\With profit margins squeezed, a fiduciary rule in the works and competition picking up, broker-dealers are busy reinventing themselves as full-bodied wealth management servicing firms.

Those that come up short on the task of reinvention may face a tough choice: sell out or transform into a branch office for a larger firm, one that has the scale to compete.

Click here to view the 2018 B-D ranking.

Click here to view the 2018 B-D expanded ranking.

Challenging as the environment may be, the good news is that the turmoil stemming from the U.S. Department of Labor over the past several years is gone, and advisors and firms are refocused on growth, observers say.

Yet the loud debate over a fiduciary standard has sparked questions from clients about how they’re being cared for, says Amy Webber, CEO of Cambridge Investment Research. That, in turn, has prompted some clients to leave those firms or advisors who haven’t stacked up.

And that’s made it easier for other firms to pick those clients up, says Webber. It’s an opportunity for advisors who want to grow, and for firms that can afford to remain competitive and offer the flexibility advisors want, she says.

The old way of doing things isn’t going to work for most broker-dealers if they want to grow their base of advisors and assets. Fee compression and higher costs are forcing a rethink of business models, explains Jamie Price, CEO of the Advisor Group.

Robo platforms are pushing down the prices for services like asset allocation, Price says, while regulatory costs have mushroomed with tightened oversight. “People are realizing we’re in a fiduciary era,” he says.

The DOL “made most of us take a hard look at our businesses,” agrees Bob Oros, CEO of HD Vest Financial Services. Firms have had to address conflicts of interest, level their product pricing and review the appropriateness of everything they sell.

Overall, it’s been a good development, Oros says. “I do think the independent space has some catching up to do [to] get away from the transactional model.”

A final DOL rule may be on the back burner until the SEC floats its own fiduciary standard (something that’s expected in the middle of this year). Meanwhile, firms got a reminder in February that they’re on the hook for the DOL provisions that have already gone into effect: That month, Massachusetts regulators filed a claim against Scottrade for violating its DOL-related policies and procedures for sales contests.

As far as what the SEC will come up with, hope is in the air. “I am optimistic that [SEC chairman Jay] Clayton understands more about our business than perhaps others have in the past,” Webber says. It’s possible the best-interests contract will be more workable, and the private right of action could be dropped, she believes.

Regardless of when any new fiduciary rule takes effect, the shift to fee-based platforms will continue. “We’re definitely seeing shifts to cheaper share classes [and] we absolutely see a shift to managed accounts,” says Carolyn Clancy, head of the broker-dealer segment for Fidelity Clearing & Custody Solutions. “Our managed account book in the B-D segment is about 42% [of assets] on average. Five years ago, it was 31%.”

Although fee options for insurance products and alternatives are still limited, that’s changing. Insurers and alternatives sponsors “are all working very quickly to build improved products on the fee side,” says Wayne Bloom, CEO of Commonwealth Financial Network.

Along with the movement to fee-based accounts, advisors and firms are bolstering financial planning services. The robo platforms and fee wars among discounters and index products have made it clear that basic investment advice won’t command the same profit margins going forward. Advisors clearly have to offer more, observers say.

And many B-Ds aren’t content with their traditional mass-market segment, either. “A lot of them are focusing on client segmentation,” Clancy says, “to ensure they have an offering … for the high-end segment, so they can really go after those wealthier clients.”

Consolidation Fever

Clearly, consolidation was one of the big trends among broker-dealers last year. No one expects that to change, and it is spawning recruiting opportunities.

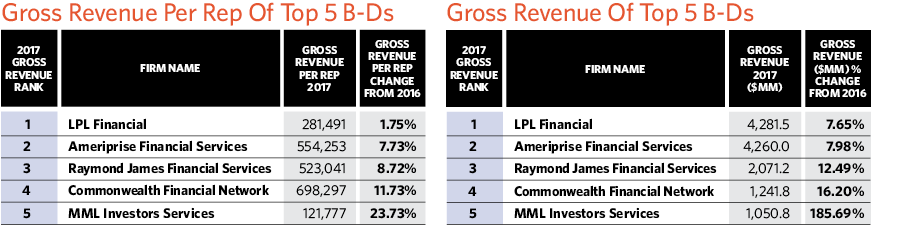

In February, LPL Financial officially completed its purchase of assets from those broker-dealers formerly under the umbrella of National Planning Holdings. That deal set off a scramble by competitors to grab NPH-affiliated reps. According to its latest disclosures, LPL expected to get about 70% of NPH reps’ production, which would be just near the range of what the firms expected according to terms of the deal. The deal required LPL to begin contingency payments if it retained 72% of production.

