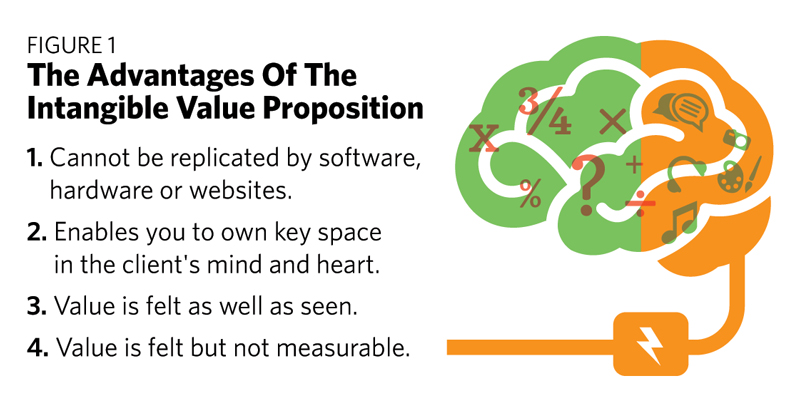

In my last column, I described how messy a financial advisor’s value proposition is when it’s based on a return on investment and how unsustainable that value offering really is. Trying to guess the future and constantly outperform the market is an activity done out of hubris. Your offering, to be truly valuable, must be sustainable and immune from techno-threats that continue to threaten you with obsolescence. Author Daniel Pink said the value propositions of the future need to be clearly housed in the right side of the brain. (See Figure 1).

What does this mean? The following graphic might help as it illustrates four ways that advisors can differentiate themselves.

If software, hardware or websites are available to do what you do, you’re in trouble. If clients can compare what you do to what most other advisors do, you’re in deeper trouble. If your firm’s history is a story of numbers, not the story behind the numbers, your relationships will inevitably be at risk.

The more important message coming from your business to your clients today needs to be a message of what you are going to do to help them accomplish the best life possible with the money they have. (I call this “Return on Life,” or “ROL,” as a counterpoint to “ROI.”) If this is not your message, then you are on shaky ground, because it’s simply unsustainable to try to outdo everyone else at gathering and managing money.

The three primary objectives in a greater ROL are to:

1. Help bring clarity to your clients about the purpose of their money.

2. Help your clients understand the personal side of planning. Numbers tell us nothing if we don’t know the story behind them.

3. Help clients answer the three big money/life questions.

The Sustainable Value Proposition

July 1, 2019

« Previous Article

| Next Article »

Login in order to post a comment