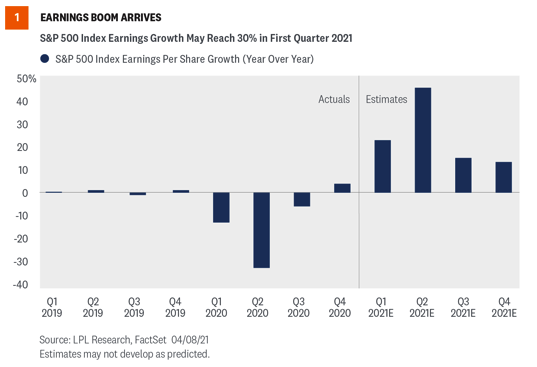

The outstanding fourth-quarter earnings season we had in 2020 is a tough act to follow, but 2021’s first quarter has the makings of another potentially great earnings season. The reopening of the economy continues to move forward, and corporate America has done an excellent job managing through the pandemic. In fact, it won’t take much of an upside surprise for year-over-year S&P 500 Index earnings growth to reach 30% this quarter. The 2021 earnings boom is here.

Poised For Another Strong Earnings Season

Coming into fourth-quarter earnings season, investors had plenty of reasons to expect companies would deliver better-than-expected results—and they did. Virtually no one—ourselves included—expected S&P 500 companies to grow earnings in aggregate during fourth quarter 2020, especially considering fourth quarter 2019 was over before the pandemic began in the U.S. Well, corporate America delivered 4% year-over-year earnings growth in the fourth quarter of 2020 despite the difficult year-over-year comparison, as shown in [Figure 1], which was about 13 percentage points better than the consensus estimate when the fourth quarter began on October 1, 2020.

The first piece of good news is that we now have much easier comparisons over the next couple of quarters, setting up a possible 30% year-over-year increase in S&P 500 earnings for the first quarter of 2021. FactSet consensus is currently calling for a 24% increase, and six percentage points of upside appears very realistic given double-digit upside surprises the past three quarters.

The second piece of good news is that most of the factors that contributed to such a big upside surprise last quarter remain in place today, including the following:

Stronger economic growth. Bloomberg’s consensus expectation for first-quarter U.S. economic growth, measured by gross domestic product (GDP), increased from 2.5% to 4.7% during the first quarter. The raised forecast, which would represent a modest improvement from the 4.3% GDP growth rate in the fourth quarter, may still be too low given the accelerating vaccine rollout and the latest $1.9 trillion fiscal stimulus package.

Rising estimates. The consensus estimate for first-quarter earnings growth has risen by 6% since January 1, 2021, the most recorded by FactSet since it began tracking earnings data in 2002 and slightly ahead of the 5.4% increase in S&P 500 earnings in the first quarter of 2018, when corporate taxes were cut. Higher estimates tend to signal companies will be able to deliver upside, potentially more than the typical several percentage points. Over the past 20 years, estimates have been reduced by an average of about 3% quarterly. The past 17 quarters are shown in Figure 2.

Positive guidance. An unusually high 64% of S&P 500 companies guided numbers higher during the first quarter. Last quarter’s tally was similar at 66%. This level of optimism is rare, given the five-year average of positive guidance is 33%. The 61 companies that have already raised guidance for the first quarter is the highest total since FactSet began tracking this data in 2006.

Manufacturing is booming. Last quarter we highlighted the Institute for Supply Management (ISM) manufacturing index level of 60.7 in December 2020 as a reason for earnings optimism because of the connection between manufacturers’ spending plans and corporate profits. The reading for March 2021 reached 64.7, the highest level in over 35 years.

How Much Upside Could We See?

We think we’re set up for very strong earnings growth and a lot of upside surprises this earnings season. However, the magnitude of last quarter’s beat, the big increase in the consensus estimate for this year, and the latest rally in the U.S. dollar all suggest that double-digit upside may be too much to ask for this quarter.