Retirement planning comes with a number of complex calculations and variables. Some are easier to quantify and explain than others.

Since retirement is often portrayed as this picture-perfect time of life where everything falls into place, it’s more important than ever for financial professionals to employ new ideas, methods and calculations to explain to clients how they will make the transition both financially and personally.

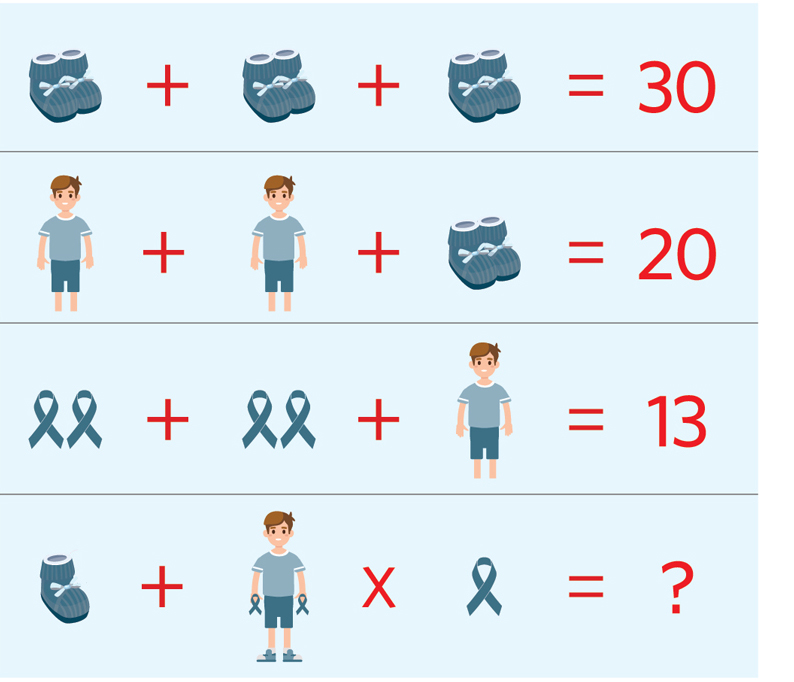

Here, I have adapted a popular brain teaser. This illustrates the ways advisors can use a simple picture to explain retirement planning and make it much more personal.

Can You Solve This Problem?

Take a moment to look closely at this picture and identify the total in the last column.

What Is Your Answer?

I have shared this picture with a variety of groups and on social media and am always amazed by the variety of answers. Let me go over some common answers and why this picture is so valuable to the future of retirement planning.

Some of the most common answers are 12, 19, 20, 30, 43, 46, 48, 60, 80 and 112, to name a few.

But they are all wrong and illustrate a major flaw in the way people approach some situations, including retirement. First and foremost, what most people miss is the fact that in row one there are a pair of shoes and in row three a pair of ribbons. When you get to the final row, there is only one shoe and one ribbon, which decreases the value of each.

Additionally, you may not have noticed that in the final row, the third step in the equation uses not addition but multiplication. It’s a subtle change but has a major impact on the answer you get.

Lastly, you may have missed that the person in the last row is different from those in the previous two rows. The figure is wearing a pair of shoes and holding two ribbons.

That miss is important because it replicates what can happen with traditional retirement planning. Many advisors don’t look closely at the person first, they just jump into the normal math and, as a result, they can set their clients up to fail in the ultimate test of life after work.

The harsh reality is, in order to get the right answer we can’t just do straight, left-to-right math because people, our clients, are the most important part of the equation. Thus, the financial services industry needs to shift its focus from a straightforward dollar-and-cents approach to one that takes a deeper dive into the individual, couples and families first.

We can’t gloss over or ignore these details or assume they will fall into place if we just focus on numerical values and representations. What clients need is a written plan with concrete action steps to replace their work identity, fill their time, stay relevant and connected, and keep mentally and physically active. Without this, there’s a major void in any retirement calculation/decision, making it foolish to use traditional methods alone.

