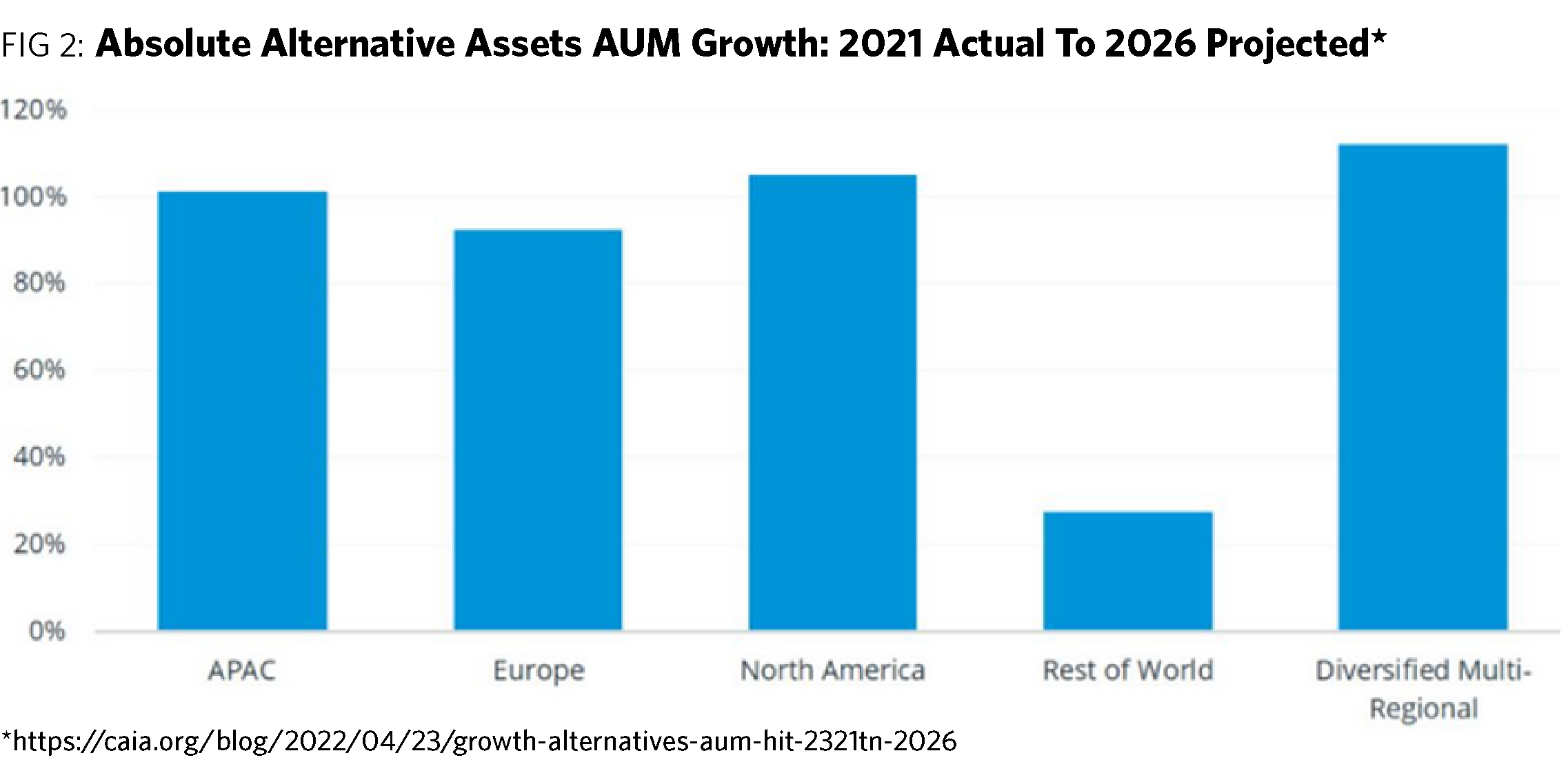

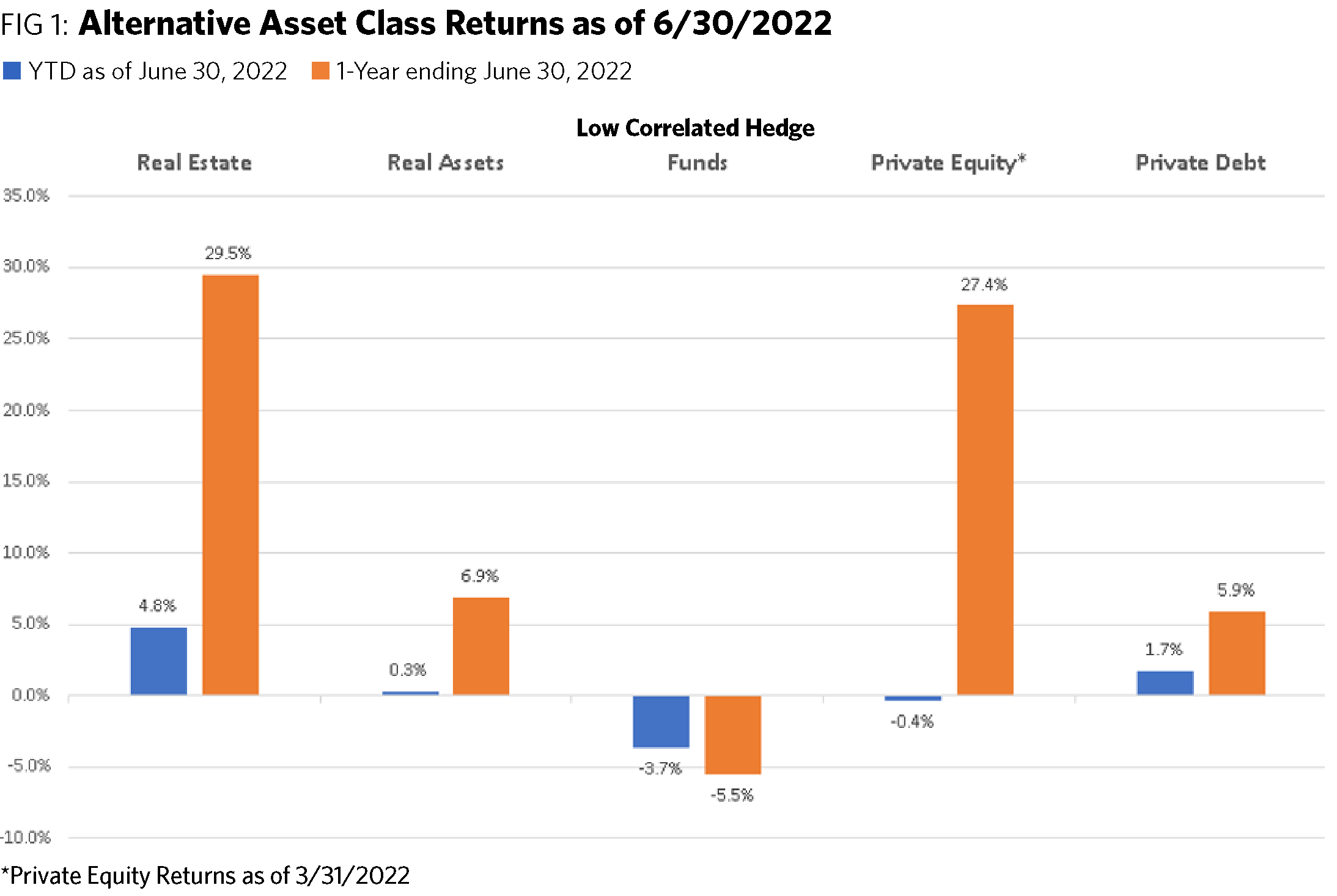

In the equity and fixed income markets, 2022 has been an unprecedented year. As of June 30th, 2022, global equities are down close to 20%, while high-quality fixed income has experienced a drawdown of approximately 10%. From a historical performance standpoint, it is the worst start to a year in the bond market since 1842 and the third worst first half in equities since 1972. However, if you look at alternative asset classes, it tells a different story. Real estate, real assets, hedge funds, private equity, and private debt have outperformed both equities and fixed income in 2022 and have played key roles in mitigating portfolio volatility. Alternative asset classes have often been criticized for their fees, minimums, and illiquidity, but this year they have added tremendous value, especially to portfolio diversification. Though alternative asset classes have helped when in relative performance and reducing risk, the question remains whether this trend will continue.

