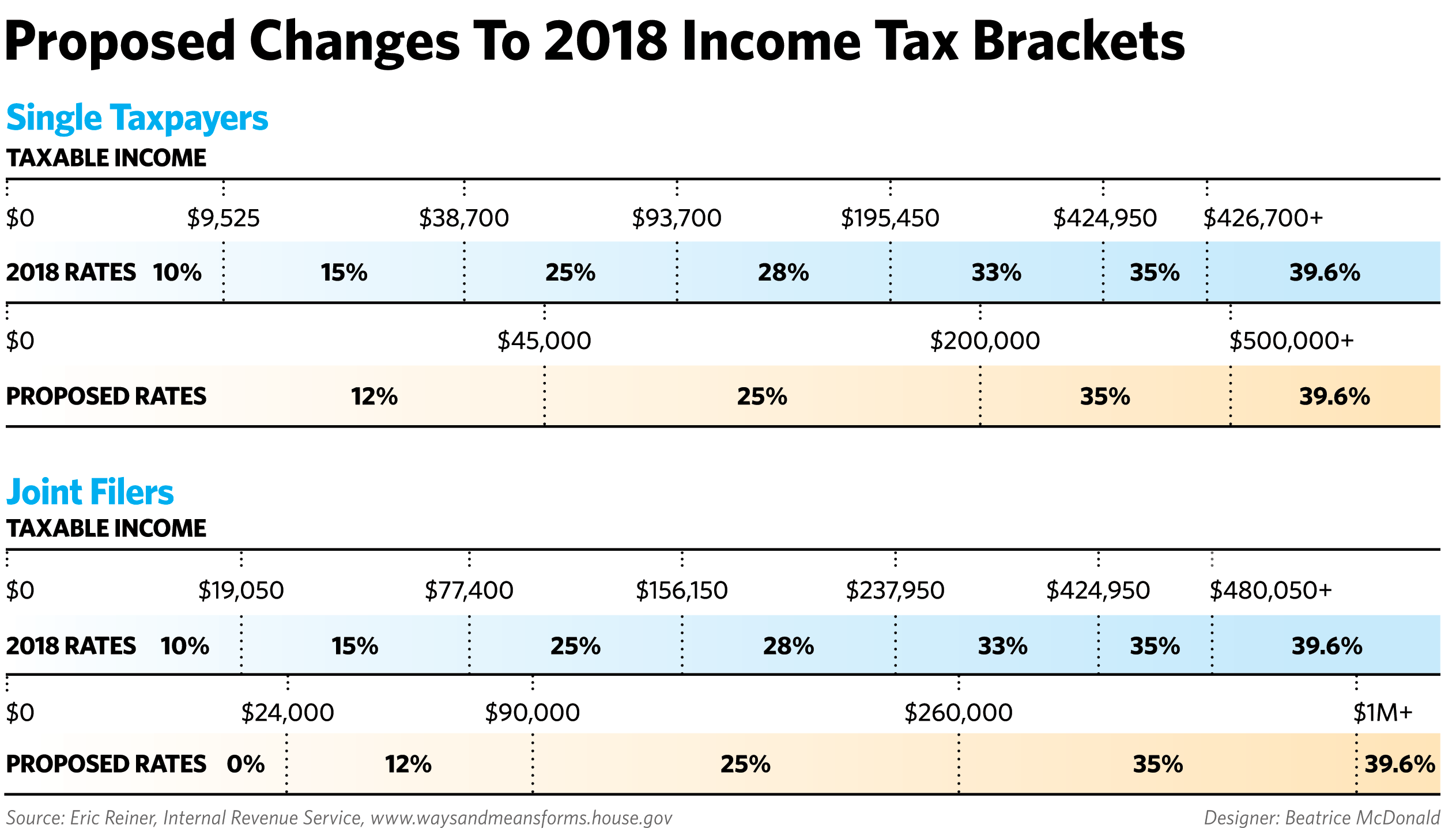

Marginal tax rates would drop for many clients in 2018, as the accompanying chart shows.

But others would face a higher marginal rate next year. For example, single taxpayers with taxable incomes between $200,000 and about $425,000, along with joint filers between $260,000 and about $425,000, would jump from the 33% bracket currently to 35% under the proposed legislation.

A marriage penalty remains built into the brackets, observes Mark Luscombe, principal analyst at Wolters Kluwer Tax & Accounting in Riverwoods, Ill. Couples filing jointly with taxable incomes between $260,000 and $400,000 would land in the 35% tax bracket, whereas singles with half that income (i.e., between $130,000 and $200,000) would face a 25% marginal rate. At other income levels, couples filing jointly would pay the same marginal rate as a single taxpayer earning half as much.

“Currently there is no marriage penalty in the bottom brackets but there is in the higher brackets. The proposal would eliminate the marriage penalty at the top but not in the middle,” Luscombe says.

Repeal of the alternative minimum tax could have a significant impact on investment plans. Under current law, alt min’s top rate is 28%. Its elimination would drive many AMT clients into the 35% bracket and “push them to invest in tax-free municipal bonds,” says CPA Blake Christian, a partner at HCVT LLP in Park City, Utah.

“Existing private activity bonds”—a genre of muni whose interest is taxable for clients subject to AMT—“should see an increase in value because their after-tax yield would increase with the repeal of AMT,” says CPA Allan J. Zachariah, co-CEO of Pathstone Federal Street in Atlanta.

The AMT’s elimination would also mean clients who have been subject to it would become free to itemize investment-advisory fees and other investment-related expenses, subject to the 2-percent-of-adjusted gross income floor for miscellaneous itemized deductions, Zachariah points out. “The ability to deduct these expenses would have a huge impact on the investment advisory market,” Zachariah says.

As expected, the House bill nixes many itemized deductions, including those for medical expenses, tax preparation fees and personal casualty and theft losses (although casualty losses associated with special disaster relief legislation would stay deductible).

The home-mortgage interest deduction remains in the tax code under the proposed legislation. But for new mortgages (existing debt would be grandfathered), clients could only deduct interest on up to $500,000 of new home-acquisition debt, down from $1,000,000 under current law. How would House Republicans’ long-awaited tax bill, issued November 2 and dubbed the Tax Cuts and Jobs Act, change planning for high-income clients if it’s enacted?

How would House Republicans’ long-awaited tax bill, issued November 2 and dubbed the Tax Cuts and Jobs Act, change planning for high-income clients if it’s enacted?

Tax Reform Slams HNW Clients On Real Estate

November 3, 2017

« Previous Article

| Next Article »

Login in order to post a comment

Comments

-

The graphic for Joint Filers is very misleading. It suggests there is a 0% tax bracket for taxable income up to $24,000 and income between $24,000 and $90,000 would be taxed at 12%. This is not the proposal. The proposal is a standard deduction of $24,000 for Joint Filers which would reduce taxable income by $24,000. The first $90,000 of taxable income after taking this deduction is then taxed at 12%. The deduction reduces the tax payer's taxable income in the highest tax bracket, not the lowest.