On Saturday morning, I learned that the U.S. election had at last been called for Joe Biden from the sound of car horns honking in the streets outside, soon followed by singing and the noise of people leaning from their windows and banging pots and pans. My neighborhood, Washington Heights at the northern end of Manhattan, is utterly unrepresentative of the country as a whole; overwhelmingly Latino and very liberal, with the local Democratic Congressman receiving more than 90% of the vote. It’s not surprising, therefore, that the news was treated as the excuse for a vintage Latin fiesta in the streets.

It is more surprising that global stock markets seem to have treated it the same way.

At the time of writing, trading in S&P 500 futures in Asia suggests that a new all-time record, for the first time since early September, is a real possibility. They are rallying strongly again:

As I wrote last week, the narrative is already well established that divided government, with a relatively moderate and market-friendly Democratic president countered by a slim Republican majority in the Senate, should be perfect for stocks. (And divided government we will almost certainly have, although there is a slim chance that Democrats could force a tie in the Senate if they win two run-off races in Georgia in the first week of January). To this can be added the basic market physics that there was pent-up demand for another rally. The reduction in perceived risk also means a weaker dollar (because people feel less need to shelter in U.S. assets), which in turn helps American securities prices.

There are plenty of reasons to buy or sell stocks that have nothing to do with U.S. politics. There always are. But something significant has changed this week, and a lot of uncertainty has been removed. What real reasons have these changes given us to feel more or less bullish about U.S. stocks under President Biden?

The Bullish Case

As president, Biden will have sweeping powers over trade policy, as Trump has demonstrated. The last thing he needs is a continuing trade war with China. He would have no guarantee of winning, and the latest trade figures from Beijing suggest that the build-up in tension under Trump has done minimal damage to the Chinese export complex:

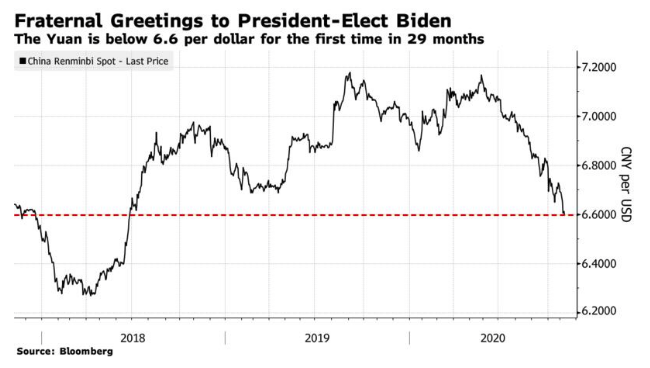

If there is anything the markets haven’t liked about the current president, it is his trade policy and its unpredictability. A look at the Chinese currency, which has been wielded as a weapon during the hostilities, shows that Beijing is now extending the hand of welcome. The yuan is its strongest against the dollar since Trump started to amp up tariffs and rhetoric in the summer of 2018:

The Biden presidency can also reverse much of Trump’s work on the environment via executive action. Anyone who was hoping for an impulse for alternative energy should be happy. As for doubts over the incoming administration’s attitude toward fracking, the current price of crude oil, hovering around $40 per barrel, renders them moot. Prices at that level are going to be terrible for the U.S. oil industry whoever is president. The fly in the ointment is that much good news is already in the price, particularly for solar energy:

Most importantly, the Trump approach to dealing with Covid-19 has been close to indefensible. Consistency and discipline are necessary until a vaccine is available — and will also be vital for making sure the vaccine reaches people quickly. The Biden team has already given word of the group of advisers he is appointing to guide his Covid-19 strategy, to be headed by the former surgeon-general Vivek Murthy, and including Obama administration health adviser Ezekiel Emanuel. They have a body of work that can be reviewed. A more competent handling of the pandemic won’t eliminate risk, and won’t turn the U.S. into Germany, but it should at least reduce market jitters.

A final point is that Biden in these circumstances is going to appoint a treasury secretary with whom the market is comfortable (Elizabeth Warren wouldn’t be confirmed by the Senate, and so won’t be nominated), and he isn’t going to pick anyone from the far fringes to serve on the Federal Reserve, as Trump has done. If, as is widely speculated, the treasury job goes to Lael Brainard, currently a Fed governor, there should be a return to joined-up monetary and fiscal strategy, which could be vital if the winter wave of the virus causes another serious dip in economic activity. If any eyes roll at the prospect of yet more of the policies that have dragged on for more than a decade now, bear in mind that they have worked out really well for markets.

The Bearish Case

This is likely to be an unusually short honeymoon, because:

• Although Trump won’t have presidential power for the next four years, he will still have very real political power, and can be expected to use it. He will be a pain, and lead a large and obstructive opposition.

• Biden, given his age, is expected to be a one-term president. Politicking to replace him is already under way.

