For good investors, a third-party rating system—for example, credit ratings from Moody’s or Fitch, or mutual fund star ratings—is usually just a first step in an investment decision-making process that involves a lot of other research and analysis. Yet when it comes to environmental, social and governance (ESG) research, a growing number of investors are keen to adopt a third-party rating system as the beginning and end of their process.

The simplicity of this idea is appealing. If you want to invest in “good” ESG companies and avoid “bad” companies, it would be wonderful to simply apply a prepackaged ratings screen to an index to achieve that result. To be clear, leading ESG research firms like MSCI and Sustainalytics have strong research teams and provide valuable information to thousands of investment firms, including ours. But if investors rely solely on the ratings built from that research to gauge an investment’s sustainable merits and risks, they will almost always miss out on key information that can only be surfaced through diligent, primary research.

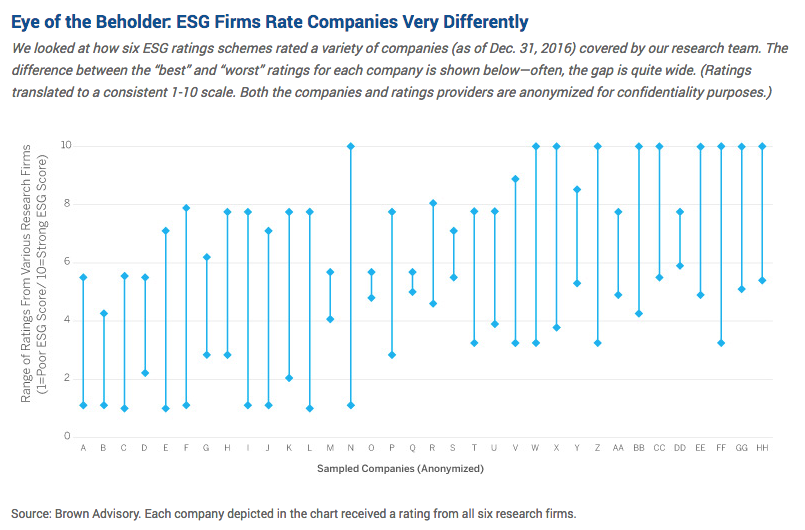

There are several problems with leaning too heavily on ESG ratings. One specific challenge is a lack of standardization—every ratings system prioritizes different factors when defining a “good” ESG company. Some prioritize transparency and disclosure; others prioritize a company’s environmental or social track record or its past controversies; others prioritize current carbon emissions. Depending on which ratings service you choose, you may see wildly different results.

Last year, Brown Advisory published a journal article in the Journal of Environmental Investing, which discusses the opportunities and challenges of using ESG information to improve investment decisions. In one section of the article, we conducted an exercise to compare six leading ESG ratings schemes. We translated each firm’s ratings system into a consistent, 1-to-10 scale (1 representing the “worst” ESG score and 10 the “best”), then looked at how each firm rated the holdings in our firm’s Large Cap Sustainable Growth portfolio. The average result was a spread of nearly five points between the best and worst score—in other words, a typical company might receive a top-quartile rating from one ratings system, and a bottom-quartile rating from another.

For example, American Tower (a cellular tower company in which we’ve invested) currently receives a top rating from one leading ESG ratings system, and a rock-bottom rating from another. In the former case, the ratings analysis lauds American Tower for various factors, such as enabling communication in developing markets, and treating its workers well. In the latter case, the low rating is largely driven by a lack of transparency and disclosure on various matters. The key question here shouldn’t be which rating is correct—each firm’s analysis raises good points. Instead, investors should ask what they can learn from each of these ratings, to help them build a more complete picture. Our investment isn’t based on a 3rd-party rating; we invest due to strong company fundamentals and a solid ESG profile that, in our estimation, tangibly enhances American Tower’s business prospects. Specifically, it is the only tower operator to offer shared (and thus efficient) backup power generating capacity for the multiple carriers on its towers. Backup power is a critical need for carriers, who spend on the order of $15 billion per year in outages and degradation.

What we take away from this discussion is that ratings—whether you’re looking at mutual fund rankings, credit ratings or ESG grades—should not be viewed as an endpoint, but as the start of a research journey that spurs subsequent questions and more digging for information. In our view, no amount of raw ESG data can tell an investor whether a company is a sound fundamental investment—we believe that primary research is the only way to consistently drive well-informed investment decisions.

Karina Funk is portfolio manager and head of sustainable investing at Brown Advisory. Emily Dwyer is a research analyst at Brown Advisory.