I have the best job in the world. I help people live better lives while making a decent living and exercising a lot of control over my time. It is truly a fantastic blessing. Yet, neither of my kids, Megan, 23 and Josh, 21, nor any of their friends are interested in financial planning.

Given all the plusses of the field, the helping nature of many in that generation and a demand for planning talent that far exceeds supply, financial planning should be one of the most popular majors on campus. But it’s not. Less than 2 percent of universities even have programs and the biggest of those have only a couple hundred students.

There are a lot of reasons for this. There is little, if anything, about financial literacy taught in grades K-12, let alone much mention of the financial planning profession. This contributes to a lack of awareness among students and their parents.

The CFP Board’s “I’m a CFP Pro” and general public awareness campaigns are helping but they pale in comparison to the ad budgets of financial service companies. The active recruiting and on-campus sponsorships of large firms make it such that many students believe financial planning means selling for a brokerage or insurance company. Sometimes graduates will do well in that role, but attrition rates are high. When it doesn’t work out, that failure gets back to other students.

It is also true that some students go to work at highly professional, fiduciary financial planning firms and it doesn’t work out. Why? Sometimes smaller firms don’t have good career tracks but often it is because the student thought they wanted to be a planner but realized it doesn’t really suit them. That kind of false start is a common hazard of youth.

Sadly, many of the graduates that have bad experiences wherever they start their careers, do not pivot to another planning related career. They go into other fields entirely and their financial planning education is diminished.

This frustrates many professors at planning programs because a degree in financial planning is not only a ticket to a career as a financial planner, it can be useful in many jobs at many financial planning related companies, not just professional practices.

Luke Dean, PhD, CRC, RFC is the CFP program director and associate professor of personal financial planning in the Woodbury School of Business at Utah Valley University recruits and works with a lot of students and next gen professionals.

“In a field that’s desperate for new talent we were losing a lot of potential recruits because they were turned off by the approach of some firms,” says Dean.

He felt a responsibility to educate students and parents about what to expect from various firms to avoid poor fits. At one point in his efforts to explain the different working environments, he was informed by his dean that life insurance sales companies were upset that they were having a tough time hiring his students and felt he was the cause. He wasn’t, but the dean asked him to create something to put on their website that would objectively describe the different paths in, and around, the financial planning profession.

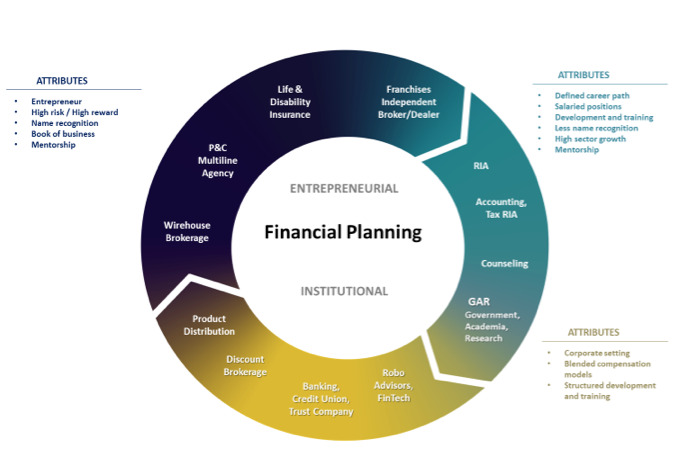

So, Dean created the “12 Tribes of Financial Planning,” to teach major differences in approach between types of firms. Dean believed people outside of financial services the financial planning “tribes” seem very similar, but they have distinct cultures and traditions. He discovered quickly that students and employers could use the framework to find better matches.

Dean found other professors and program directors having similar experiences with students, parents, recruiters or university administrators and collaborated with them to expand what he began. Earlier this year Dean was joined by those collaborators, Craig Lemoine, PhD, CFP director of financial planning program and associate professor at University of Illinois at Urbana-Champaign; Nathan Harness, Ph.D., CFP TD Ameritrade director of financial planning at Texas A&M and Martin Seay, Ph.D., CFP program chair and associate professor of personal financial planning at Kansas State University and 2019 president elect of the Financial Planning Association to present the 12 tribes construct. Formally named “Financial Service Business Models and Job Opportunities” the quartet explained the work at the CFP Board Registered Programs conference. They received a standing ovation, a rarity for panel discussions at any conference. They will present again at FPA’s national conference in Minneapolis, October 16-18.

