School’s in session. Let’s talk about math.

Go back to your calculus class senior year in high school. You take the derivative of y with respect to x. You are finding the sensitivity to the change in the function with respect to a change in the argument. In practical terms, this is the slope of a line or the velocity of an object.

Then, take the derivative of the derivative—the second derivative. In practical terms, this measures the curvature of a line or the acceleration of an object. As it turns out, people have a very difficult time with the second derivative.

The second derivative is everywhere in finance. It is convexity in bonds or gamma in options. When someone blows up in the financial world, it is usually a failure to understand the second derivative. Human beings think linearly and statically. You may know your exposure here, but you may not know it over there.

Some second derivatives, like convexity and gamma, are measurable and known. Some of them are hidden and unknown. I’ve talked about hidden gamma before in The 10th Man, which we saw in March 2020—the point where people liquidate their positions and selling accelerates.

Once you see the second derivative, you can’t unsee it. It is everywhere you go. And then you’re on the lookout for it.

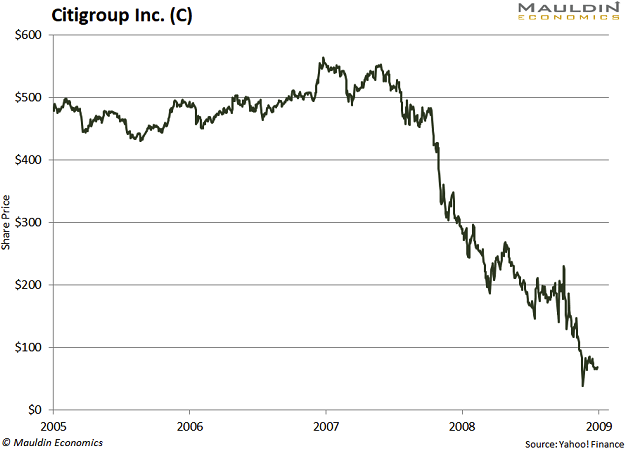

The second derivative produces charts like this:

And then people wonder what the hell happened.

Stocks Have Convexity

The first thing to understand is that stocks have convexity. Some stocks are positively convex, and other stocks are negatively convex.

If that sounds like Greek to you, here’s a simpler way to think about it…

• A positively convex stock goes up faster than it comes down.

• A negatively convex stock goes down faster than it goes up.

A lot of stocks, like the banks, were negatively convex in 2007. The banks had sold a great deal of optionality, which turned them into engines of negative convexity. They went up slowly and came down fast, which is roughly the payoff of a short option.

You can see this with Citigroup Inc. (C) in the next chart.