High Tech; High Touch

In the 1980s, futurist and Megatrends author John Naisbitt predicted that business and society would evolve astoundingly on both the technology and social fronts. The big winners in business would be those that mastered a high-tech/high-touch approach.

For financial advisors today, it’s imperative that the high tech (think fintech) aspects of the business be integrated with the high touch components such as listening, emotional intelligence and being able to facilitate family conversations about money.

According to Steve Gresham, managing director of The Execution Project and Next Chapter (which partners with Financial Advisor magazine), savvy advisors need to take advantage of new time-saving technology, which can afford more time to focus on value add “high-touch” skills. “The best advisors have learned to listen carefully, acknowledge concerns, identify points of friction and help the clients find a common path. It is the most valuable service they can provide.”

The Challenge Of Adoption Of New Technologies

The recent pandemic forced many advisor firms to adopt new technology sets and pivot in ways to help serve the needs of their clients. From Zoom videoconferencing to secure electronic signatures to AI-fed personalized content, financial advisors spent nights and weekends learning new ways of doing business—aided by technology.

In some cases, they were learning brand new tools and in others, finally using technology that they had access to, but had never put to use.

“Adoption is really the best way to measure success for advisor technology,” says Kim Mackrill of Milemarker, a Mount Pleasant, SC-based Integration as a Service (IaaS) company that delivers a fully managed data integration platform for financial services companies.

“It's quite common to run across firms who have a lot of tools only to discover that they are barely using any of them. Understanding how to integrate them with the rest of your technology stack is one thing. Understanding how to use them every day effectively is another, but both are significant,” she adds.

Seeking Ways To Help Advisors And Clients Pull The Right Levers

“One of the key reasons advisor adoption has been challenging is software has historically been written by techies, not advisors, says Jack Sharry, EVP and CMO of LifeYield and host of the Wealthtech on Deck podcast.

“Tools are available that develop personalized recommendations—think eMoney, Riskalyze or LifeYield, but there’s little, if any, integration that identifies specific implementation steps,” says Sharry. “For advisors to add the most value, they need to see and act on a client’s full financial picture. The industry calls this a Unified Managed Household (UMH). What is now becoming available is data integration across all applications, accounts and products so the advisor can operate the key levers that improve financial outcomes for the client and the advisor—managing cost, risk, and taxes in a coordinated way.”

According the Sharry, managing cost, risk and tax goes from being discrete tools via single sign on (SSO), to being integrated and coordinated as critical pistons in the engine, all via API (applications programming interface).

“Cost, risk and tax don’t go away but coordinating these elements needs to be synthesized in a way the human mind just can’t do,” says Sharry. “Only sophisticated software capabilities working together with consistent data can determine how the benefit is quantified. This then determines the prioritization and sequence of the next best actions that a client should take. We need better ways to help the clients execute on the recommendations. Today, it’s disjointed. Software is now available to enable the tech stack to connect the dots, quantify and prioritize next best actions, and creates a win for clients and advisors.”

Are these changes on our doorstep? “Yes. Some firms have it today,” says Sharry, noting the complexity and the capital required to build these new integrated, coordinated UMH ecosystems happens over time. “However, the big change on the horizon will be leveraging tech to make the portfolio management process more comprehensive. This is big and will transform our industry.”

Sharry shared an example: Bain Capital recently made a big investment in the Carson Group, one of the largest RIAs. The valuation equated to 6% of AUM, a record high valuation. It’s representative of what’s driving the build out of UMH platforms. That level of valuation presumes Carson will be doing more and more of the asset management, while the advisor will be doing less and less. The advisor will focus more on relationship management, handholding and client and asset acquisition and retention.

Engaging Advisors To Adopt New Tech Across The Enterprise

“The wealth management industry is now discovering tech, but how do you do it productively?” That’s one the key questions beings asked by industry leaders and Next Chapter advisor members like Kabir Sethi, head of Digital Wealth Management at Merrill Lynch.

“Sure, you can start with support from senior management and their strategic focus on technology,” says Sethi. “But you can’t assume that just because you put new technology out there, people will use it. Most advisors operate in their comfort zone. But that needs to change,” he suggests.

“At our firm, we understand there is no substitute for hand-to-hand combat and equipping field leadership with the right tools and knowledge. That means that we as senior leaders are required to put ourselves in the shoes of the advisors in the field. We have 19,000 advisors and over time, we have built a regional team of over 40 digital specialists who are separate from the practice management team and focus on coaching advisors as they evolve to a digital operating model over time,” Sethi explains.

Jack Sharry recommends a “nudge or micro engagement strategy” to boost adoption of tools. “You can’t overwhelm people with too much technology all at once. If you give them a specific new tool to use, such as an RMD tool, or a Roth conversion tool, if you can clearly communicate the benefits of each tool and show how it can save the advisor time and lead their client to the next best action, then you’ve hit a home run,” says Sharry.