Says Lemoine, “I found it very useful to stress the importance and range of financial planning opportunities for our students.”

Seay adds, “To me, this is one element of the "2nd generation" of financial planning programs. Programs began by slapping the CFP content onto existing programs and were not true financial planning degrees.”

I first learned of the 12 tribes on a Facebook group I belong to called FPA Activate. The four program heads have been releasing short videos on that platform to explain the concepts. FPA Activate is comprised of almost 1800 members and has become a significant member benefit for new or aspiring planners of any age and experienced practitioners like me who want to help new planners.

So, what are the business models and job opportunities available to a financial planning graduate? What skills are needed to be a good fit?

Some firms fit in multiple areas but the models in the top half are considered more entrepreneurial than those in the bottom half. “Entrepreneurial” was the word chosen to describe high risk/high reward models with good incomes for those that make it but high attrition rates. The more “institutional” models typically have lower career ceilings but often offer stability of income and strong benefits packages.

The dark blue models are typically firms with older, well-known brand names, and familiar TV ads. Most of these firms, share similarities to a wirehouse brokerage, using a “book of business” or production model requiring various sales licensing tests, a transaction-based compensation system and the standard of care of suitability or caveat emptor.

P&C affiliated planning firms tend to cater more to the middle market, adding planning to their long-running business lines. Employment opportunities are often at home offices because agents are largely not skilled in planning.

Life and Disability insurers formed financial planning’s roots. They typically have lots of offices, and often lead with insurance first and move to varying degrees into broader financial planning. Home office support of agents is growing but the outcome for most new hires is either lucrative or a failure.

Franchises and independent B/Ds present a hybrid of activities. Planners are usually independent contractors, often marketing their own brands. The brand recognition is lower. Benefits and mentorship are spotty.

Fee-only RIAs are the fastest growing of the models depicted according to Cerrulli. Some RIAs are largely money management shops and not planning firms. They often use a production-based model. Planning oriented RIAs usually offer new hires salaried positions to start with many presenting equity opportunities in time. A bona fide fiduciary standard of care applies.

This is the heart and soul of the financial planning profession and is largely comprised of small private firms. New hires typically have high flexibility and gain experience with a broad set of duties including building technical competence and counselling skills. The rigor of mentorship and training varies and is usually the most significant predictor of new hire satisfaction and success.

Tax RIAs often start with tax and move to financial planning, but business is conducted as an RIA.

Financial counseling/therapy typically puts hires in front of a different clientele than other channels. Clients are often trying to fix or prevent a crisis and need basic money management skills. Employers are often non-profits with tie-ins to certain populations like the military.

Government, academia and research organizations offer financial planning graduates opportunities in policy making, literacy and advocacy. As a growing field, there will be more opportunities for PhDs. Most professors in other fields can’t start a program from scratch but many of these new PhDs could get that chance.

Robos and fintech are a newer but rapidly growing group of employers. In addition to “cyborg” jobs for human planners, it is hard to produce, sell, implement or maintain good financial planning related software without a solid understanding of financial planning.

Many banks, credit unions, trust companies and discount brokerages are expanding to include some form of financial planning or related services. Some are face to face, others via call centers.

Product distribution refers mostly to employment opportunities with retirement plan companies and wholesalers. More and more larger retirement plans offer some sort of planning assistance.

I think these educators are onto something here. As Harness put it, “I think a basic overview of the profession and different pathways/tribes into planning is important for both firms and students. Firms can use this to help explain their vision and value proposition to students, so they get better placements with students who want to approach planning through the lens of that channel. Students can use this to help them understand where they fit into planning. “

I’d like to think that students would be clamoring to become professional, fiduciary financial planning practitioners like me. These professors definitely want to mint such professionals and most students are going to firms at which they can advise clients directly but I am happy these educators are showing students that a financial planning education can lead to a wide variety of careers even if they aren’t suited to being a fiduciary practitioner. That should boost awareness, lead to more successful job placements and expand the talent pool for the profession.

Dan Moisand, CFP, has been featured as one of America’s top independent financial advisors by Financial Planning, Financial Advisor, Investment Advisor, Investment News, Journal of Financial Planning, Accounting Today, Research, Wealth Manager and Worth magazines. He practices in Melbourne, Fla. You can reach him at [email protected].