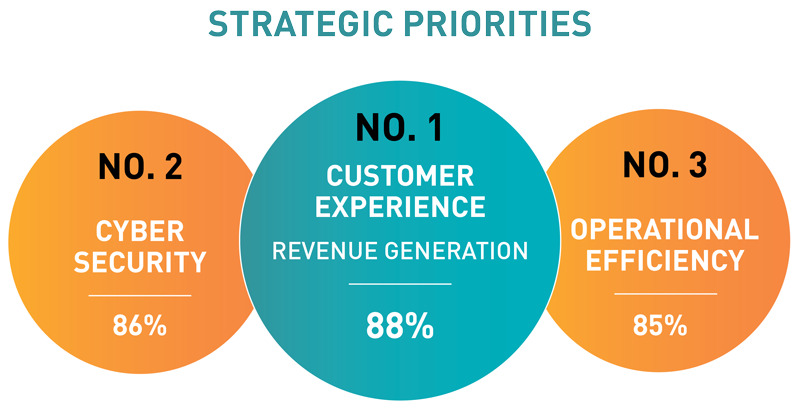

In the world of financial services, every year brings new strategic imperatives. The 2020 Beacon industry trends report from global consulting firm North Highland revealed the top priorities cited by financial services leaders: 1) client experience (CX) and revenue generation—tied, 2) cyber-security, 3) operational efficiency.

Revenue generation, a new entrant this year to the leading priorities, is not surprising given continued fee compression and increased competition. Operational efficiency rose to third, reflecting industry transformation with client expectations rising, fees decreasing and regulations making practice management more complex.

While financial services execs and financial advisors report being enthusiastic, the majority do not feel well prepared to manage their priorities: only 23% feel very prepared to address CX and just 8% feel very prepared to manage operational efficiency. The only bright spot is the 50% who feel very prepared for cyber-security. Preparedness is a key component of the study; it highlights where firms may know what they want to do but need help on how to implement and succeed.

Opportunities For Moving From Vertical To Horizontal Organizations

Tackling CX and operational efficiency requires financial services firms to move from vertical, siloed organizations toward matrixed organizations with horizontal ways of operating focused on client solutions. Within this horizontal world, the Beacon research highlights opportunities across talent, ways of working and data/technology.

1. Talent: The financial services industry is still very people-centric. Talent is the key to any successful client experience, operational effectiveness and successful growth strategy. In our survey, 65% of leaders cited knowledge/skills as the top internal factor impacting firms’ preparedness to tackle top priorities. However, while 73% say talent management and development is important, only 13% feel prepared to address it. Part of the complexity is knowing the right skillsets, culture and competencies needed.

When going horizontal, strategic hiring with a focus on multi-disciplinary skillsets is essential, yet only 29% of financial services firms in our research feel very prepared to address talent acquisition. The financial services industry is no longer a strictly quantitative world. Today’s institutions are also life coaches—evaluating financial wellness, integrating values with money and helping clients succeed. The solution is both hiring from non-financial services backgrounds and developing financial services employees in more advanced ways of working.

2. Ways of Working: In a horizontal organization, new processes and ways of working are equally critical to powering client experience and operational efficiency. As firms move away from legacy systems, more agile ways of working can provide a stronger foundation for always-on transformation. In our research, 49% of respondents cited cross-functional integration/collaboration as the top factor when configuring teams for transformation. The benefits of this? Greater cross-team collaboration, reduction in handoffs and decision-making closer to the client.

Through agile ways of working, firms can unlock not only greater efficiency, but also responsiveness to deliver on client experience. Only 27% of financial services firms cited agile ways of working as a “very high” strategic priority in the Beacon survey, signaling that ways of working may be a blind spot when addressing operational efficiency for improved client experience.