The decade-long bull market has made a strong case for passive investing in equities, and some of this sentiment has convinced many fixed income investors to do the same. But the arguments for passive equity investing don’t fly for passive fixed income investing. As economic growth slows in the U.S. and around the world, it may be signaling the end of the current credit cycle, which may increase risk for passive fixed income investors or those who invest in actively managed fixed income funds that use the Bloomberg Barclays U.S. Aggregate Bond Index (the BarCap Aggregate) as a bogey. A better choice may be to consider nimble and flexible active managers who offer a more selective approach offering greater defense against economic recession.

The End Of Credit Cycle May Be Approaching

Ten years of economic growth and mostly positive market returns has created a false sense of security that the good times will last forever. But a recession is inevitable. The only questions are when and how bad.

There are already signs that a downturn may be on the way. The Federal Reserve’s recent cut in interest rates was a reaction to slowing economic growth both in the U.S. and China, reduced business spending, plateauing corporate earnings growth and anticipation of trade-war driven instability. A historically low unemployment rate is making in next to impossible for many companies to add the workers they need to scale up production.

Fixed income investors, who often have an uncanny ability to sniff out recessions before everyone else, have on several occasions this year inverted the yield curve, locking in lower yields on long-term Treasury notes while demanding higher yields from short-term Treasury bills. Historically, inverted yield curves have predated recessions.

In such an environment, the one size fits all attraction of passive and active fixed income funds that track to the Barclays Capital US Aggregate Bond Index (BarCap Aggregate) can actually expose investors to a greater variety of risks than those associated with equity index funds. Here’s why.

Diminishing Credit Quality

Many investors consider the BarCap Aggregate to be the bond world’s analogue to the S&P 500. But this is a foolish assumption. The only thing they have in common is that they’re comprised of securities issued by larger companies. Their risk characteristics are quite different.

Weightings in the S&P 500 rise and fall with the market capitalization of the companies that comprise the index. Conversely, weightings in the BarCap Aggregate reflect the number of bonds each company issues, subject to the index’s credit quality standards.

Here’s the problem. In recent years, many lower-rated companies in the index have taken on more debt, which is giving these companies higher weightings in the index.

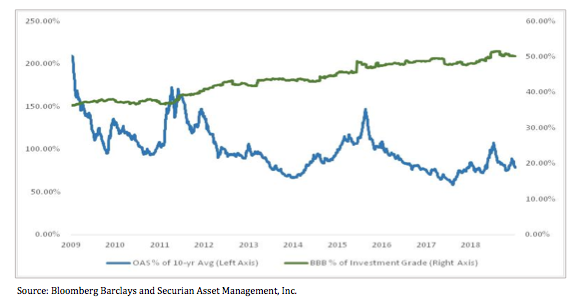

The chart above shows that a hypothetical buyer of the index would historically have received less compensation for holding riskier credits.

Currently, option-adjusted spreads for the BarCap Aggregate are hovering around 75% of its 10-year average. During this time, the weightings of BBB-rated issues have risen by almost 20% and now constitute more than 50% of the index’s investment-grade debt.

This increasing credit risk reduces the overall credit quality of most passive funds and many active funds that track to the BarCap Aggregate. Why? Because their mandates often restrict deviations from the index. This means they must take on the added debt of constituent companies, even if their underlying fundamentals are weakening.

Investors in these funds may not be aware that as their exposure to lower-rated debt increases, the overall credit quality of the funds is declining. When a recession occurs, these funds and their investors will take the biggest hit. As the default risk of these lower-rated issues skyrockets, prices will plummet, likely triggering a flood of outflows that will result in huge losses for these funds, since index restraints will limit their ability to selectively jettison their most damaging bond holdings.

Looking For Yield Premiums

An uncertain fixed income market favors managers who can be nimble and selective and focus on finding yield premiums and higher credit quality outside the larger issuer universe. For example, right now, bonds from highly rated (A to A-) smaller issuers offer a yield premium ranging from nine to 41 basis points higher than their larger counterparts, as shown in the chart below.

Some of this yield premium reflects the overall lack of market efficiency in the small end of the market. With mainstream investors favoring larger issuers, bonds from smaller companies are often undervalued, providing open-minded fixed income investors with opportunities to selectively exploit these opportunities.

Other yield premiums may be found among private placements. These fixed income issues, authorized by SEC Rule 144a, are generally only traded by qualified institutional investors and offer the benefit of shorter holding periods that range from six months to a year, compared to two years for other kinds of private placements. Over the past decade, these “144a securities” have offered attractive premiums relative to the BarCap Aggregate, as show in the chart below.

Why Smaller And Nimbler Is Better

With the BarCap Aggregate lumbering toward an inflection point, taking passive and larger active fund managers along with it, smart investors are seeking better risk-adjusted returns with more nimble managers and funds that focus on the smaller end of the fixed income universe. Because they’re not bound by broad index constraints, so-called smaller managers can rely on their own proprietary research tools to manage credit risk and identify yield opportunities.

Among active fixed income managers, those who funds have relatively low level of assets relative to funds with higher assets under management have certain advantages. They’re not pressured to hold hundreds or thousands of positions to keep the portfolio fully invested. They can identify yield premiums by using technical analysis to identify dislocation and mispricing opportunities within sectors or among individual securities. Their mandates often allow them to take advantage of yield premiums offered by private placements and other alternative investments. And when recessions occur, their smaller portfolios enable them to exit positions more efficiently and thoughtfully than larger firms that must quickly make hundreds of trading decisions to generate liquidity to accommodate outflows.

When the economy is on a roll, and markets are rising, investing in passive funds and active index-huggers often seems like a no-brainer. But when warning signs like weakening fundamentals and declining credit quality rear their ugly heads, prudent fixed income investors may be better off shifting some of their assets to smaller asset managers who may be better prepared to weather the approaching storm.

Dan Henken, CFA, is vice president of Securian Asset Management.