Oil has been in the news quite a bit recently. Prices have risen to multiyear highs, and the recent decision by the United States to reimpose sanctions on Iran has rattled markets even further. We know that oil prices are a key risk indicator for the economy, but is it time to start worrying? Plus, what do higher oil prices mean—if anything—for the financial markets?

Short-Term Trend

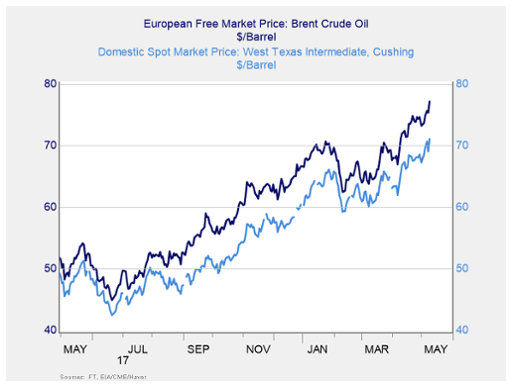

As you can see in the chart below, both U.S. prices (West Texas Intermediate) and European prices (Brent) have trended higher over the past year. So, we are definitely seeing an upward trend, and the difference—from around $50 per barrel to more than $70 per barrel—has also been significant.

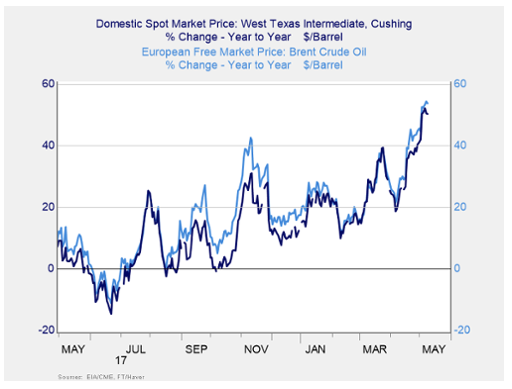

If we look at the annual percentage price changes, we also see a rise of between 20 percent and 50 percent. More important, we see the price increases are both ongoing (positive since October 2017) and accelerating (up from around 20 percent year-on-year a couple of months ago to about 50 percent now).

Longer-Term View

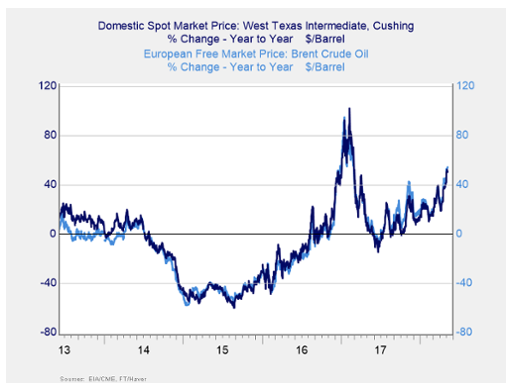

Over the past five years, we can see this trend has been consistent since 2015, including a spike at the end of 2016. Clearly, there is something going on in the oil markets—and it is something we need to pay attention to.

The big story here is that the structure of the industry is changing back to a more centralized one, which will give suppliers more power and which I wrote about last year. Since then, the process has moved further forward, and we can see the effects in the chart above. Note that this change has occurred even as U.S. production has continued to increase. This is a long-term structural change, not a short-term market fluctuation, and it is one that is likely to continue.