Bonds have been as close to a sure thing as there is in financial markets over the past four decades. Since 1982, the Bloomberg U.S. Aggregate Bond Index has only had four down years, and never back-to-back. Yet, after falling 1.54% last year, the benchmark is already down 1.62% in just the first few days of 2022. Might this be the end of the winning streak?

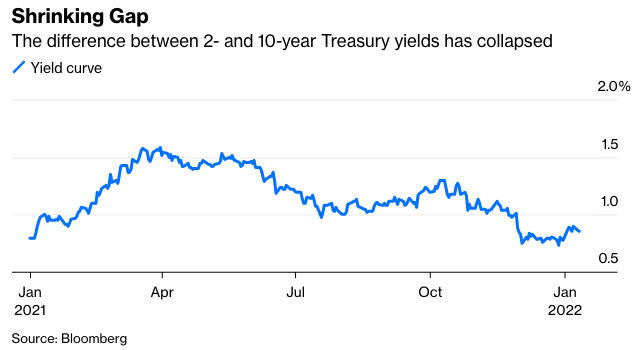

To answer that question, we need to understand that bond investors continue to forecast a hot economy that is poised to buckle under the strain of even limited interest-rate increases. That can be seen in the difference between short- and long-term bond rates, known as the yield curve, which is flattening as investors price in more Federal Reserve rate hikes this year.

Over the past 40 years, central banks have used interest rates as their main tool to influence the economy. Inflation running too hot? Raise rates. Economy struggling? Lower rates. Changing rates directly affects private sector credit creation and recalibrates the economy as needed.

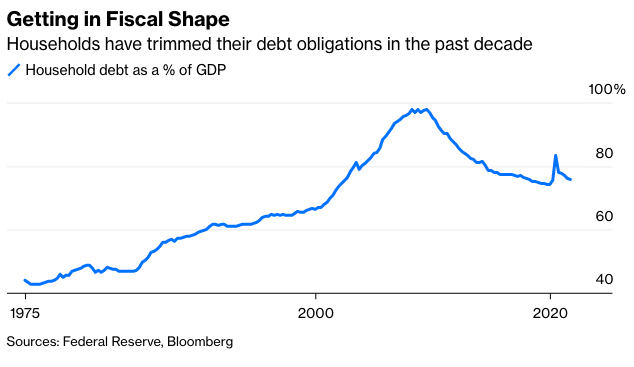

This reliance on monetary policy has also had the effect of goading the private sector into an ever-increasing debt burden. And yet, what we found in 2008 was that even lowering rates to zero could not entice any more debt expansion. In response, central banks enacted unconventional monetary policies such as quantitative easing, or QE, and yield-curve control. Some countries even tried negative rates.

Although many market participants worried these new policies would lead to hyperinflation, that didn’t happen. Instead, the economy struggled, producing one of the most sluggish recoveries of modern times. Over the next decade, the market learned that when the private sector faces a balance sheet recession, unconventional monetary stimulus does little to affect the real economy. Monetary injections are trapped within the financial system and result in limited economic growth.

This lesson is partly responsible for the very different economic response to the Covid-19 crisis. Instead of leaving the heavy lifting to the Fed, the U.S. government engaged in the most aggressive fiscal stimulus since World War II. This massive deficit spending was accompanied by unprecedented QE by the Fed. Contrary to what many market pundits predicted early in pandemic panic, both bonds and stocks posted gains in 2020 after initially generating big losses. The speed of the market recovery stunned all but the most optimistic analysts, and it was due to the dramatically different government response to the economic downturn.

Still, the market assumes this recovery will resemble one from 2009 through 2012. Many money managers are more concerned about the economy’s ability to weather higher rates than they are about the economic expansion accelerating. They cite the imminent pullback of fiscal stimulus combined with the reversal of monetary expansion to argue the Fed will have difficulties raising rates by any meaningful amount before there is an economic or market accident.