a buffer against a decline of 30 percent of losses over the outcome period, from negative 5 percent to negative 35 percent. In other words, investors are exposed to a loss between 0 percent and 5 percent, and over 35 percent, during the outcome period.

The fund yet to launch, the Innovator S&P 500 Buffer ETF (BJUL), buffers investors against the first 9 percent of losses over the outcome period.

All of these defined outcomes are before fees and expenses. Each fund charges a management fee of 0.79 percent, and they all trade on the Cboe exchange.

As indicated, the defined outcome periods are roughly one year, after which they’re reset for another year.

The Innovator S&P 500 Defined Outcome ETFs – July Series have an initial outcome period of less than 12 months to allow the period to conclude on June 30, 2019. At that point, the funds will resume their respective anticipated 12-month outcome periods. Current cap ranges in the July Series are lower due to the shortened outcome period.

Innovator plans to issue a quarterly series of each Defined Outcome ETF to enable investors to purchase shares as close to the beginning of their respective outcome periods as possible. Investors will also be able to purchase shares of a previously listed Defined Outcome ETF throughout the entire outcome period, and obtain a new set of defined outcome parameters, which will be disclosed through a web tool on Innovator’s website.

“This tool enables people to know what their payout would be if they bought today, so they know approximately what they can expect for the rest of the period,” says Bruce Bond, CEO of Innovator Capital Management.

ETF Structure

If this all sounds like a lot of moving parts . . . well, you're right. Innovator filed for these funds with the Securities and Exchange Commission late last year and expected to roll them out in early 2018. But Innovator says the SEC scrutinized these products because they are the first defined-outcome products in an ETF wrapper.

“While it took more time than expected to get approved, that’s because this was such a novel product,” says Bond. “But at the same time it has been approved, which means the SEC recognizes that it can offer value to investors.”

Bond said those words last week, when the BJUL fund still had its initial mandate of a 10 percent buffer and was expected to launch today. That mandate has since been changed to a 9 percent buffer, and its launch date has been pushed back as Innovator works through the regulatory details.

Traditional structured products that offer specified outcomes typically are issued by investment banks and insurance companies for institutional and wealthy investors. Many investors shy away from them due to their complexity, illiquidity and high costs.

Innovator touts its new ETFs as a low-cost, transparent, liquid and tax-efficient way to access products built with defined outcomes that let investors stay invested in the market knowing they have upside growth potential and downside protection levels.

And Bond recognizes that financial advisors will need some education about these products, which is why Innovator will host a webinar about these funds next Wednesday.

On the whole, Bond says, the primary customer for the Innovator Defined Outcome ETFs will likely be people at or near retirement who want to protect their nest eggs while also participating in the market’s upside in order to get the growth needed to maintain their standard of living in retirement.

“But they could be for anyone who’s nervous about the market, given the current valuations and length of the bull market,” he adds.

The Innovator S&P 500 Defined Outcome ETFs are sub-advised by Milliman Financial Risk Management LLC, a financial risk management company that provides investment advisory, hedging and consulting services on roughly $152 billion in global assets.

“This is a concept we felt was possible in the ETF structure but which we didn’t really have the capability to do ourselves,” Bond says. “Milliman is one of the top outfits that can provide these types of strategies.”