For over seven years, the Baron Fifth Avenue Growth fund was a fairly typical large-company growth vehicle with a diversified portfolio of over 100 stocks, lots of benchmark index companies, and so-so performance.

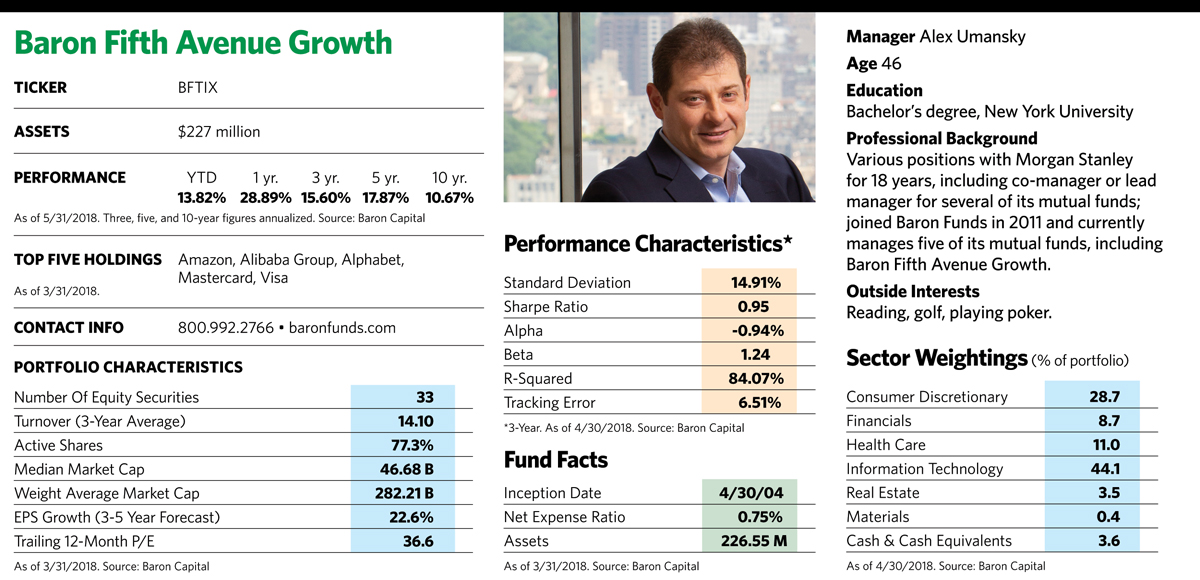

That changed pretty quickly when Alex Umansky, who had been a large-cap growth manager at Morgan Stanley for many years, assumed control in November 2011. Within a relatively short time he had whittled the fund down to fewer than 40 carefully chosen stocks and gave the best ideas ample room to run.

One such stock was Amazon, which accounted for less than 1% of portfolio assets when he took over. Now that number is up to 16%. And that bias toward concentrated holdings is evident throughout the portfolio. At the end of the first quarter, the fund’s top three holdings, Amazon, Alibaba and Alphabet, accounted for 29% of net assets, and the top 10 names represented nearly 60% of the fund. The portfolio owns 32 stocks, while the typical large-cap growth fund owns 125.

“The fund’s old portfolio was structured to guard against volatility,” says the 46-year-old Umansky. “I guard against over-diversification. If you have a portfolio of 100 names, you’re really just providing exposure to an asset class. We’re in the business of finding mispriced securities and adding alpha.”

In a world where active management is constantly measured against index performance, the stance is a bold one, and so far it has paid off. From the beginning of Umansky’s tenure through the end of March, the fund returned 182.6% cumulatively while the Russell 1000 Growth index returned 159.9%. The annualized return for the fund was 18.1% while it was 16.5% for the index. Last year, the fund’s 40.64% return trounced the index’s 30.32%.

Umansky acknowledges that part of the fund’s success since last year comes from a bounce-back following a disappointing 2016, when newly elected President Donald Trump had promised to boost more value-oriented infrastructure plays and energy and growth stocks as a result fell out of favor. When investors realized that corporate tax cuts and profit repatriation would benefit a broader swath of companies, beaten down growth stocks came roaring back the following year and have continued to reach higher ground this year.

Stock picking has also contributed to strong performance. Besides Amazon, the fund has a hefty stake in other names that have done well such as Alibaba, China’s largest e-commerce company; Intuitive Surgical, a medical device manufacturer; and genetic sequencing company Illumina.

The fund’s turnover rate is 14%, significantly lower than the 58% average in Morningstar’s large-growth category, and that points to management’s willingness to hang in with a company name for the long term—as long as the original investing thesis for it remains sound and its valuation doesn’t get too steep. Unlike many managers, Umansky usually doesn’t “trade around” existing positions by constantly buying more shares when prices are down and selling when they’re higher.

