Institutional investors have allocated to private equity for years, but getting access to these specialized opportunities can be a difficult and burdensome process for advisory professionals, family offices and high-net-worth investors. All that may be changing with the arrival of iCapital Network, a platform that streamlines access to high-quality private equity managers through a state-of-the art, secure, online portal.

I recently sat down with my longtime collaborator and co-founder of Private Wealth magazine, Hannah Shaw Grove, who just joined iCapital Network as senior vice president and chief marketing officer, to learn about the company and its plans to broaden access to the world of private equity.

Prince: Can you provide an overview of iCapital Network?

Grove: In its simplest form, iCapital is an online marketplace for private equity. Historically, there’s been very little visibility into the private capital market for wealthy investors and their advisors. Information about managers and their funds was only provided to qualified purchasers—individuals with $5 million in investable assets, excluding the value of their home—and even then, often only through a referral or an introduction. If you were granted access, the information you got depended largely on what the fund manager was willing to provide and there was no context for evaluating what you were buying.

iCapital is a platform that tracks every open fund—right now there are more than 2,000—in a consistent framework. It allows investors to compare offerings on an apples-to-apples basis, so to speak. The platform has a very intuitive, user-friendly interface that makes it easy to sort through the universe using specific criteria like AUM, quartile ranking and cumulative IRR and drill down into a range of asset classes, geographies and strategies depending on your investment goals and risk parameters.

Essentially, it’s providing the tools that allow advisors and family offices to conduct institutional-quality due diligence on private equity investments for their wealthy clients.

Prince: What about access to the funds themselves? Getting an allocation with a manager in high demand can be nearly impossible and might require a commitment of at least $5 million and, in some cases, a lot more.

Grove: That’s right, private equity managers are used to dealing with institutional investors who can commit tens of millions of dollars to funds. They don’t always have the bandwidth or the infrastructure to work with smaller relationships that have different servicing needs. By creating a centralized destination for private equity, we can help those same advisors and family offices get allocations into better funds, while providing the private equity managers with a scalable way to access the significant capital that is outside traditional institutional channels.

One of our key financial backers is Credit Suisse’s Private Fund Group and we’re partnering with prominent fund-raising firms like Blackstone’s Park Hill Group and Eaton Partners and a group of seven or eight others that will continue to expand. Collectively, those organizations diligence close to 1,000 private equity funds a year, or about half the market. Our in-house origination team identifies a sub-segment of those to make available as private access funds to advisors, family offices and qualified purchasers on extremely preferential terms—low fees, low minimum investments—in some cases as low as $100,000—and no commissions.

Prince: What’s the appetite for private equity among high-net-worth investors?

Grove: Overall, it’s pretty strong and that has a lot to do with performance results. There’s a lot of widely available data that shows private equity has outperformed other investments and asset classes by upwards of 10% annually over the long term, making it hard to ignore for certain types of investors. And 2014 was a particularly strong year for exits and fund-raising, which has helped fuel some additional interest.

In my experience, there are pockets of pent-up demand, especially among people who are already familiar with private equity. Tiger 21 recently announced that its membership has an average allocation of 19% to private equity across closely held stock, direct investments and funds, and cited it as the most popular asset class at the end of 2014. These types of investors, obviously, want to see more deals and have better access. On the other hand, there are a number of wealthy individuals who have not ever invested in private equity for one reason or another—the timing wasn’t right, the minimums were too high to allow for sufficient diversification, they were focused on other types of investments, what have you—but are intrigued about private equity and who represent the biggest market of potential investors. iCapital Network can be especially useful to those individuals and their advisors as a way to explore the asset class with turnkey support.

Prince: What’s the demand for private equity among advisors, many of whom act as gatekeepers for their clients’ investments?

Grove: A similar dynamic exists here. There are some sophisticated practitioners with very high-end businesses who are already helping their clients invest in PE. iCapital Network is a great resource for those advisors because we’ve automated everything from the sub-docs to capital calls to reporting and we can help them get their clients into high-demand funds. The advisors I know with, say, $1 billion or $2 billion under management, are all taking a close look at their capabilities to make sure they can respond to the strong client interest. But most investment advisors are not offering private equity and, in fact, are not overly familiar with the asset class. I believe the current demand for private equity from the high-net-worth market creates an opportunity for these advisors to expand their offerings and attract new business.

Prince: What’s the relationship between private equity and developing business with high-net-worth clients?

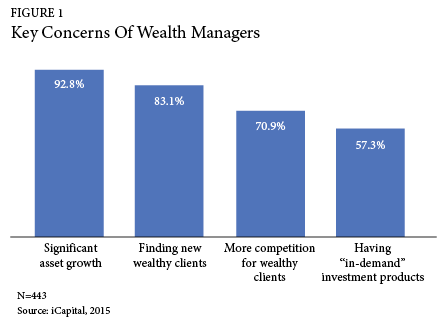

Grove: Most advisors are concerned about achieving significant asset growth because it’s directly correlated to their income, finding new wealthy clients, fending off increased competition for those wealthy clients and having in-demand products (Figure 1). Having private equity in the tool kit can help many of them address those issues. It’s certainly not the only approach, but it’s a powerful one. PE is an attractive asset class with a strong track record that has captured the attention of the investment community and the financial media. Right now, an advisor’s ability to deliver high-quality private equity funds below the stated minimums, for example, can be a distinct advantage when competing for business with people who have newly created wealth or money in motion. At the same time, PE investments are sizable and they’re locked up for around 10 years, which can generate stable and sustained revenues for an advisory practice.

We just conducted some research with advisors to gauge their understanding and use of private equity and learned that most practitioners in the U.S. have less than 10 clients for whom it would be appropriate. As a result, many firms are unlikely to commit the assets that would enable them to invest directly with a general partner and can’t justify the time and resources to develop a robust diligence effort to analyze and source these investments. The hard truth is that an alternative allocation that doesn’t include private equity is incomplete in the minds of the wealthiest investors, particularly savvy ones, and without a solution advisors can run the risk of losing clients to competitors who can provide it.

The Gatekeepers

March 10, 2015

« Previous Article

| Next Article »

Login in order to post a comment