Companies involved in industries such as construction, electric power, raw materials, transportation and energy are the drivers behind the coming build-out in both developed and emerging market countries, and infrastructure ETFs can help investors capitalize on the boom.

That's the message ETF sponsors have been sending out since infrastructure funds debuted in this space about three years ago.

Sponsors cite statistics to underscore the relevance of the theme. The Organization for Economic Cooperation and Development, for instance, says $71 trillion will be needed in infrastructure spending worldwide by 2030, while the American Society of Civil Engineers believes the U.S. will need to spend $2.2 trillion over the next five years to bring the country's critical systems up to snuff.

With a rapidly expanding middle class needing everything from highways to electricity, emerging markets are just beginning to address their growing infrastructure needs. Euromonitor International, a market research firm, predicts that consumer spending in China, Brazil and India will grow 8% annually over the next decade, and only 2% per year in the U.S.

Emerging market governments also appear ready to allocate money to projects. While the U.S. spends 2.4% of GDP on infrastructure investment and Europe 5%, China has devoted some 9% of its GDP to public building and improvement projects over the last few years.

But infrastructure ETFs also possess risks. Utilities, often a major component of the group, are highly regulated industries subject to stringent price controls and environmental regulation. While the stocks have defensive characteristics such as high yields, they tend to plod along in bull markets and can feel the brunt of rising interest rates.

Two other infrastructure sectors, construction and materials, are cyclical industries whose fortunes follow fluctuations in commodity prices and economic conditions. Public projects depend heavily on government financing, which hasn't been plentiful in some countries. Emerging markets also face political risks. Even if spending were to increase on infrastructure projects, unfavorable markets could hold back the stocks that should benefit.

Yet to some investors, infrastructure has classic appeal. A report from Brookfield Asset Management, a firm that specializes in infrastructure investments and has created two related Dow Jones indexes, cites a number of reasons to invest in these companies, and the firm even segregates them as a distinct asset class. Given the high barriers to entry into the market, infrastructure companies face little or no competition from small upstarts. Because they provide essential products and services, their revenues are insulated from big fluctuations in demand. They can also be good inflation hedges because their cash flows are often linked to measures of economic growth such as GDP, and they have a low correlation to other types of investments.

For those interested in the theme, though, it's important to check under the hood, since people define infrastructure in different ways. Some broad infrastructure indexes focus on industrial metals and materials companies or construction-related businesses, while utilities rule the roost elsewhere. The indexes follow different countries and have different risk and return profiles. Many ETFs, while they aren't specifically labeled as infrastructure funds, follow sectors that stand to benefit from a ramp-up in construction, transportation and building projects.

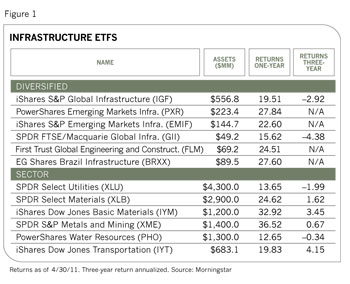

Tom Graves, an equity analyst with Standard & Poor's, identifies 32 infrastructure-related ETFs covering a broad range of sectors such as utilities, construction, transportation, alternative energy and materials. These funds have a market capitalization of $17.6 billion altogether. Only two of the funds, both in the alternative energy category, had negative returns for the year ended March 31. The others generally posted returns of 10% to 20%, winning favorable comparisons with the mid-teens return for the S&P Global 1200 Index.

"By and large, it looks like most infrastructure ETFs have generally done decently over the last year," he says.

The good performance often depends on where you're looking. The largest multi-sector ETF in the category, the iShares S&P Global Infrastructure Index fund (IGF), lagged the total return for the S&P 500 index over the one and three year periods ending with the first quarter of 2011. But another offering, the iShares S&P Emerging Markets Infrastructure Index (EMIF), is well ahead of both the S&P 500 and the iShares MSCI Emerging Markets Index (EEM) over the last year.

Industry focus also plays a key role. With the nascent upturn in the U.S. economy and increased demand from emerging markets, ETFs that key in on industrial materials have surged while others, including those with a strong utility focus, have only muddled along.

Emerging Markets

Two funds, the PowerShares Emerging Markets Infrastructure fund (PXR) and the iShares S&P Emerging Markets Infrastructure fund, zero in on China, Brazil and other developing countries.

The iShares ETF is a focused offering that follows just 27 stocks. Its largest holding, Brazilian gas distributor Ultrapar Participacoes, accounts for 13% of assets. Its largest sector is electric and gas utilities (33%), followed by transportation infrastructure (29%).

The PowerShares ETF has about three times as many stocks as that, and only 3% of its assets are in utilities. Because it focuses mainly on basic materials (42%) and industrials (55%), it is more sensitive to commodity prices than the iShares offering. It includes companies involved in construction and engineering; construction machinery and materials; and diversified metals and mining.

The iShares fund zeroes in on China and Brazil, and each country holds approximately 30% of the fund's assets. The PowerShares casts a wider geographic net, holding 12% of its assets in China, 11% in Brazil, 10% in the U.S. and 9% in South Africa.

While the ETFs may have some overlap with broader emerging market funds, they aren't a proxy for them. The Vanguard MSCI Emerging Markets Index ETF (VWO), the most popular emerging market fund, has nearly one-quarter of its assets in financial services and another 13% in technology. Those two sectors, as well as consumer discretionary and health care, are virtually absent from the emerging markets infrastructure funds. Their track records also differ. In 2010, for example, the Vanguard fund had a total return of 19.5%, versus 26.2% for the PowerShares fund and 18.7% for the iShares fund.

