The Story So Far

For decades, there has been debate over whether the UK should be a part of the European Union (and, previously, the European Economic Community). To close this debate “once and for all,” Prime Minister David Cameron committed to and called a referendum on the UK’s membership in the EU in June 2016.

The result of that referendum was a 52% majority vote to leave the European Union. However, the referendum itself did not specify under what terms that exit would occur. The details of withdrawal were subject to negotiations between the UK government and EU, which began in earnest in spring 2017. Understandably, the Europeans were not going to make the process easy – something that has strongly deterred the other 27 member countries from following the UK, in turn strengthening the “Union.”

Prime Minister Theresa May and her government eventually did negotiate a Withdrawal Agreement for the United Kingdom. However, the effort, already fraught with emotion, controversy, and uncertainty, was undermined further when Prime Minister May called a general election in 2017, a move intended to solidify her political power that backfired and left her reliant on the support of other parties. The deal was rejected by Parliament repeatedly in early 2019, leaving the UK unable to exit the EU as originally scheduled, on March 29, 2019.

May resigned, driven out by her inability to get Brexit done. Then, Boris Johnson became Prime Minister in July 2019. His approach to cut the Gordian knot of Brexit was to call a general election. However, this required Parliamentary support, which was not forthcoming until Johnson committed to a) asking the EU for an extension and b) eschewing a “No-deal Brexit” (leaving the EU without a withdrawal agreement).

In October 2019, to the surprise of many, Johnson managed to secure a revision to the previously negotiated Withdrawal Agreement by securing a compromise to avoid a “hard border” between the UK province of Northern Ireland and the independent Republic of Ireland to the south, which is part of the EU. (This border is fraught with historical significance and was once a source of strife). While this appeared to garner majority support in Parliament, Johnson’s timetable for passing it did not. Johnson had already committed to a new election in order to strengthen his mandate. This is the path upon which the UK Parliament has settled.

What Is Happening Now

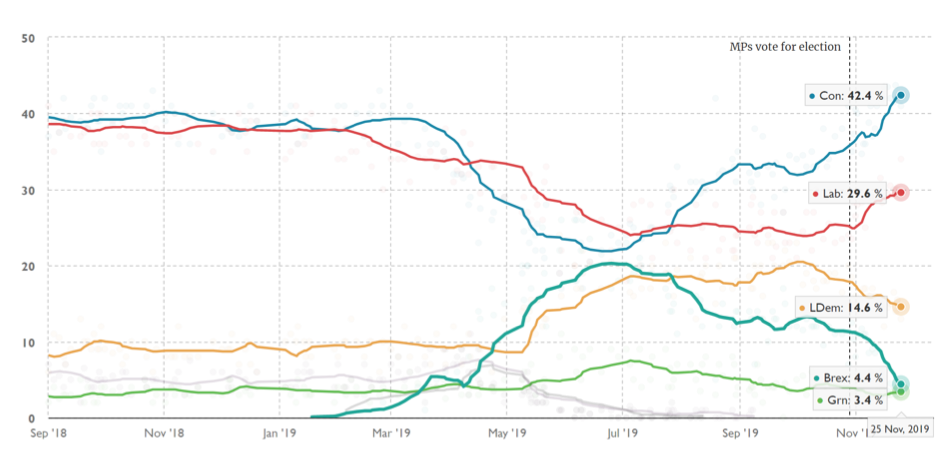

The UK is now in the midst of a furious campaign ahead of the election on December 12. The current state of the parties’ positions in the polls can be seen below:

Clearly the Conservatives are in a strong position, with a 13 percentage point lead over Labour. However, under the UK Parliamentary system, a Conservative win is not guaranteed. Each member of the House of Commons is elected by their local constituency under a “first past the post” system, which can enable minority parties to win a significant number of seats.

Based on current party positioning, we envision three plausible scenarios and assign probabilities to each:

1. Comfortable Conservative majority – 60% Probability. Johnson to push through Brexit through by January 31, 2019.

2. Conservative Party wins the most seats and governs as a minority – 20% Probability. Brexit by January 31, 2019, but a “bumpier” ride, possibly including a Second Referendum.

3. Conservative Party wins the most seats, but Labour and Liberal Democrats capture enough seats to form a government – 20% Probability. Under this scenario, there is likely to be a Second Referendum, resulting in a 10% probability for “Leave” and a 10% probability for “Remain.”

Combined, these scenarios produce the following probabilities, we believe:

1. 85-90% chance the UK leaves the EU with a Deal by January 31, 2019

2. 10-15% chance the UK ends up remaining in EU after all

We should emphasize that we struggle to see a scenario where Labour wins an outright majority. This is very important, as one bearish outcome for UK equity markets would be the unencumbered implementation of Jeremy Corbyn’s left-wing agenda. If Labour gets “near” government, it would only be as part of a coalition, which would restrict them considerably.

