The astronomical increase in private wealth the world over is creating a boom in the family office universe. Specifically, individuals and families across the entire wealth spectrum very much want the myriad advantages of having a family office. This includes single-family offices, multi-family offices and—the more recent innovation—virtual family offices.

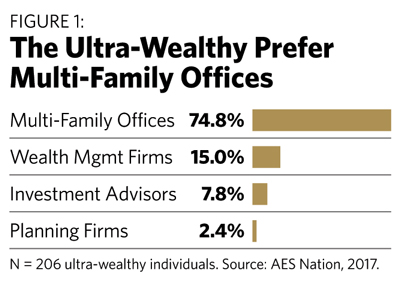

In a 2017 study of 206 ultra-wealthy individuals (those with a net worth of $30 million or more), nearly three-quarters said their preference is to work with a multi-family office (Figure 1). Another 15% like wealth management firms. Less than 10% chose investment advisors. The remaining few percent opted for planning firms. Clearly, individuals with money are strongly attracted to multi-family offices.

It is evident that the concept of the family office is strongly taking hold. This is not a surprise considering the effectiveness of a large percentage of single-family offices. The complication is that relatively few families can afford to set up and run their own family office, or want to deal with the oversight requirements.

Because of technological advancements and some very ingenious professionals, most any affluent family can get the same advantages of a single-family office. The answer is a virtual family office. Moreover, the virtual family office is proving to be a superior solution to the traditional multi-family office.

The Virtual Family Office

To begin with, today, all family offices are to some extent virtual. All of them are outsourcing to external experts to some degree at various times. It is important to note that recent innovation we are referring to, as a virtual family office is more akin to a single-family office than it is to a traditional multi-family office.

A single-family office is constructed around the needs, wants and preferences of an exceptionally wealthy family. A multi-family office, for the most part, is an advisory firm providing a broad array of services and products to the affluent. There is a significant but nuanced difference between a multi-family office and a virtual family office.

A single-family office is constructed around the needs, wants and preferences of an exceptionally wealthy family. A multi-family office, for the most part, is an advisory firm providing a broad array of services and products to the affluent. There is a significant but nuanced difference between a multi-family office and a virtual family office.

The virtual family office, like the single-family office, is designed and structured around the affluent individual or family. It is regularly much more bespoke than a multi-family office. A virtual family office is exceedingly customized in various meaningful ways to each affluent client. The ability to deliver family office capabilities and world-class experiences is possible because of strategic outsourcing coupled with validated client-centered methodologies.

The virtual family office is at the pinnacle of the wealth management hierarchy. It is the way financial professionals can best optimize the financial worlds of their affluent clients and can be thought of as an evolutionary step up from elite wealth management.

The two critical perspectives of virtual family offices that make them so effective are their range of deliverables and the three key drivers that make them successful.

Deliverables: Virtual family offices, writ large, tend to provide two principal categories of expertise: those that relate to managing wealth and those that relate to family support. Falling under the umbrella of wealth management is investment management and wealth planning. Usually, administrative and lifestyle services as well as special projects fall under support services (Figure 2).

In practice, each of these sub-categories comprises specific products (such as private equity funds or intentionally defective trusts or cross-border arbitrage strategies) and services (bill paying and close protection personnel, for example) based on the needs of the underlying families. The sheer scope of possibilities and combinations mean that truly unique and thorny issues can be addressed in wholly customized ways.

Critical Drivers Of Success: The ability of virtual family offices to optimize the financial world of their clients is predicated on what they are able to deliver, but also on three critical drivers … the human element, the cohesive team and systematic processes.

The human element is the emotional and psychological aspects of the advisor/client relationship. Each driver has multiple indispensible components referred to as essentials. Three prevalent essentials of the human element are:

• Client-centered discovery

• Coherent, connected communications

• Deep, intimate relationships

The human element is where financial professionals effectually differentiate themselves. As just about all financial and legal solutions are being commoditized, proficiency when it comes to the human element enables financial professionals to structure virtual family offices for the affluent.

The big difference between a virtual family office and many professionals, who could conceivably refer other professionals, is that the virtual family office brings together an elite group of specialists on an as-needed basis who work collaboratively. It is a cohesive team. A virtual family office is able to deliver a wide range of state-of-the-art expertise because they structure (many times idiosyncratic) cohesive teams for each affluent client. Three essentials of a cohesive team are:

• Best-of-the-best contacts

• State-of-the-art capabilities

• Preferential agreements

Most of the experts of each cohesive team are external. Strategic outsourcing makes it all possible. Still, the financial professional is responsible for forming the cohesive team as well as managing it.

So often professionals deal with their affluent clients in a haphazard manner. Virtual family offices operate so effectively because of systematic processes. With a virtual family office, all solutions are intricately coordinated and synergies extracted to produce superior results. Three essentials of critical systematic processes:

• Address failures

• Identify opportunities

• Continuously improve

A key methodology of virtual family offices is stress testing. By carefully assessing where affluent clients are, it is then possible to take steps to optimize their financial worlds.

From Wealth Management To Virtual Family Offices

The appeal of family offices to the wealthy, from individuals with a million or two all the way up to the super-rich (with a net worth of $500 million or more), cannot be overstated. For financial professionals who want to build high-quality, highly profitable practices with the affluent, the present and future is their ability to provide virtual family offices.

Virtual family offices incorporate exceptional wealth management with added robust attentiveness to administrative and lifestyle matters. They are able to deal with all the important one-off situations that might arise, which are commonly referred to as special projects.

At the center of any virtual family office is the affluent client, supported directly by a coordinator—a person or team of people who:

1. Provides a particular expertise

2. Coordinates and facilitates other professionals on behalf of the affluent client

That coordinator can readily be a wealth manager (although accountants and trusts and estates attorneys are increasingly taking on the role of coordinator). The coordinator must be very adept when it comes to the human element.

To be clear … what helps draw many of the affluent to virtual family offices is their ability to help clients deal with an array of issues and concerns that are not at their core financial. All in all, virtual family offices regularly are able to deliver a comprehensive expertise and an exceptional experience.

Aside from the expansion of expertise beyond wealth management into family support capabilities, a powerful and dominant advantage of a virtual family office is synergies. Because virtual family offices are bespoke, the ability to look at all the needs and wants of a client, including those that are more than just financial, results in connecting services in ways that optimize that client’s financial world.

It is possible, for example, to extensively benefit by combining wealth management with longevity planning. The result is that the affluent client will be better able to afford the medical breakthroughs that can extend his or her life or the lives of their loved ones. Also, the affluent client will be more likely to have the economic resources needed for living past 100.

It should come as no surprise that the wealthy, given their druthers, want the myriad advantages of a virtual family office. At the same time, the business benefits of financial professionals that can structure virtual family offices for their affluent clients are substantial and only likely to get much, much better.

Russ Alan Prince is president of R.A. Prince & Associates.