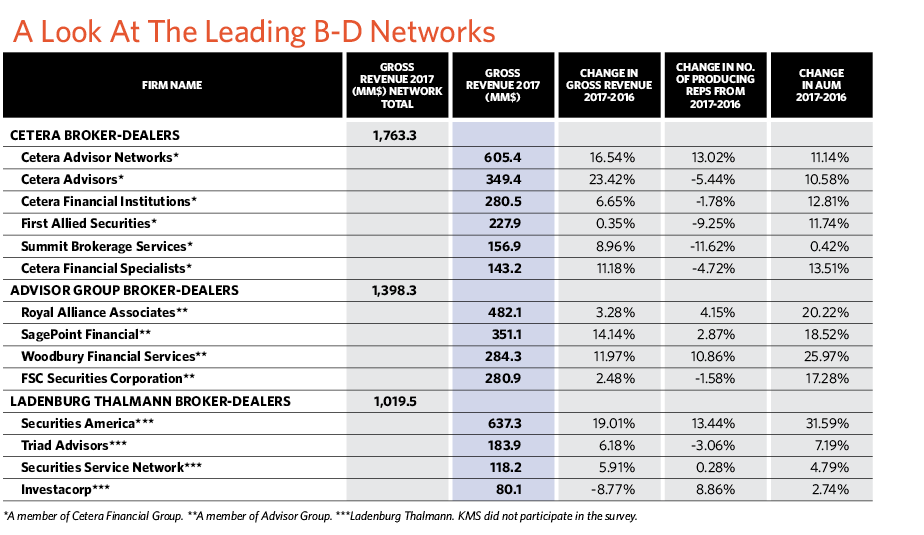

Also in February, Cetera Financial Group confirmed that it had retained Goldman Sachs to support a “capital structure review” process and identify future strategies. That news, of course, led to speculation that Cetera would be put up for sale.

In an interview in late January, the company’s CEO, Robert Moore, said Cetera had emerged with surprising strength from its bankruptcy, triggered by the collapse of its former parent, Nick Schorsch’s RCS Capital. Although the network suffered attrition over the past few years, Moore said Cetera’s six different firms managed to recruit 784 new advisors, including 194 from National Planning Holdings. It also attracted more than 150 new entrants to the business.

Some observers expect LPL to chew on the NPH addition for a while before taking on any new targets, while others think it could become a bidder for all or parts of Cetera if that broker-dealer does indeed go on the block. LPL is still “highly interested in growing,” admits Bill Morrissey, managing director of business development for the firm. Since acquiring National Planning Holdings, LPL’s stock has reached new highs and, given its size, acquisitions may be the best means for LPL to achieve meaningful growth as it faces the law of large numbers.

The NPH purchase demonstrates the accelerating consolidation trend, Morrissey says. Tighter profit margins, low interest rates, tougher regulations, the shift away from commission business and an aging advisor population are all driving firms to merge, he says.

That will mean continued advisor migrations. Big deals like the NPH transaction always spur advisors to at least kick the tires at other B-Ds.

Securities America has probably scored the most in the hunt for National Planning Holdings reps who didn’t want to go to LPL. The firm would not divulge the number of reps it specifically snagged from NPH in 2017, but it did add 291 reps last year, bringing its total number to 2,586. Outside recruiters say the firm’s flexibility was its primary attraction to reps from other firms.

“Independent advisors are anxious about the future right now,” says Securities America CEO Jim Nagengast. “Advisors want two key things from the firms that support them right now: the stability to help them plan ahead for their clients and practices, and the personal touch that assures them they won’t be just another number.”

Webber says one-third of Cambridge’s recruits in the first quarter are coming from LPL, a higher-than-normal number. “That could be [because] there’s some uncertainty about how big [LPL] can get,” she says.

As for the developing news at Cetera, “just the uncertainty is creating phone calls,” she adds.

“Stability is a huge factor for advisors right now, because there’s so much change in the marketplace,” says Jodie Papike, executive vice president of Cross-Search, a recruiting firm. Broker-dealers all have similar offerings, she says, so what distinguishes them is the level of service they provide, which can be harmed during times of transition.

Yet other firms are managing to grow their networks by looking in pools beyond the LPL-NPH-Cetera universe. Raymond James, in particular, is enjoying impressive results, according to one headhunter.

Scott Curtis, president of Raymond James Financial Services, says his firm has been in talks with advisors at LPL, NPH and other independents, but says the wirehouses are its most fertile source of new advisors. “For many years, [Raymond James] recruits have transitioned primarily from large national employee model firms,” he says.

Late last year, Morgan Stanley and UBS announced they were leaving an established recruiting protocol to which hundreds of major B-Ds are signatories. The protocol allowed brokers the freedom when they left their firms to take a limited amount of information with them, including clients’ names and contact information (just not actual documents).

Curtis says Raymond James has seen no impact on recruiting activity so far, adding that the firm’s in-house recruiters and outside consultants have “many years of experience in assisting advisors moving from protocol and non-protocol firms.”