What Will Happen Next—And What Will It Mean For Investors?

If we awake on December 13 to news of a comfortable Conservative majority, it will probably be the most market-friendly short-term outcome. The Conservatives will, presumably, follow through on the withdrawal agreement that Johnson agreed to in October 2019 – this will ensure a transition period between the UK and EU while further trade arrangements are negotiated in the coming months. Furthermore, Johnson has pledged significant fiscal stimulus from his government should he win. This should further cement a Conservative majority as a significant “win” for financial markets and UK risk assets. It is worth noting that this fiscal stimulus would echo what we see currently happening in France and Holland, while the possibility of German fiscal stimulus would be the real dynamite to kick-start European economies

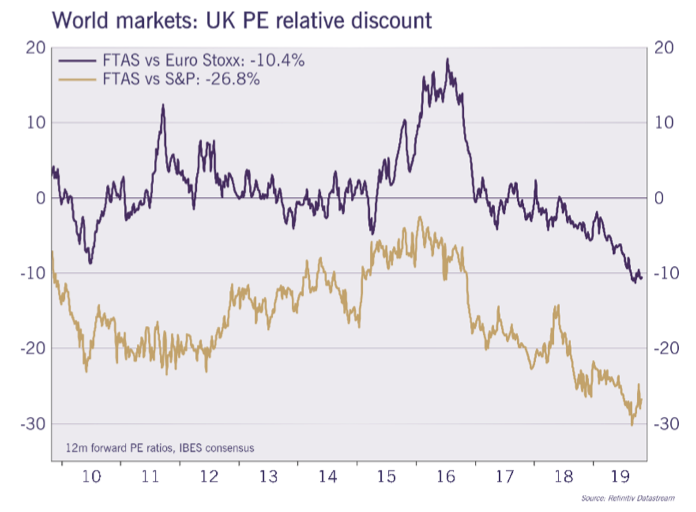

UK equities look particularly attractive in this context. The FTSE All Share Index currently trades at the biggest discount since the Global Financial Crisis, relative to both European and US markets.

A resolution of much of the uncertainty surrounding Brexit would undoubtedly be positive for business investment and economic activity – as much as an additional 1.5% to GDP (Source: SWMitchell Capital/Berenberg) – which means the UK market combines excessively cheap valuations with the prospect of positive earnings momentum.

Of course, a Brexit resolution would also benefit economies in Continental Europe also, with forecasters suggesting a 0.5% boost to European GDP (Source: SWMitchell Capital/Berenberg).

Our Task—Seeking Small Cap Equity Opportunities Across Europe Amidst Change

Our task at SW Mitchell Capital for our small cap European strategy remains to focus on finding exceptional companies that will thrive independent of shifting political dynamics. For our portfolios, we have found what we believe to be a select group of compelling UK domestic companies trading at attractive valuations, including:

• City Pub Company—a “roll up” of premium pubs across London, England, and Wales

• On The Beach—leading on-line provider of discount vacation packages across Europe

• Loungers—growing UK hospitality chain combining elements of cafés, pubs, and restaurants

• Dalata—Ireland’s largest and UK's fastest growing hotel operator

• Brickability—leading supplier to UK construction companies and landmark architectural projects

• Gym Group—pioneer of affordable, low-cost, no-contract, 24/7 gyms across the UK

We have also found what we believe to be a select group of compelling companies from across Continental Europe with specialty products offered globally, trading at attractive valuations, including:

• MIPS—global provider of patented technology to protect against brain injury in sports and work helmets (based in Sweden)

• Raisio – “healthy food” company with cholesterol lowering Benecol as key brand (based in Finland)

• Varta – global provider of specialty batteries, notably for hearing aids and next generation ear buds for cell phones; Varta batteries landed on the moon with Neil Armstrong (based in Germany)

All of these companies look well set to benefit in 2020. We factor in the uncertainties and risks, both positive and negative, but we believe that the sound course is to discover companies that can win in a wide variety of circumstances. We feel we have a portfolio of such special companies today.

Jamie Carter is a partner of S.W. Mitchell Capital in London and portfolio manager of the SWMC Small Cap European Strategy.

Security holdings are presented to illustrate examples of securities that the strategy has bought and the diversity of the areas in which the strategy may invest, and may not be representative of the strategy’s current or future investments. Portfolio holdings are subject to change and should not be considered investment advice. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities in this list. You may request a list of all recommendations made by the firm for the prior year, free of charge, by contacting F/m Acceleration LLC, Attn: Compliance, 3050 K Street, Suite W-170, Washington, DC 20007.