The super-rich (those with a net worth of $500 million or more) are increasingly choosing to establish single-family offices to address many of their needs. In comparing what else is available—in the form of private banks and wealth managers, lawyers and accountants—single-family offices have proved to be the superior providers.

Because of the structure and dynamics of these offices, they can provide the bespoke solutions super-rich families need and want. But since the family that the office is formed to serve is driving the decision-making, its operations are not all geared to making a profit.

If a single-family office is not viable for them, wealthy families might prefer multi-family offices to the more traditional providers. This way, a much larger subset of affluent people, in many cases those with between $10 million and $20 million, can enjoy the same advantages that single-family offices offer to the super-rich.

What A Multi-Family Office Delivers

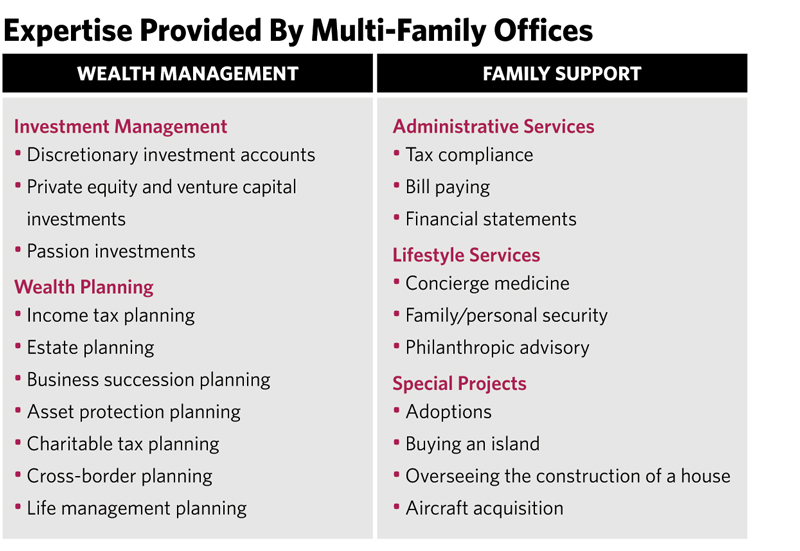

Generally speaking, multi-family offices tend to provide two major categories of expertise: wealth management and family support (see the chart). Wealth management consists of investment management and wealth planning. Family support tends to include administrative and lifestyle services, as well as special projects.

Let us dig a little deeper into each of the categories.

Investment management: Investment management is a cornerstone capability of many multi-family offices. There are familiar investments that these offices make, though the patterns can change easily as social, economic and family circumstances change. So a well-connected multi-family office is inclined to invest almost anywhere it sees profit, as long as the investments meet specified criteria.

Though the investment experts usually work in-house, the multi-family office also likely uses outside investment managers. However, the investment philosophy, strategy and asset allocation, as well as the selection of external managers, is done by the in-office professionals, who also evaluate investment performance.

Wealth planning: For some wealthy individuals and families, wealth planning is much more important than investment management, since wealth planning can often deliver more predictable outcomes: It often involves legally muting the family’s tax burden, protecting assets from frivolous lawsuits, enhancing the impact of charitable gifts and ensuring the continuity of family values and the family fortune.

The following are the most common specialties within wealth planning:

• Income tax planning focuses on blunting the tax bite on money earned by working.

• Estate planning involves using legal strategies and financial products to determine the future disposition of current and projected assets.

• Business succession planning principally deals with the operational and often tax-efficient transitioning of businesses to others, whether it’s to family members or somebody else.

• Asset protection planning entails employing legally accepted concepts and strategies to ensure that a family member’s wealth is not unjustly taken from him or her.

• Charitable tax planning enables tax-efficient philanthropy.

Multi-family offices generally have wealth planning expertise in house but also rely heavily on external experts, as they do with investment managers. Usually, the more complex wealth management situations are outsourced, depending on the level of expertise among office specialists. The more the multi-family office can offer wealth planning expertise to a broader number of wealthy clients, the more likely the firm is going to use experts from within. The offices likely need at least some in-office expertise, in any case, to effectively coordinate the external wealth planning specialists.

Administrative services: These services tend to be very straightforward and frequently mechanical, but they often serve a critical role. They include:

• Dealing with all tax compliance matters, including the filing of tax returns, audit defense, estate and gift-tax execution, tracking and administration;

• Developing and updating the family balance sheet;

• Producing income and cash-flow statements;

• Providing budgeting plans;

• Bill paying and expense reporting;

• Tracking and reporting investments, including addressing cost and tax basis; and

• Bookkeeping.

Some multi-family offices provide a wide range of administrative support services (though rarely compliance) using in-house experts. Most often, the offices have arrangements with high-net-worth accounting practices or other types of providers to deliver administrative services.

Lifestyle Services

These are non-financial and non-legal services that benefit super-rich families. Of great concern to most wealthy families and individuals is health care. This often requires multi-family offices to connect family members with concierge medical practices and oversee the ongoing relationships. Family security is also very important to super-rich families, and there are security firms that provide a range of services such as privacy and cyber protection, personal protection services and investigations, and due diligence.

Some lifestyle services may be offered by in-house staffers. If the multi-family offices can deliver this expertise to a number of wealthy individuals and families, it makes having the in-house expert cost effective.

Special Projects

Multi-family offices regularly engage in the management of one-off projects. These can include, for example:

• Facilitating an adoption from another country;

• Buying an island;

• Arranging for experimental stem cell treatments in a foreign country;

• Overseeing the construction of a 60,000 square foot mansion; or

• Arranging the paperwork and facilitating the process for admissions to a private club.

For special projects, external experts are almost always brought in, and the multi-family office acts as coordinator and monitor.

Delivering Synergistic Outcomes

The attraction of top-of-the-line multi-family offices is that they can generate synergies among the various forms of expertise they provide either directly or with outside help. By combining their focus on the wealthy with the vast range of potential services and products, they can make available just about anything the family or individual wants. Many wealthy investors, for example, can pretty consistently benefit in various ways from the combination of investment management and wealth planning—say, to eliminate the taxes on gains produced by an investment portfolio. This type of thinking (followed by action) is just about automatic at the better multi-family offices. It is much less common for a lot of other types of providers.

Special projects are another area where wealth planning can be highly synergistic. From the buying and selling of private islands or private jets or yachts, from adoptions to paying for unique cravings tax efficiently, wealth planning can often get the results wealthy families seek in the most secure and cost-effective manner.

What this shows is that well-managed multi-family offices are fairly adept at duplicating the advantages that single-family offices offer when it comes to serving the super-rich. And next to other sorts of providers, they have proved to be a more effective way for the wealthy to achieve their financial and personal goals.

Russ Alan Prince is president of R.A. Prince & Associates.