Additionally, an advisor needs to be able to understand and explain to clients how things will change as they move into retirement. Just as the equation in the last row changed from addition to multiplication, so does life in retirement change.

People assume that retirement is nothing but a big plus sign. That more freedom, time and leisure will suit them well and result in the life they have always dreamed of. But the reality is that problems, stress and boredom can multiply if people don’t have some structure, goals, direction and purpose for this phase of life.

Yes, no longer going to work means clients have more time and fewer distractions, but if they don’t find things they like and value to fill them up, a darker side of retirement can creep in and take over.

It’s time to wake up to the fact that retirement doesn’t equal happiness. There is no direct correlation. The joyful, positive feelings come from other things—impact, involvement, love and generosity to name a few. In other words, retirement is not a feeling but a stage of life requiring concrete plans and action steps to foster positive feelings.

It’s also worth pointing out that retirement doesn’t eliminate work, just reorients it. Being a successful retiree, couple, friend, grandparent, volunteer or gig employee takes work. It’s just a different type of work than what the client was doing to earn a living. But nobody talks about it that way, including advisors, who just want to focus on the numbers and argue that the right answer depends solely on having enough money or reaching a certain age.

Getting back to the brain teaser, now that we know that the guy in the last row has a pair of shoes on and a ribbon in each hand, you could come up with a few different answers depending on how you did the calculation. If you started left to right in order, you would get: Shoe (5) plus guy (5) plus a pair of shoes (10) plus a pair of ribbons (4) equals (24) which needs to be multiplied by one ribbon (2) to equal 48.

Unfortunately, this is wrong because in math there is a process called PEMDAS, an acronym for “parenthesis, exponents, multiplication, division, addition, subtraction.” Basically, this tells you how to approach an equation. First, all exponents should be simplified, followed by multiplication and division from left to right and, finally, addition and subtraction from left to right.

What that means is that you have to approach each equation in a specific way. The same is true with retirement planning calculations. Following this concept, advisors must first and foremost simplify all of the exponents. This reiterates my earlier point, that before we do any multiplication, division, addition or subtraction we have to look at the person and get that piece of the puzzle right.

This is important because unlike getting the answer to a simple brain teaser wrong, if you or your client get retirement wrong, there can be far-reaching consequences that someone can’t easily erase or rework with a calculator. Which is why it’s more important than ever to either get trained in helping clients develop plans for these other areas of retirement or partner with someone with extensive training like a Certified Professional Retirement Coach (CPRC).

Some advisors will read this article and get a good chuckle out of it. They will feel it’s crafty; it will cause some of them to nod in agreement to my emphasis on the non-financial aspects of retirement. However, it may just end there for some people and it doesn’t mean they are going to change or do anything different.

So let me hit you with this. The answer is 63, and it should have taken you only a minute or less to figure it out—if you read and followed the instructions, which at the top of the page say, “What is the total in the last column?” If you look all the way to the right and go from the top down, the answer is 30 + 20 + 13 = 63.

Many of us have been so programmed to jump in and solve or fix things that we miss key instructions along the way. We see a funding gap for retirement and assume we have to redo the math and adjust the calculations. But we need to focus on a new area of instructions for retirement.

The eye-opening reality here is that you, the advisor, are the instructor with the master instructions. Therefore, if you don’t adapt to the new era of retirement and include factors that are necessary to help your clients make a successful transition, they may enter the most anticipated phase of life with the wrong equation, calculations and, worst of all, wrong answer.

Now is the time to stop being conditioned or programmed to keep doing things the same way. It’s time to shift your focus to a picture perfect retirement that includes planning with new, more personal equations, calculations, processes and considerations.

Robert Laura is a best-selling author, nationally syndicated columnist and president of Wealth & Wellness Group. He is a seasoned conference speaker, corporate trainer, and pioneer in “The New Era Of Retirement” which focuses on the non-financial aspects of life after work. He can be reached at [email protected].