“Beware an inverted yield curve!”

Those five words, declared by an otherwise mild-mannered college economics professor, were forever seared into my mind and have stuck with me all these years. Not only was the professor’s advice sage, it was also very timely. I was in this particular economics course at a time when the yield curve was flattening, eventually to become inverted ahead of the Great Recession. That got me thinking—what would happen when the yield curve inverts again?

A yield curve inversion, as measured by the difference between the 2-year U.S. Treasury and the 10-year U.S. Treasury, first inverted ahead of the Great Recession on December 27, 2005, according to the Federal Reserve Bank of St. Louis. At that time, the S&P 500 was trading at 1,248. It wasn’t until 651 days later on October 8, 2007 that the S&P 500 peaked, hitting a high of 1,561 before dramatically tumbling and starting the Great Recession. Despite the professor’s timely warning, the market was 25 percent higher on a price basis than when the yield curve first inverted.

The financial losses endured by so many due to the Great Recession still linger in the collective consciousness of the financial services industry. As a means of helping forecast future market decline, many experts have been focusing on the yield curve to predict a potential downturn in the markets. Looking back at the last 41 years, an inverted yield curve has indeed preceded all five recessions.

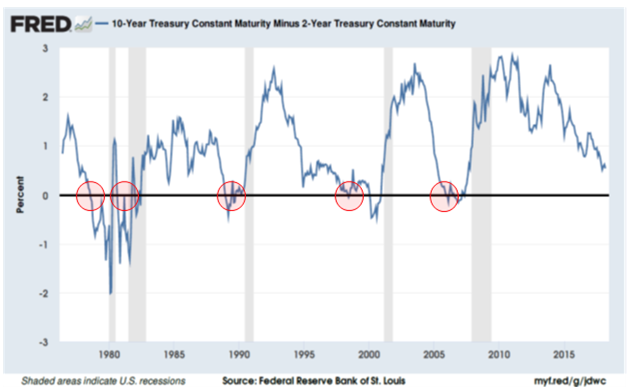

The blue line in the following chart measures the difference between the yields on the 2-year and 10-year Treasury. When said line crosses below the black centerline, it signifies the 2-year Treasury yield is now higher than the 10-year Treasury yield. In other words, the yield curve has inverted. The red circles highlight the first instance when the yield curve inverted ahead of each of the subsequent recessions indicated by the shaded areas.

The chart above suggests, therefore, inverted yield curves can be useful in predicting economic recessions. The next question becomes—can it be used to predict a recession-induced bear market? Let’s break it down by recession.

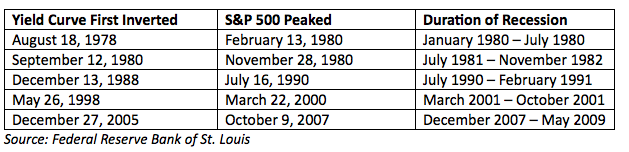

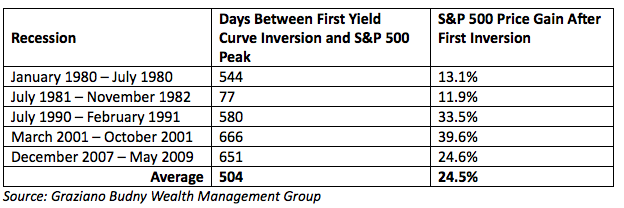

Below is a table showing when the yield curve first inverted, the associated peak in the S&P 500, and the duration of each of the last five recessions:

The yield curve inverts on average 614 days, or about 20 months, ahead of a recession. The following table then analyzes when the S&P 500 peaked in relation to the yield curve’s first inversion:

In all five recessions, the yield curve inverted ahead of the S&P 500 peak. The average amount of time between when the yield curve first inverts to when the S&P 500 peaks is 504 days, or about 16 months. The average price gain for the S&P 500 during those five periods is 24.5 percent.

While “beware an inverted yield curve,” is a strong battle cry worth respecting, it shouldn’t be cause for investors to immediately exit the markets as soon as it happens. Not only did the S&P 500 rise each time after the yield curve inverted as shown above, in some instances it rose by a significant amount. Bear in mind the gains noted above do not take into account dividends, so the total return for the S&P 500 in each of those time periods is actually greater than the values listed. This makes the case for staying invested after the yield curve first inverts that much more poignant. While an inverted yield curve is cause for concern, it shouldn’t be a cause to abandon the stock market and run for the hills. What it does call for is caution and demands investors pay close attention to changing winds in the marketplace.

Following the yield curve is but one of many important economic indicators investors should reference to gauge the health of the stock market and economy. An investment strategy should not be based on this or any other indicator alone. What watching the yield curve can do for investors, however, is inform tactical and asset allocation decisions. Knowing how past yield curve inversions, recessions and market actions have played out can provide insights on how to invest for the next yield curve inversion.

The prudent and germane advice on the yield curve bestowed forever upon me those many years ago have been echoing in my mind as the yield curve marches toward inversion. While that advice holds merit all its own, I’d like to add my own twist, which is:

“Beware an inverted yield curve! It can save you money!”

Michael J. Graziano, CMT, CRPC, is managing director at Graziano Budny Wealth Management Group.