Three infrastructure ETFs offered by Emerging Global Advisors focus on single countries. The sector weightings in the EGShares Brazil Infrastructure (BRXX), EGShares India Infrastructure (INXX) and EGShares China (CHXX) funds are based on each country's respective dominant industries. In China, for example, the fund has 24.5% of its assets in construction and another 23% in real estate, while the Brazil offering focuses more heavily on electric utilities and industrials.

Performance diverges widely among different countries. The Brazil fund was up 23% for the year ending March 31, making it one of the leading infrastructure plays over the period, compared to 7.5% for the China offering.

Global

With yawning budget deficits leaving little money for public projects, returns have been subdued for the two diversified global infrastructure ETFs that focus mainly on developed markets. But improving economies are sparking hope that the U.S. and other countries will finally make serious attempts to address their infrastructure needs, which could be one reason these ETFs have seen an uptick in performance since the beginning of the year.

The iShares S&P Global Infrastructure ETF (IGF) has 39.1% of its $524 million in assets in utilities, 40.5% in industrials and 20% in energy. Its much smaller competitor, the SPDR FTSE/Macquarie Global Infrastructure ETF, has over three-quarters of its exposure in electric and other utilities.

The latter fund has 41% of its assets in the U.S., with the rest spread broadly among Europe and Japan and a smattering of emerging markets. The iShares fund has only 23% in the U.S., while another 10% is in Canada and the remainder mostly in developed market countries.

Two options offer targeted exposure to capital expenditure and construction in developed markets. The First Trust ISE Global Engineering and Construction fund (FLM), focuses mainly on companies involved in large public works projects. It has 21% of its assets in the U.S. and 15% in Japan and typically has a 10% to 15% allocation to merging market companies. PowerShares Dynamic Building and Construction (PKB) follows 30 U.S. companies in construction and related industries.

Infrastructure-Related Sectors

A good argument could be made that lumping together a group of seemingly disparate companies under an infrastructure banner is more of a marketing move than logical portfolio construction. Those who agree can opt for more focused ways to stake out the theme on a sector-by-sector basis. Since many of these ETFs have been around longer than the more diversified infrastructure offerings, they also have longer track records.

Utilities. A concentrated ETF whose top ten holdings account for more than half its assets, the Utilities Select Sector SPDR (XLU) follows 34 U.S. companies that produce, generate, transmit or distribute electricity or natural gas.

At $4.2 billion in assets, it is the largest ETF that could be considered an infrastructure play. But it's also a utility holding, which means it will probably drag along in strong bull markets. Still, its returns have edged out the S&P 500 index over the last ten years, and utilities can be a good income generator with a growth kick at a time when bond yields are still near historic lows. The ETF's dividend yield was recently around 4.5%.

Materials. Companies involved in producing material and chemicals for construction projects offer indirect exposure to infrastructure growth in emerging and developed markets. They're also good inflation hedges, since they tend to move with commodity prices.

With a $3.0 billion market cap, the Materials Select Sector SPDR (XLB) dominates this group. The index it is based on is primarily composed of companies in industries such as chemicals, construction and forest products. Its largest components include classic U.S. materials companies such as Monsanto, Dow Chemical, Freeport-McMoRan and DuPont. The concentrated portfolio of 30 stocks has 68% of its assets in the top ten holdings.

Another large materials ETF, the $1.4 billion SPDR Metals & Mining (XME), is based on an equal-weighted index consisting mainly of steel, coal and consumable fuels and diversified metals. The volatile ETF fell nearly 60% in 2008 as demand for materials plummeted. But it shot up 88% in 2009 and has beaten the S&P 500 index by a substantial margin since then.

Exchange-traded notes that follow the price of industrial materials are another way to play the theme. Two that fit the bill include iPath Dow Jones Industrial Materials (JJM) and iPath Dow-Jones-UBS Copper (JJC).

Water. The scarcity of water, a resource with a declining supply and rising demand, is a growing concern, not only in China and India, and also in some parts of the Western United States. At $1.3 billion in assets, the PowerShares Water Resources fund (PHO) is the largest ETF aimed at capitalizing on the growing demand for this precious resource.

Since many of the companies in the component index are also involved in other industries besides water treatment and distribution, the ETF's relationship to water demand seems a little soggy to Morningstar analyst Abraham Bailin. "The holdings come from a hodgepodge of industries with vastly different exposures to the water theme," he observes. "You can get similar exposure by putting about 85% of your money in an industrials sector fund and the remainder in a utilities sector fund."

Clean energy. Alternative energy stocks plunged more than the overall market in 2008 and have lagged for most of the last three years. But they have picked up in recent months, in part because their valuations are so low. The oldest and largest alternative energy ETF, the PowerShares Wilderhill Clean Energy fund (PBW) invests heavily in solar and wind stocks but also has assets in other sectors such as information technology and materials.

Two more narrowly focused clean energy ETFs, First Trust Global Wind (FAN) and Guggenheim Solar (TAN), fell 31% and 28%, respectively, in 2010 amid concerns about decreasing government support in Europe and competition from cheap natural gas. But high oil prices and prospects for increased demand for electricity with an economic recovery have given the stocks a lift this year.