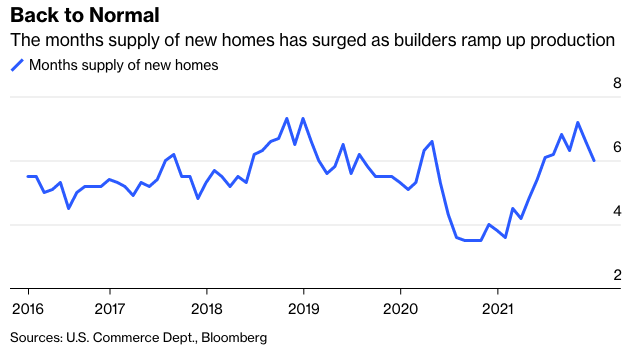

As demand for single-family houses begins to weaken, supply is starting to leap. After the 2008 financial crisis wiped out many homebuilders, the survivors were extremely cautious. But with the passage of time, their confidence has leaped. From an index low of 9 in 2009, it climbed to 76 in December 2019 just before the pandemic, and in January of this year, rose further to 83, well above the pre-financial crisis top of 72 in June 2005. The number of new houses under construction exceeds completions by the largest margin since 1984. This will increase inventories of unsold new houses. They’ve already risen from 3.5 months’ supply in October 2020 to 6.0 months in December. Rising costs for everything from lumber to copper will make these houses more expensive and harder to sell. The National Association of Realtors’ index of pending house sales in December fell 7% from a year earlier.

The likely drop in single-family house prices that is coming will reduce inflation but more in a technical than functional way. Decades ago, the Commerce Department accounted for housing costs by using the prices of houses sold. This was misleading since home sales, 6.9 million in 2021, are just 5% of the 142 million single-family housing stock. So, the statisticians switched to Owners’ Equivalent Rent, or EOR, now 23.5% of the total Consumer Price Index. This number is suspect since it’s based on the relatively few single-family houses that are rented. Also, it assumes that homeowners rent their houses from themselves, paying OER. But who looks at this concept in figuring their cost of living? In any event, removing it from the total CPI reduces the year-over-year CPI increase in December from 7.1% to 6.2%.

If single-family house prices drop overall as I expect, OER inflation will decline and so will the total rise in CPI. I don’t look for a huge single-family housing price plunge as during the subprime mortgage collapse, but a decline of 15% to 20% seems likely. This would be a big shock to the many who have relied on housing as well as stock appreciation to support their spending.

Equity investors are already anticipating weakness in housing. The SPDR S&P Homebuilders ETF is down about 16% from its December top. As usual, Wall Street bulls are trying to make these stocks look cheap. They’ve emphasized prices in relation to forecasted earnings over the next 12 months, which is almost always lower than using the last 12 months. But that’s double-counting and relies on estimates that are chronically optimistic.

Gary Shilling is president of A. Gary Shilling & Co., a New Jersey consultancy, a registered investment advisor and author of The Age of Deleveraging: Investment Strategies for a Decade of Slow Growth and Deflation. Some portfolios he manages invest in currencies and commodities.