What advisors don’t know could hurt them — but what advisors think they know could hurt them even more.

With more than four months having passed since the U.S. Department of Labor released the final language of its fiduciary rule, advisors are still digesting the regulation’s implications.

Yet with less than eight months before the new rule goes into effect, a number of misconceptions still exist, according to Concord, Calif.-based AssetMark.

“There continues to be misconceptions or, if nothing else, a lack of awareness concerning what the requirements will be,” says Matt Matrisian, senior vice president of strategic initiatives for AssetMark. “Advisors are kind of sitting on the sidelines to see what their broker-dealers or custodians will do, they’re waiting to see how the industry is going to operate. They’re being reactionary.”

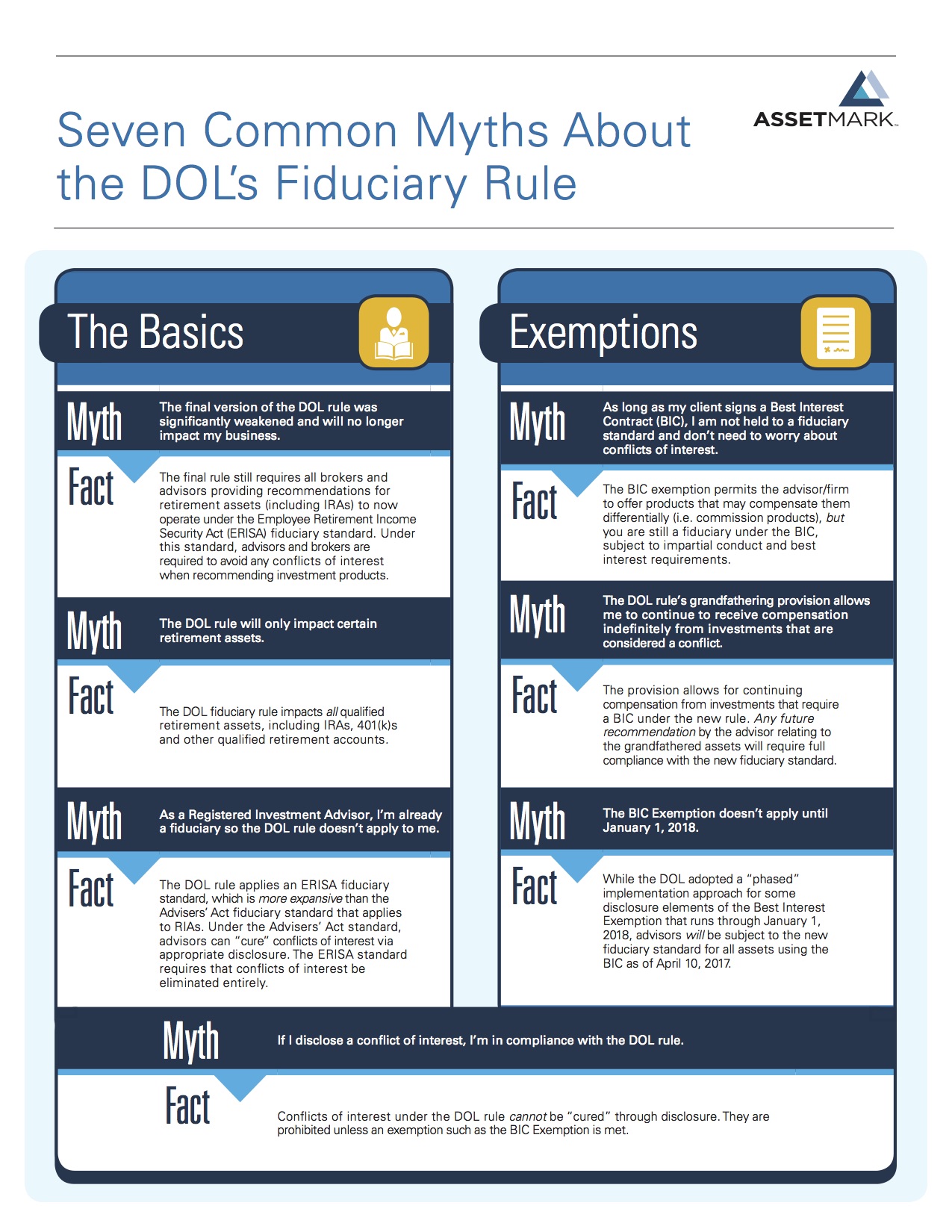

In a recently released infographic, AssetMark uncovers seven common myths surrounding the DOL’s fiduciary rule.

Myth No. 1: The final version of the DOL was weakened so it will not impact an advisory business.

Not so. According to AssetMark, the final rule will require all advisors and brokers to operate under the ERISA fiduciary standard, which at its core mandates that advisors avoid any conflicts of interest when recommending investments.

“The goal of the DOL was to implement a fiduciary standard across all of the retirement accounts to eliminate those conflicts, and that’s what they did,” Matrisian says. “After their initial draft, they did incorporate some feedback from the industry to allow them to transition to the requirements to the new rule, which led to a perception that the rule was weakened, but what they actually created was a stop-gap, not a long-term remedy for the DOL regulations themselves.”

Myth No. 2: The DOL rule will only impact certain retirement assets.

