The astronomical increase in private wealth the world over is creating a boom in the family office universe. Specifically, individuals and families across the entire wealth spectrum very much want the myriad advantages of having a family office. This includes single-family offices, multi-family offices and—the more recent innovation—virtual family offices.

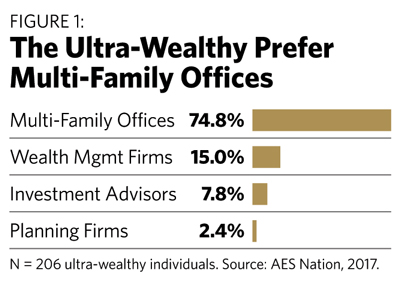

In a 2017 study of 206 ultra-wealthy individuals (those with a net worth of $30 million or more), nearly three-quarters said their preference is to work with a multi-family office (Figure 1). Another 15% like wealth management firms. Less than 10% chose investment advisors. The remaining few percent opted for planning firms. Clearly, individuals with money are strongly attracted to multi-family offices.

It is evident that the concept of the family office is strongly taking hold. This is not a surprise considering the effectiveness of a large percentage of single-family offices. The complication is that relatively few families can afford to set up and run their own family office, or want to deal with the oversight requirements.

Because of technological advancements and some very ingenious professionals, most any affluent family can get the same advantages of a single-family office. The answer is a virtual family office. Moreover, the virtual family office is proving to be a superior solution to the traditional multi-family office.

The Virtual Family Office

To begin with, today, all family offices are to some extent virtual. All of them are outsourcing to external experts to some degree at various times. It is important to note that recent innovation we are referring to, as a virtual family office is more akin to a single-family office than it is to a traditional multi-family office.

A single-family office is constructed around the needs, wants and preferences of an exceptionally wealthy family. A multi-family office, for the most part, is an advisory firm providing a broad array of services and products to the affluent. There is a significant but nuanced difference between a multi-family office and a virtual family office.

A single-family office is constructed around the needs, wants and preferences of an exceptionally wealthy family. A multi-family office, for the most part, is an advisory firm providing a broad array of services and products to the affluent. There is a significant but nuanced difference between a multi-family office and a virtual family office.

The virtual family office, like the single-family office, is designed and structured around the affluent individual or family. It is regularly much more bespoke than a multi-family office. A virtual family office is exceedingly customized in various meaningful ways to each affluent client. The ability to deliver family office capabilities and world-class experiences is possible because of strategic outsourcing coupled with validated client-centered methodologies.

The virtual family office is at the pinnacle of the wealth management hierarchy. It is the way financial professionals can best optimize the financial worlds of their affluent clients and can be thought of as an evolutionary step up from elite wealth management.

The two critical perspectives of virtual family offices that make them so effective are their range of deliverables and the three key drivers that make them successful.