Other advantages that have helped firms win the recruitment battles are sophisticated technology and investment platforms, a “full suite of service components,” and the capital to offer transition assistance, Clancy says.

Observers say insurance-company-owned broker-dealers are the most likely to sell out and become the next source of bulk recruits. Product manufacturers that own wealth management businesses “are reassessing whether that’s a model that has real value in the future,” Price says. Those firms realize they won’t be able to commit the needed resources to a competitive wealth management platform, he says.

“The trend line around insurance-owned B-Ds is not great,” Morrissey agrees. “They got into the business for proprietary distribution.”

Some smaller B-Ds and stand-alone practices are also looking to sell. So much so, in fact, that Commonwealth Financial, which requires its affiliated hybrids to custody independent advisory assets at Fidelity, its clearing firm, is thinking about going to a multi-custodian platform to make it easier for its advisors to acquire new firms.

“The big driver [of supporting multiple custodians] is from advisors who are presented with lots of acquisition opportunities,” Bloom says. Potential sellers may custody somewhere other than Fidelity, and it’s a much easier conversation if a potential target won’t have to make a custodian switch, he says.

Oros rejects the idea that small firms will have to consolidate. But smaller players will need to offer something unique, he says.

HD Vest, for example, has a niche of serving tax professionals, which is an advantage after the recent tax reform, Oros adds, because clients are seeking more help with tax planning.

Niche firms that have a unique investment capability or serve an industry segment well can survive, Clancy says. “I actually think the future is bright for these firms.”

Broker-dealers aren’t the only ones searching for ways to stay competitive. Hybrid practices face similar regulatory pressures. Some are increasingly working under the auspices of a corporate RIA rather than running their own RIAs as a way to cut costs and focus on clients instead of paperwork. That move has been prompted by the increased regulatory complexity and the more frequent audits by both the states and the SEC—something many advisors haven’t seen before, Webber says.

“We have some advisors who ended up with enforcement cases over some administrative thing,” she says.

“They don’t want the liability,” Papike adds when talking about hybrid RIA owners who wonder about keeping their own firms.

A Better Client Experience

Besides meeting the day-to-day challenges, brokerage firms have something else on their minds: creating better client and advisor experiences.

“There’s a hyper focus on the customer experience,” says Oros. “For too long in the financial services industry, [service delivery] has been done the advisors’ way” rather than the clients’ way, he says.

Clancy confirms that Fidelity’s custodian client firms are “super focused on technology, and how to use it to enhance” user experience and make the business more scalable. Firms are hiring chief technology officers, she says, and “many are revamping what they call the front door [for customers] and their advisor portals.”

Webber thinks the industry is poised to use technology to enhance the deeper planning process many advisors are pursuing.

“I really think 2018 is going to be a year of leveraging those [digital] offerings,” Webber says. That means more combinations of advice and technology, and more ways for a client to engage an advisor—through a subscription model, perhaps. Cambridge plans to offer some new service options this year so that self-directed or low-cost clients can “ratchet up” to the level of advice they need, Webber says.

“We will be leveraging robo technology across the investment advisory space,” says Advisor Group’s Price. The goal is to empower advisors to handle larger asset pools.

“With fee compression, I think it’s obvious that advisors will leverage technology to manage more assets,” Price says.

Despite the increased reliance on technology, the importance of advice is not going away, industry execs insist.

The robo platforms have done a good job of shaking up the industry, says Doug Ketterer, chief executive and founding partner of Atria Wealth Solutions, a New York-based roll-up firm. “But the human [advice] aspect is critically important and here to stay.”

Ketterer envisions advisors moving past investments and planning and engaging in more life planning and client collaboration—and they want more support from their firms along those lines.

Advisors have in the past viewed their B-Ds as just utilities, he says. “Now they are much more looking to a home office or firm as a partner.”

Morrissey also sees advisors stepping up to address challenging issues for clients like long-term-care needs, retirement, second families and sandwich generations—issues far beyond simple asset allocation.

Advisors’ value is “helping [clients] with an insurance check in a time of despair, or helping with a difficult family situation—those are the things that are overwhelming” for people, Bloom says. “I’ve heard countless stories and seen e-mails thanking advisors for those things, but I’ve never seen one thanking them for an extra 30 basis points they got out of their large-cap growth fund.”

After a trying few years of DOL-driven change, advisors now seem to be thinking the same way, and are more focused on helping clients than worrying about what they can’t control. “Advisors understand … where their real value is,” Bloom says.

Last year “was stressful, but I think [advisors are] coming out the other end stronger and healthier,” Webber says.

Brokerage firms, too, are more focused, Clancy adds. “They are extremely focused after a couple years of consolidation and regulatory activity. They have a renewed sense of energy [about] how to reignite growth.”