In the eternal investor quest for upside participation in rising markets and downside protection in falling markets, Wall Street created structured products—which typically combine debt obligations and derivative products linked to various assets—that aim to provide specified returns and generally have been employed by institutional investors and high-net-worth individuals.

Innovator Capital Management LLC has brought that structured outcome concept to exchange-traded funds with Wednesday’s launch of the risk-managed Innovator S&P 500 Defined Outcome ETFs – July Series, which are designed to provide pre-set upside and downside return potential benchmarked to the S&P 500 Index. This so-called controlled exposure to the S&P 500 uses an options-based strategy built around a defined outcome period of about year.

Two of the three funds in this series began trading today; the other is expected to launch at a later date.

The funds employ FLEX Options with varying strike prices (the price where the option holder may buy or sell the security by a specified expiration date) and the same expiration date of roughly one year. FLEX Options are customizable exchange-traded option contracts guaranteed for settlement by the Options Clearing Corporation.

According to Innovator, layering these FLEX Options with varying strike prices produces a fund’s intended upside cap to the performance of the S&P 500 or downside buffer. The actual cap for each fund will be set at the beginning of the outcome period, and is dependent upon market conditions at that time.

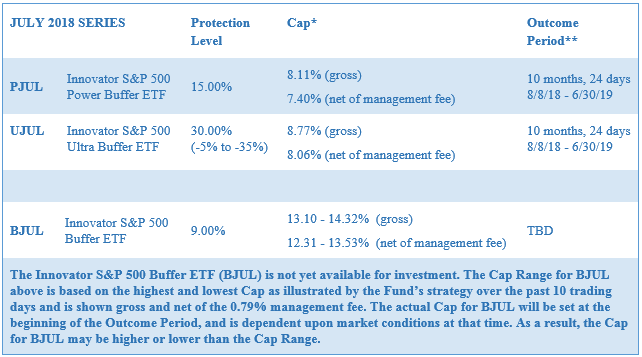

The Innovator S&P 500 Power Buffer ETF (PJUL) buffers against the first 15 percent of losses over the outcome period, while the Innovator S&P 500 Ultra Buffer ETF (UJUL) offers a buffer against a decline of 30 percent of losses over the outcome period, from negative 5 percent to negative 35 percent. In other words, investors are exposed to a loss between 0 percent and 5 percent, and over 35 percent, during the outcome period.

The fund yet to launch, the Innovator S&P 500 Buffer ETF (BJUL), buffers investors against the first 9 percent of losses over the outcome period.

All of these defined outcomes are before fees and expenses. Each fund charges a management fee of 0.79 percent, and they all trade on the Cboe exchange.

As indicated, the defined outcome periods are roughly one year, after which they’re reset for another year.