Investors are growing concerned, with good reason, we think, that yields have bottomed for the 10-year Treasury and will surge as the economy gains strength. Prices, which move inversely to yields, would fall, and the question is whether rising rates in 2013 could trigger a bond bear market along the lines of the Great Bond Bear Market of 1994. We don’t think so.

Investors are growing concerned, with good reason, we think, that yields have bottomed for the 10-year Treasury and will surge as the economy gains strength. Prices, which move inversely to yields, would fall, and the question is whether rising rates in 2013 could trigger a bond bear market along the lines of the Great Bond Bear Market of 1994. We don’t think so.

Treasury Yields Probably on Their Way Up

My last blog, Why U.S. Interest Rates Will Rise, reviewed how 10-year Treasury yields remain at historically low levels and don’t reflect current economic fundamentals. We believe rates will rise and numerous factors are helping support that case. But what about the sustainability of that trend?

In order to determine the future direction of long-term interest rates, we’ve looked at the following guideposts, taking to heart the Fed’s forward guidance:

- Employment: Weekly jobless claims have been consistently below 400k since Q4 2011 – a level that is in line with monthly nonfarm payroll gains of 160k/month or more. It’s what we have been averaging during the last 12 months. We believe if this trend continues and the employment-to-population ratio declines slightly, it would not be surprising to see the unemployment rate fall below 7 percent by Q4.

- Inflation: While there remains enough spare capacity in the economy to keep a lid on inflation, inflation expectations can be fairly arbitrary. Strong asset price performance like equity and house prices and better-than-expected economic growth could feed into inflation expectations.

Why this Is Not 1994

The Fed tightened monetary policy in February 1994 that triggered one of the worst bear markets in recent history, and investor concerns are that this might occur again. While investors are becoming concerned of a repeat of 1994, especially the longer 10-year Treasuries remain at or below -2 percent real yields, there are 3 key factors why we do not see a repeat.

-

Fed’s Forward Guidance – Unlike 1994, the Fed has emphasized more transparency and more communication, believing it makes monetary policy more effective.

- Key Stakeholders – The overwhelming majority of the U.S. Treasury market is held by non-market sensitive investors such as the Fed and global central banks. They are acutely aware that selling U.S. Treasuries could have broad consequences, including affecting their bottom line and overall foreign exchange reserve management. In December 1993, the Fed and foreign central banks owned 30 percent of the Treasury market, but that figure has now ballooned to 64 percent as of September 2012 (the following table). As long as the holdings by these key stakeholders remain large, this should help cushion any potential selling of Treasuries by market-sensitive investors.

- Regulation – The banking system came under immense pressure and scrutiny following the Great Financial Crises in 2008. Policymakers implemented regulation to de-lever the banking sector. Most of the regulations forced banks to hold higher quality assets, and that led to a growing share of their balance sheets in sovereign bonds. For many global banks, that led to Treasuries. According to a BiS survey (Bank for International Settlements), the Top 30 largest banks have increased their share of Treasuries as a percent of overall exposure from 12 percent in 2008, to 19 percent in 2012. This regulatory environment is not likely to change for the foreseeable future.

But Beware Of Duration Risk

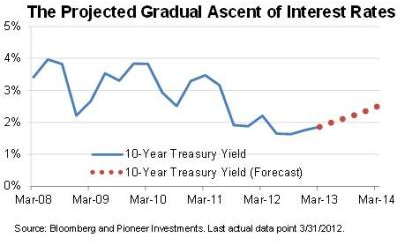

If the economy continues to maintain its current recovery, and perhaps gain some momentum with unemployment maintaining its gradual descent, and inflation expectations remaining near 2 percent, we think 10-year yields can be expected to rise gradually over the next few years. Bloomberg consensus expects the 10-year yield to rise to 2.64 percent by Q2 2014 (see chart).

In a landmark speech on long-term rates, Fed Chairman Bernanke stated, “long-term interest rates are expected to rise gradually over the next few years, rising to around 3 percent at the end of 2014.” However, we do not expect a dramatic and destabilizing rise in long-term interest rates in 2013. As a result, we foresee continued strong performance in equities, high yield, and multi-sector bond funds.

While we don’t anticipate a bond bear market like 1994, we would caution investors to beware of duration risk. As we’ve described, we foresee the mis-evaluation of long-term interest rates and fundamentals are coming together to push yields higher. Interest rates do not have to back up much to create significant losses. My colleague Michael Temple will soon publish a piece with an examination of the exit strategy of the Fed and its potential impact on a broad range of fixed income strategies. In the piece, he will include a table and a description to show the danger of duration with this current economic backdrop.

Paresh J. Upadhyaya is Director of Currency Strategy, U.S. He leads Pioneer Investments’ currency research effort out of Boston and serves as an advisor to the firm’s global fixed-income and equity investment staff on currency-related issues. In addition, he helps lead sovereign credit analysis and advises the investment team on sovereign bond investments.