Real Estate

During 2022, real estate has performed well, benefiting from increased rents tied to higher inflation and strong fundamentals. As of June 30th, 2022, the asset class is up close to 30% over the last 12 months. Momentum seems strong in this space, considering U.S. commercial real estate investment volume increased 45% year over year in Q1 2022 to $150 billion. The multi-family sector saw the largest investment volume, followed by industrials and logistics. In general, real estate fundamentals remain healthy, from a supply and demand standpoint, despite the potential threat of a recession.

Real Assets

Real assets – comprised primarily of private infrastructure, timberland, and farmland – are slightly positive, year to date as of June 30, 2022, and are up close to 7% over the last 12 months. Infrastructure fundraising has remained elevated and strong demand has led to meaningful premiums for container movement while port volumes remain close to all-time highs. When it comes to farmland, grain shortage in much of the world has driven the prices of some commodities to record levels. Drought conditions have resulted in low wheat harvests and increased prices. Total U.S. agricultural exports continued to rise in 2022. Housing remained at elevated levels since rebounding from low levels due to COVID. Timber pricing remained strong, with prices at the end of Q1 up 11% year-over-year. All of these trends make real assets an area of intrigue going forward.

Hedge Funds

When it comes to hedge funds, there has been wide return dispersion between different strategy types. For example, long biased and equity long short hedge funds are both down between 13-15% this year. However, quantitative, and multi-strategy hedge funds have provided some robust relative returns, especially against fixed income and equities considering they are both up in 2022. Even though hedge funds, as a whole, are down close to 4% in 2022, they have still served an important role in minimizing risk, especially on the downside. This theme should continue as well.

Private Equity

Private equity as an asset class has benefitted substantially from lower interest rates and is up close to 27% over the last twelve months, as of 3/30/2022. But private equity faces some potential headwinds due to increased borrowing costs caused by higher inflation. Issues in the public market in 2022 have already had an impact on exits given that the market for initial public offerings (IPOs) has dried up substantially. Nonetheless, the long-term outlook for private equity remains strong. Limited partners have consistently shown their intent to maintain or increase their private equity allocations. With trillions of dollars in dry powder generating fees, general partners are well positioned to ride out a downturn in the economy. It is important, though, that private equity strategies anticipate change and have a clear understanding of how to add value and manage effectively during a period of inflation and rising interest rates.

Private Debt

Despite the challenges of a global pandemic, volatility in the public markets, and a recent hawkish stance in central bank policy, private debt has garnered substantial interest from investors. That interest is mainly due to its potential resilience, which is in part because of its seniority in the capital structures and avoidance of fixed rates. The asset class is up close to 2%, year to date, and up 6% over the last twelve months as of 6/30/2022. Overall, private debt has become more practical in an environment where public debt is offering comparatively less return to investors. Following the Global Financial Crisis in 2008, low interest rates and bank regulations have made investors and portfolio companies comfortable with private lenders.

Overall, alternative asset classes have added value to portfolios in 2022. In a year when we have a meaningful increase in both inflation and interest rates, we have seen the importance of allocating to assets classes such as real estate, real assets, hedge funds, private equity, and private debt. Each provided a different risk and return profile and diversification benefits, especially during down markets. Allocating to alternative asset classes will continue to serve an important role in portfolios going forward considering each will play a key part in enhancing return, mitigating risk, and generating robust risk adjusted returns for portfolios.

Sloan Smith, CAIA, MBA, CPWA® is a Principal & Director at Innovest and a member of the Investment Committee, which drives the firm’s investment related research and due diligence. He serves as a consultant working primarily with institutions and families. He is the Director of the Due Diligence Group, responsible for independently sourcing investment managers, as well as monitoring recommended products and strategies. The group utilizes both quantitative and qualitative analysis evaluating performance, understanding return attribution, and meeting management teams both at Innovest and at their offices. The group works in conjunction with Innovest’s Investment Committee. Sloan is responsible for covering traditional equity and fixed income investments as well as alternative investments such as hedge funds, private equity and real estate