• The Republicans have a very strong chance of taking back control of the House in two years. (This isn’t just because presidents tend to suffer a big mid-term swing against them; it’s also because there will be re-districting after the completion of the U.S. census.)

• The Senate is also very probably up for grabs in 2022. Expect a repeat of the past week’s dramas, as Republican senators plan to retire in North Carolina and Pennsylvania, while the winner of January’s Georgia special election will also have to defend in 2022. Republican seats are also up for re-election in Wisconsin and Florida.

• Recriminations among Democrats are likely. A few more firebrand progressives were elected to the House, while a number of moderates were ousted.

• The Supreme Court could force the issue of healthcare, on which there is minimal chance of compromise between presidency and Senate, if it rules Obamacare unconstitutional. Beyond causing a big political mess, and risking unrest, it could also cause economic problems if and when people lose coverage.

Then, more important than any of the purely political factors, Biden will be greeted by the coronavirus, which hasn’t gone away. If it mutates, or gains ferocity during the winter, he won’t be able do much in terms of solving America’s longer-term problems.

Finally, there is the nagging feeling that divided government can have its place, but this is one time when a clear-cut plan involving spending some money would have been a really good idea. The rate of change is what matters to markets, and the U.S. economy is still improving. But as Torsten Slok, now of Apollo Global Management, shows in this chart, employment remains far below its level from a year ago, and improvement is slowing:

You don’t need to be Alexandria Ocasio-Cortez to think that this is the time to throw some money at the problem. There are worrying indications that U.S. economic activity is beginning to slow in the face of the latest Covid-19 wave. Jeremy Grantham, the sage who founded the GMO fund management group, even suggests a need for a new Marshall Plan. Not all will agree with what follows, but bear in mind that Grantham is no AOC:

A program modeled on the Marshall Plan would help address growing inequality. Typical workers – as we are all beginning to realize – have been hung out to dry, really since the mid-1970s. Much of the spending on new infrastructure would be industrial and labor-intensive. It would have the same effect as a major onshoring of manufacturing, providing hundreds of thousands of jobs and raising wages for both skilled and unskilled labor. (Although, certainly, retraining and improving skills will remain a priority given the changing economy.)

It would also help challenge the growing dominance of China in the energy and industrial technologies of the next century. Under current trends, that dominance could soon become unassailable. For one example, the U.S. has 400 electric buses, while China has 400,000! Green energy and industry will be not just economically important in coming decades, but, like oil was before, incredibly geopolitically important. A major new infrastructure program would help the U.S. – still the most innovative country in the world – catch up to China's lead.

He wrote these perfectly sensible words before the election. Nothing like this is going to happen. Meanwhile, the odds are that under divided government the U.S. slips further into “Japanification,” possibly including negative nominal yields. Another British sage, Societe Generale SA’s bearish investment strategist Albert Edwards, commented over the weekend that he no longer feels alone in predicting negative yields. Even Scott Minerd, the well-known CIO of Guggenheim Partners, has now joined him.

Negative real yields might turn out to be necessary. They haven’t been a boon for investors in Japan or the euro zone.

Put differently, a Biden-McConnell government will be good for bond vigilantes, who care about government deficits, but there aren’t many of those around. Instead, it is “stock vigilantes” who need to be appeased. A big collapse in asset prices would do nobody any good, and it would be less likely to happen under united government. I strongly agree with this verdict, from TS Lombard’s chief U.S. economist, Steve Blitz:

The old saw that markets like divided government because it leaves everyone in checkmate, a “do no harm” mode for the economy, is fair when things are going well, but fool’s gold when they are not. The Fed is stuck with a reactive position because there are no more rate cuts to be had, leaving them to manage the size and maturity of their balance sheet in case equity markets crumble. We expect the current rebound to top out soon enough, barring a vaccine, because the level of activity is ultimately squelched by what the virus has impaired – and the impact is worse without a Covid-relief package.

It’s easy to see why my liberal neighbors in Washington Heights are celebrating. It’s much harder to see why the stock markets are doing the same.

Survival Tips

Not all readers will find Biden’s victory a reason to celebrate. But for the many who do, I’d like to offer some songs that have accompanied the weekend’s party in Washington Heights. Arcade Fire released this song on Steven Colbert’s show on election night; the chorus is “I can’t wait,” and it works as a great hymn to impatience. I first learned of the election result when I heard people singing this song in the street. And the boomboxes in the street confirm that at times like this you can’t beat ‘70s disco: Try Good Times by Chic, and Celebration by Kool & the Gang. And if you don’t happen to feel like celebrating, I hope this will take you back to when you last did. Have a good week.

John Authers is a senior editor for markets. Before Bloomberg, he spent 29 years with the Financial Times, where he was head of the Lex Column and chief markets commentator. He is the author of The Fearful Rise of Markets and other books.