Kirbyjon Caldwell, senior pastor at Windsor Village United Methodist Church in Houston, orchestrated the scheme with financial planner Gregory Alan Smith, 55, of Shreveport, La., who was permanently barred from the securities industry in 2010 by Finra, according to the U.S. Justice Department and the SEC.

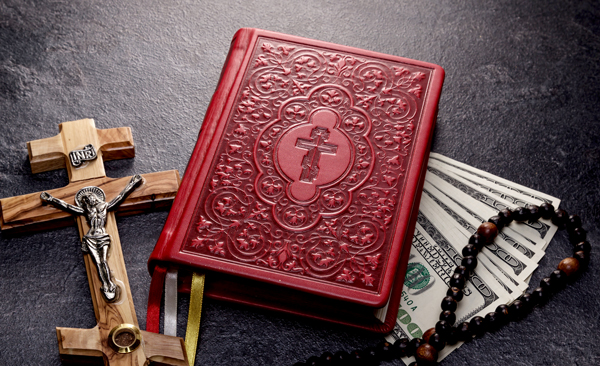

Caldwell, 64, was accused by federal authorities of abusing the trust engendered by his status as a high-profile clergyman, noting that he used religious references to deflect investors' complaints about not getting their money back.

"Caldwell took advantage of his victims, encouraging them to remain faithful even as he and Smith broke faith, stealing from elderly investors in an outright fraud," Eric I. Bustillo, director of the SEC's Miami regional office, said in a prepared statement. The SEC filed civil fraud charges against Caldwell and Smith in U.S. District Court in Shreveport on Friday.

In addition, Caldwell and Smith were indicted by a federal grand jury in Shreveport on Thursday and face 13 criminal charges, including six counts of wire fraud.

The scheme targeted 29 investors, many of them elderly people, some of whom liquidated their annuities to invest in the scheme, according to the SEC.

In an interview with ABC News in Houston, Caldwell contended the bonds were legitimate and none of the investors were members of his church.

"I am absolutely innocent," he said.

The SEC alleges that between 2013 and 2014 Smith recruited people, with the help of Caldwell, to invest in Chinese bonds that date back before 1949, when China came under Communist control. The SEC noted that the bonds have been in default since 1939 and unrecognized by China's Communist regime, making them mere collectible items with no investment value.

Smith, who was barred from the securities industry for allegedly misapproriating investor funds, lured investors by telling them he could resell the bonds to third-party buyers for large returns, according to the SEC. Smith told one woman she would receive 15 times her investment back within 30 days, the agency said. Caldwell assisted in the recruitment by falsely claiming he was a large investor in the bonds and telling investors they were backed by gold or silver, according to the SEC's complaint. The pastor of one of the nation's largest Protestant churches defrauded elderly investors of $3.4 million in an investment scheme involving pre-Communist era Chinese bonds, according to a federal indictment.

The pastor of one of the nation's largest Protestant churches defrauded elderly investors of $3.4 million in an investment scheme involving pre-Communist era Chinese bonds, according to a federal indictment.

Advisor, Pastor At One Of U.S.'s Largest Churches Allegedly Defrauded Elderly

April 2, 2018

« Previous Article

| Next Article »

Login in order to post a comment