Though any non-qualified accounts, like normal brokerage accounts, are exempt from the rule even if they are intended for retirement, any qualified retirement account is impacted by the rule. This includes traditional IRAs, Roth IRAs and 401(k)s — but not 403(b)s.

“Broker-dealers and advisors are already starting to react here,” Matrisian says. “They’re going ahead and treating non-qualified accounts similar to the way they’re going to be required to treat qualified accounts. Some aren’t allowing for direct mutual fund business anymore, and they’re seeking consistency in compensation and share class moving forward. The burden of having different supervisory and compliance responsibilities across different types of accounts is just too difficult.”

Myth No. 3: An RIA is already a fiduciary, thus the DOL rule will not impact them.

While RIAs are already bound by the fiduciary standard as mandated in the Advisers’ Act, the DOL rule applies the more stringent ERISA fiduciary standard to retirement advice.

“Under the rule, fee-based advisors deriving compensation directly from their clients don’t have the same conflicts of interest, but they’re still bound by the disclosure requirements,” Matrisian says. “That disclosure will not be in the form of a contract, it’s going to be more easily delivered to the client and will have fewer rules and regulations associated with it, but RIAs will still have to adjust.”

In fact, the DOL rule has major consequences for advisors with IRA rollover and managed accounts businesses. Many advisors, however, seem unaware that they’re going to fall under a more restrictive standard for advice, which has led to AssetMark’s fourth myth.

Myth No. 4: Merely disclosing a conflict of interest puts advisors in compliance with the rule.

AssetMark says that a major difference between the Advisers’ Act fiduciary standard and the ERISA fiduciary standard is their treatment of conflicts of interest. Per the Advisers’ Act language, conflicts can be remedied via appropriate disclosure, while the ERISA standard requires that conflicts be eliminated entirely. The DOL did provide some relief for conflicts of interest via the Best Interest Contract (BIC) exemption.

“The Best Interest Contract is not only about disclosure, but a higher level of responsibility,” Matrisian says. “It’s to ensure that whatever their recommending is in the best interest of the client. While the standard of care was formerly around suitability alone, now advisors will also have to ensure that whatever they recommend, especially from a cost perspective, is to their knowledge what is best for the client.”

Myth No. 5: As long as a client signs a BIC, the advisor will not be held to a fiduciary standard.

Not exactly. According to AssetMark, the BIC exemption permits advisors to offer products that may compensate them differentially through commissions, but they are still fiduciaries under the BIC and subject to the rule’s impartial conduct and best interest requirements.

“Advisors are going to have to think carefully about their product recommendations to make sure they’re complying with the BIC,” Matrisian says. “They’re required to attest that the product is in a client’s best interest, that they’ve reviewed other available products, and that they’re still recommending the product. They’re still required to disclose any conflicts of interest. Any failure to disclose and act in the client’s best interest opens up the advisor or firm up to litigation for breaching the BIC.”

Myth No. 6: The DOL rule’s grandfathering allows advisors to receive compensation indefinitely for conflicted investments.

Per the DOL’s rulemaking, advisors can “grandfather” in existing investments in variable compensation products that pay them in the form of trailing fees or commissions -- meaning that a firm or advisor can continue to receive their compensation even though the investments require a BIC in the new rule. However, any future advice by the advisor relating to the grandfathered assets will need to comply with the ERISA fiduciary standard.

“Grandfathering is a grey area because according to the DOL’s language, it’s only effective until further advice is provided to the client concerning their investments,” Matrisian says. “When the rule goes into effect, advisors will have to put these clients on notice that potential conflicts exist and advisors are going to continue to receive the third-party or differential compensation. The next conversation they have with that client, even if they’re advising the client to ‘stay in the products they’re currently in,’ will require a BIC to be put into place in order for those clients to continue to hold those investments.”

Myth No. 7 The BIC exemption doesn’t apply until Jan. 1, 2018.

In response to concerns from the financial industry, the DOL adopted a phased implementation for the BIC exemption that run through Jan. 1, 2018, but that doesn’t exempt advisors from conforming with the fiduciary standard for all assets using the BIC as of April 10, 2017.

“From our understanding, clients will have to sign off on the BIC as of Jan. 1, 2018,” Matrisian says. “The fiduciary standard itself kicks in on April 10, 2017. At that point, if advisors want to put clients on notice from a grandfathering perspective, they’ll need to be postmarked, by that date and advisors will be bound by the best interest rules on that date. My guess is that most firms, especially broker-dealers, will try to have their rules in place in April 2017 and will try to force compliance to eliminate the grey area.”

Matrisian argues that advisors and firms should be proactive and put in place new processes and procedures for complying with the rule as soon as possible. Those who choose to wait until April 10, 2017 or Jan. 1, 2018 to respond to the new regulations will face significant disadvantages.

“The timing behind this becomes messy,” Matrisian says. “Assuming that advisors sit on their hands and don’t do anything until April 2017, at that point they’re going to try to buy more time so they’ll send out their grandfathering notices. Then, midway through summer, they’re going to be meeting with their clients and will have to get the BIC signed off on because they’re providing advice. Then, at years end, they’ll likely come to realize that they can’t continue receiving differential compensation, it’s just too burdensome to have everyone sign off on a BIC, so they put clients on notice a third time to notify them of a change to levelized compensation.

“In a short period of time -- six months or less -- their clients could receive at least three different notices of how the advisor is being compensated. That’s typically not something advisors want to put front and center.”