At times he may raise cash from the sale of an existing position and use it to buy something more interesting, which happened more than usual in the first quarter of 2018. Although the fund usually buys only a few stocks each year, the market volatility during that period gave Umansky the opportunity to establish several new positions at favorable prices.

“The market in 2017 went more or less in an upward direction with little volatility, so everything went up,” he says. “This year we’ve seen volatility more in line with historical averages. That’s good news for us because it gives us a chance to replace good ideas with better ones.”

He and the fund show off their strong independent streak in other ways as well. The fund’s 6.02% tracking error against the Russell 1000 over the last five years is more than three times higher than that of its peers. By some measures, the approach has also raised the fund’s risk profile. Morningstar pegs its standard deviation over the last three years at 14.93, compared with 11.77 for its large-cap growth category peers and 10.26 for the S&P 500. Over the same period the Baron Fifth fund’s beta against the index was 1.20, while peer beta was 1.03.

Umansky believes that traditional measures of risk, such as standard deviation or beta, don’t tell the whole story. And he points out higher volatility, both on the upside and downside, is a natural outgrowth of a more concentrated portfolio where each stock carries more weight.

“We rail against risk-adjusted returns, and I don’t believe volatility is the best gauge of risk for a large-cap growth fund,” he says. “We will be volatile from time to time. But if our thesis is right, our investors should recoup short-term drawdowns and come out ahead.”

He says the fund’s goal is to maximize long-term returns without taking significant risks that there will be a permanent loss of capital, and he employs a number of risk control measures to do that. These include buying stocks that sell at least 20% below the firm’s estimates of intrinsic value and selling them when their price moves up to over 20% above intrinsic value estimates. Portfolio companies must also have high returns on invested capital, a sustainable competitive advantage, dependable recurring revenues, a diverse customer base and ample free cash flow yield.

Umansky prefers scalable “platform” businesses that don’t require huge capital outlays to grow. For example, Apple and Amazon make money from third-party sellers who pay a significant cut of their sales in order to appear on iTunes and Amazon.com. Yet it costs virtually nothing to add new sellers to these platforms. Mastercard, another fund holding, is able to add new global customers quickly and efficiently at minimal cost with its huge “digital railroad.”

But Umansky isn’t fond of banks because he thinks their balance sheets are too difficult to understand. And energy companies don’t make the cut because they are too difficult to value.

The “New Oil”

A number of the portfolio’s most prominent stocks have come under fire recently for different reasons. Mark Zuckerberg’s apologetic testimony before Congress earlier this year over privacy shook Facebook stock, if not the legions of ardent users. President Trump has meanwhile publicly trashed Amazon for draining U.S. Postal Service resources. And some worry that the threat of a trade war with China could weigh on the stock of Alibaba.

Umansky admits he has no particular insight on whether the negative publicity surrounding Facebook will raise costs for those companies or affect ad revenues over the short or long term, what the fallout might be for Alibaba if more protectionist trade policies come into play, or whether Amazon’s growth trajectory will succumb to political pressure. “However, I do believe the substance of the current debate is largely missing the forest for the trees,” he says.

In the case of Facebook and Alphabet, the forest is data collection, which Umansky calls “the new oil.” Even with all the noise about privacy issues, he believes that these companies will continue to be able to leverage their extensive user databases and maintain their dominant footholds. As for Amazon, the stock’s meteoric 32% increase in the first four months of the year speaks to the company’s staying power “even in the face of the relentless assault from our commander in chief, which would be comical if it wasn’t so sad.” He adds that the continued growth of digital ad spending, cloud computing and e-commerce should benefit these and other tech holdings in the portfolio.

His newer positions include Activision Blizzard, a leading video game publisher whose key game franchises include Call of Duty, World of Warcraft and Candy Crush. He believes the company has an excellent management team and stands to be a major beneficiary from tailwinds such as the shift to higher-margin digital revenue, mobile gaming and international expansion.

S&P Global, another position initiated in the first quarter, is a diversified provider of financial and business information. About half the company’s revenue comes from its credit rating agency business, and a quarter of revenue comes from maintaining benchmark prices for commodities and the S&P and Dow Jones indexes. The indexing side of the business should continue to benefit from the shift to passive investing, while the credit rating business is a well-recognized brand name with few competitors that should continue to grow with the debt markets. Sage Therapeutics, a new biotech holding, is developing unique drugs for central nervous system disorders. The company has also seen positive results in clinical trials for drugs used to treat postpartum depression and major depressive disorders, and its maturing pipeline bodes well for future prospects.