Lastly on adoption, what is the role of direct incentives for advisor/staff adoption of technologies? Should people expect to be compensated in some fashion?

Focus Financial, which partners with 55 RIAs, uses game and reward-based systems to drive technology adoption. One technique they discovered was only enabling 20% of the functionality in new software to start, then adding more in successive phases. This helps avoid overwhelming advisors who usually don’t have time for long training sessions.

Challenges Of Integration: Out With The Old?

In technology, it’s often a question of old vs. new. The old tech is dated, but at least people know how to use it to get the job done. The new tech holds the promise of efficiency and boosting productivity, but may require lots of change, training and time away from clients.

“Even when there’s a path for integration, the blending of old and new is more complex when some of the old is proprietary and not easily integrated,” says Jud Mackrill of Milemarker.

“As the wealthtech industry matures, we all need to think about data portability and how data connects between layers in the tech stack,” he continues. “Many smaller RIAs are still running their business on Excel. They need to migrate to the cloud where they can vertically integrate with other applications that will improve their workflow, free up their time, and eliminate waste from some processes. Sure, the pain of changing legacy systems is difficult, but it works better when you show people a path without asking them to reinvent the way they serve clients and run their businesses,” he adds.

The future of client engagement is quickly evolving, according to Kim Mackrill. “The idea that you have to be physically present in front of your clients died in 2020. You don't have to do video conferencing, but you certainly should be ready and able to whenever your clients want to meet that way. Humanity won't march backwards,” she adds.

“Advisors and advisor tech firms have a lot of hard work in front of us to provide clients with accurate, up to date pictures of their wealth that allows them to communicate with ease to their loved ones, wealth advisors, attorneys, CPAs and other personal advisors,” she says.

Seeking Support From The Advisor Community

Over the next year, Next Chapter*, an industry wide group of leaders and innovators from the financial services community, seeks to better the integration and adoption of tools and resources to help improve the digital client engagement experience. A focus will be placed on measuring the ROI of critical digital capabilities that will lead to better outcomes for clients of all sizes.

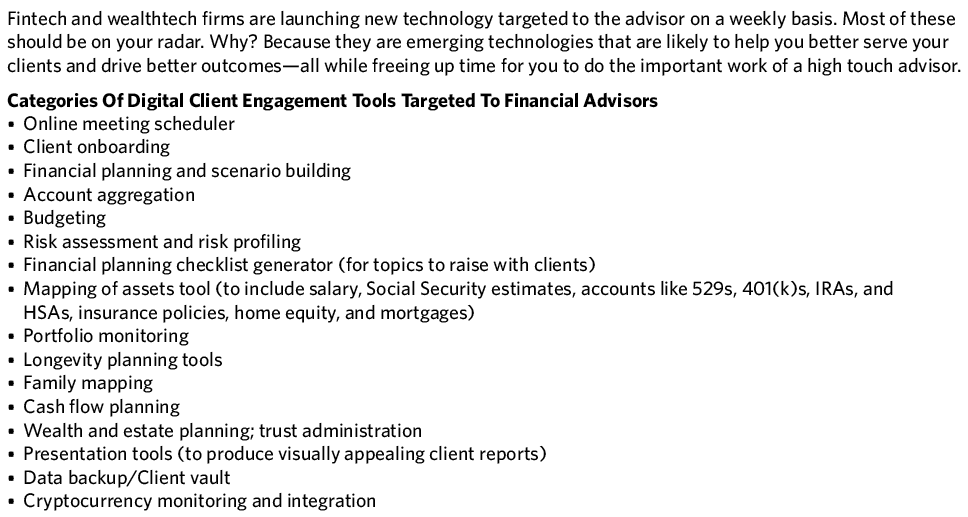

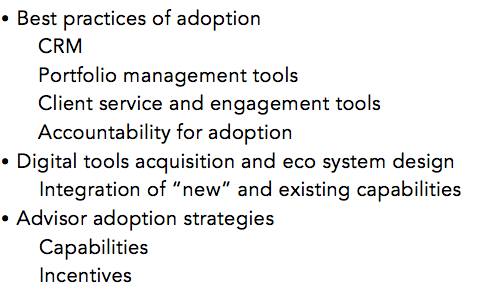

To build alignment across the industry, Next Chapter seeks use cases for:

If you or others at your advisory firm can provide details on any of the above scenarios based on your work with existing clients, please contact Steve Gresham at [email protected].

David Conti is a NH-based writer, editor and content marketing consultant. He was editor at Fidelity Wealth Management and now writes about personal finance, retirement, aging and wealth for several national publications. Contact him on LinkedIn.

*Working for the greater good, a group of more than 30 industry leaders built Next Chapter—a think tank/take action team focused on retirement. It’s sponsored by the Execution Project, Financial Advisor and the Money Management Institute, and we are working on behalf of the MMI’s 180+ member companies and FA’s 200,000+ advisors.