Budget deficits, tariffs and protectionist government policies have the potential to slow economic growth in the United States and abroad. What risks and opportunities should fixed income investors consider in this new era?

U.S. Markets: Recent Events And Factors

Several influences have increased U.S. deficit projections and the likelihood of higher interest rates and lower bond prices. In recent months, the United States passed a $1.5 trillion tax reform bill and a $1.3 trillion omnibus budget bill. Both pieces of legislation will increase the deficit and will result in more federal borrowing.

With a low national savings rate of 2.2 percent, the U.S. federal government must finance its deficit by borrowing money, much of which will originate from outside the United States. If foreign trading partners decide not to continue purchasing U.S. debt because of a threatened trade war, the United States faces more economic risk and a negative impact on the bond market.

Most recently, the United States imposed tariffs on steel and aluminum, with an exemption for Canada and Mexico among other countries. The announcement increased the risk of retaliation from other countries, particularly China. In addition, the European Union suggested it might implement tariffs on U.S. motorbikes, clothing and other consumer goods. A trade war would lead to higher material prices, slower economic growth and higher inflation, at the same time as we expect to experience inflationary pressures from high budget deficits and full employment. These protectionist government policies complicate the Federal Reserve’s efforts to manage inflation and unemployment rates.

Tariffs are expected to reduce trade and capital flows between countries. In recent years, protectionist government policies have resulted in tariff retaliations from other countries. In 2009, for example, the United States imposed tariffs on Chinese tires and placed restrictions on Mexican cross-border trucking, prompting China and Mexico to introduce retaliatory trade restrictions.

Risks And Opportunities In Latin America

A trade war presents both risks and opportunities for bond investors, depending on the country. When thinking about countries vulnerable to a potential global trade war, it is useful to think about trade volumes as well as trade diversification.

Only four Latin America (LATAM) countries fall within the 30 most important U.S. trading partners of 2017: Mexico, Brazil, Colombia and Chile. Of these, the American trade relationship with Mexico dwarfs the other three. With over $550 billion in annual bilateral trade in goods, Mexico is the third largest trading partner with the United States, closely behind China and Canada. Brazil ranks as number 12 with over $65 billion in total trade in goods with the United States.

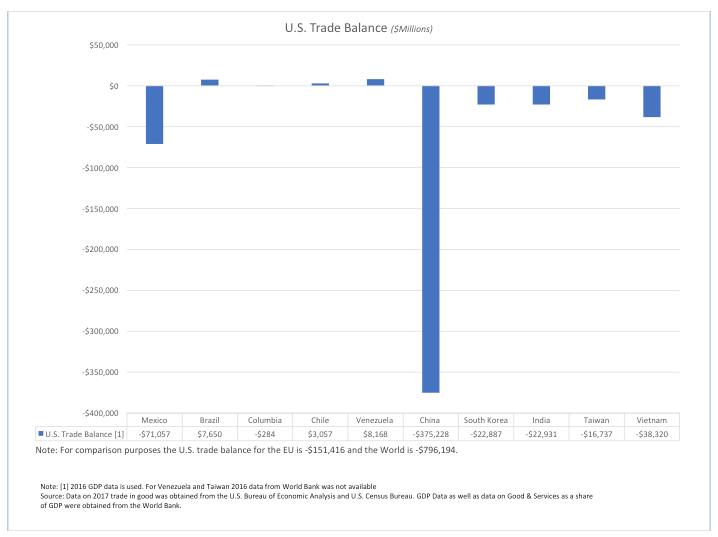

We have a cautious outlook for Mexico, given the country’s upcoming presidential election and the uncertainty surrounding the renegotiation of the North American Free Trade Agreement (NAFTA). While we expect many sections of the agreement, such as rules of origin, to be updated, we also believe a version of the agreement will remain in place. Mexico represents only 10 percent of the U.S. trade deficit, and we believe that the Trump Administration will focus more on the trade deficit with China. Mexican Sovereign bonds offer higher yields than comparable U.S. Treasury debt, but the country will face unchartered territory for the first year or two after the next Presidential election, because the current front-runner is campaigning on a populist platform, which concerns many investors.

The dependence of the Mexican economy on trade with the United States becomes even more apparent when considering differences in trade diversification across LATAM countries. Approximately 80 percent of Mexican exports are destined for the U.S. market and 47 percent of Mexican imports originate in the United States. On the other hand, Brazil sends only 13 percent of its exports to the United States and 18 percent of its imports originate in the United States. For perspective, the shares for China are 19 percent and 10 percent, respectively.

Cross-border supply chains partially explain why the Mexico-U.S. trade relationship dominates the U.S trade relationships with other LATAM countries. Integrated production often involves components crossing the border multiple times, which boosts the gross trade numbers.

We would expect the four LATAM countries discussed above to be the most affected by a global trade war. Mexico would clearly experience a disproportionate shock, emphasizing the importance to Mexico of NAFTA's successful renegotiation.

The new U.S. steel and aluminum tariffs are not expected to have a big impact on LATAM. Only Brazil and Mexico are counted in the top five exporters of steel to the U.S. and both have been exempt from the new tariffs. No LATAM countries are counted in the top five exporters of aluminum to the United States.

Impact Of A U.S. Trade War On Other Emerging Markets

In general, we expect larger countries, such as Brazil and India, to experience less of an impact on their economies and bond markets.

Smaller economies more open to trade, such as the Netherlands and Vietnam, will feel a larger impact due to a trade war, and their bond prices may decline. We would also expect Asian economies like Taiwan and Malaysia to be hurt by a U.S.-China trade war as these countries supply much material to the Chinese production of final goods.

Deborah Watkins is an economist and emerging markets specialist at LM Capital Group LLC.