Alternative investments have become more influential in portfolios, especially since the onset of the Covid-19 pandemic in 2020. Over the last two years, equity valuations have become stretched and bond yields have fallen considerably. This has led to lower expected returns going forward and forced investors to look at areas such as private equity, private debt, real estate, real assets, and hedge funds to enhance return and mitigate risk.

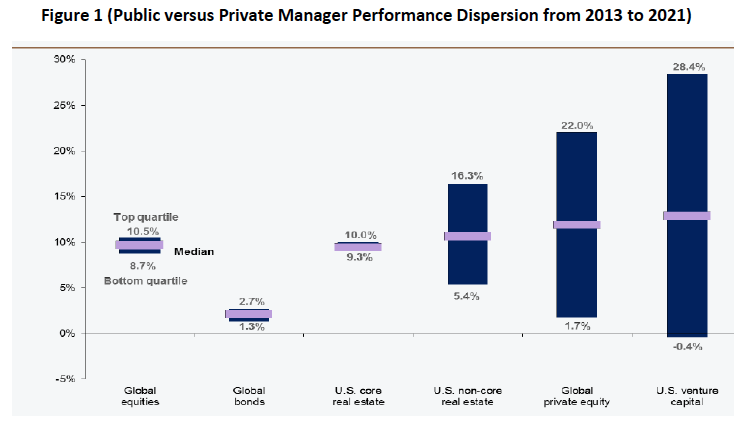

The results of utilizing some of these asset classes over the last few years have been beneficial. They have been able to mitigate rising inflation, higher energy prices, and lower bond yields while further diversifying portfolios. However, the range in performance between the various alternative managers in each of these areas has been dramatic. For example, the difference in return between a top and bottom quartile private equity manager is approximately 20%. Therefore, when allocating to alternative strategies, it is paramount to get access to funds managed with a proven process that can generate top tier performance.

In order to identify the most reputable managers in the alternative investment space, it is important to focus on the following characteristics:

1. Team—the key decision makers within an alternative investment firm must have a sound relationship where they are identifying unique opportunities within their particular asset class while retaining talent, evolving their business, and instilling a culture of collegiality and competition.

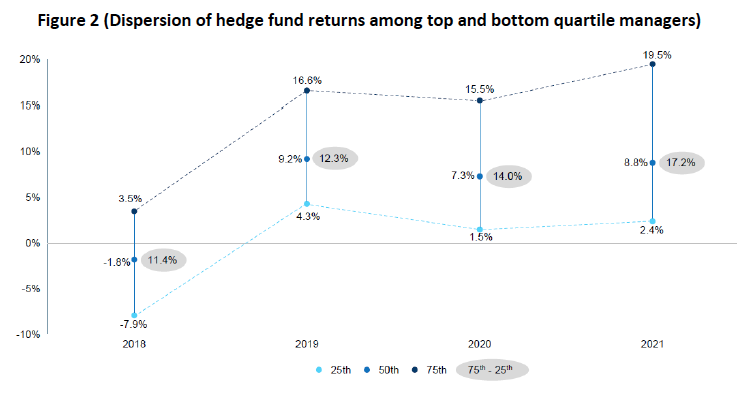

2. Track Record—the firm must show a history of consistent performance in different market environments while continuing to act as a diversifier to equities and fixed income. For example, a sought-after hedge fund strategy is able to generate strong returns with minimal volatility, correlation, and beta to public markets.

3. Investor Base—reputable alternative managers have a large number of institutional investors that include pension plans, endowments, foundations, family offices, and high net worth individuals. If a strategy is not heavily diversified among these different investors, it could lead to issues, particularly during times of underperformance when redemptions are more prevalent.

4. Capacity—respected alternative managers are thoughtful about their assets under management (AUM) and too many assets could potentially hinder their ability to generate consistent long-term returns. If any alternative investment manager becomes too large, it is important to ask whether they can execute their strategy with even more capital. If AUM becomes an issue, many strategies will close their fund to new dollars in order to avoid any risk of return degradation.

5. Fee Arrangements—there are typically two types of fees in the alternative space. First, there is a management fee, which is charged by the strategy to operate the fund. Second, there is a potential incentive fee which is rewarded to the strategy if they achieve a particular return threshold (i.e. above 10%). Highly regarded managers do not share their fee with any outside vendors or service providers. For example, in some cases private banks and other institutions will take a piece of the management fee to assist with marketing and distribution. Top tier alternative managers do not need to follow this exercise since they are comfortable with their asset and investor base.

6. Deal Flow—the ability to source a sufficient volume of high-quality investment opportunities is key. Strong alternative managers have robust networks and can identify unique ideas that enhance the risk and return profile of their funds. This item is especially critical in the private equity and private debt space where return dispersion is significant. If capital is consistently invested in strong deals, then returns can be substantial.

7. Terms—the best alternative investment strategies have a fee structure that is aligned with both the money manager (i.e., general partner) and the investor (i.e., limited partner). These managers are mostly compensated for consistently generating outsized absolute and relative performance. If management fees represent a significant amount of the manager’s total compensation, it may reduce the incentive for the team to generate strong returns. So, it is important to identify this issue at the onset before any allocation is made.

If each of the following criteria are met when researching an alternative investment manager, then the probability of identifying a top-quartile strategy is high. It is important to consistently stay in contact with manager, build a relationship, and learn about the strategy’s performance, team, and opportunity set. These tasks are accomplished through on-site due diligence visits, research calls, and ongoing conversations. Unfortunately, there are times when successful teams may break up or a strategy may diverge from its core investment competency. At that point it may make sense to reevaluate the manager and determine whether an allocation going forward is adequate.

Alternative investing has become mainstream and transitioned from optional to an essential part of portfolios. Adding to different asset classes such as hedge funds, private equity, private debt, real estate, and real assets should improve the risk and return profiles of portfolios, especially relative to a more traditional equity and fixed income portfolio mix. It is vital, though, that the alternative strategies that are implemented are top tier and have outstanding qualitative and quantitative characteristics. Otherwise, investors will suffer and miss out on opportunities that are currently not heavily available in the public markets.

Source; Lipper, NCREIF, Cambridge Associates, HFRI, J.P.Morgan Asset Management, Data is as of August 13, 2021.

Source: HFR, HFM, Capital Solutions, Barclays

Sloan Smith is principal and director at Innovest.