"Owning leadership remains important, and while it may not feel like it, Technology (both equally-weighted and cap-weighted) is still the best sector YTD and sports the highest % of stocks in uptrends."

—Strategas Technical Strategy, 4/18/18

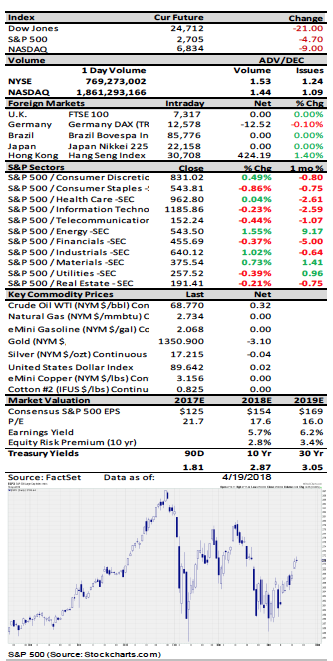

In yesterday's Charts of the Week report, in which we gave a number of individual stock ideas, we mentioned that one of the reasons we're confident that this year's lows will not be retested is that we're seeing much better strength across the broad market. It may not feel like it, but things are actually looking pretty good right now: all of the S&P 500 sectors were positive for the month of April coming into yesterday's session; two-thirds of NYSE stocks are currently above their 50-day moving averages; and the NYSE Common Stock Only Advance-Decline line is back to making new all-time highs. There is still some obvious disparity across the various areas of the market, though, and, because of this we think it's important to continue to actively rotate into the industries and stocks leading the way.

So what has been leading the way recently? Well, we've mentioned the outperformance of the energy sector in the last few weeks, but, surprisingly, technology continues to impress as well, despite weakness in a few of its key names. As the Strategas Technical Strategy team pointed out in a report yesterday:

"…Technology (both equally-weighted and cap-weighted) is still the best sector YTD and sports the highest percent of stocks in uptrends. The Internet Index had its best day in more than 2 years yesterday and 4 of the largest 6 names in the Russell 1000 technology sector made fresh relative highs vs. the S&P 500 (AAPL, MSFT, INTC, and CSCO)."

Contrast that with the financial sector, where recent underperformance has prompted the most common question we have received over the last week: why are the financials selling off despite notable earnings beats? Like many aspects of the global financial markets, the short answer to that question is that "it's complicated." It is always difficult to isolate why the masses that make up the market are buying and selling, but there are probably a few reasons combining to create the banks' struggles.

For one thing, interest rates have mostly been flat to down over the last two months except on the short-end of the curve. This sluggishness is perhaps tied to the softening witnessed in a few economic reports, and, of course, the still present fear that the Fed could make a policy mistake or that a disruption in global trade could occur at some point in the future. And then there was this quote from a CNBC.com article on the subject written yesterday by Miller Tabak equity strategist Matt Maley: "Investors have given some blame to the rise in credit card delinquency rates, the fall in loan demand, as well as the ever-flattening yield curve."

So, it seems a case can be made that investors are a little more worried about the economy and, by extension, the outlook for the banks than they have been over the last year. However, let's not overlook the fact that investors have been heavily buying the bank stocks until recently, so there could definitely be some profit-taking and "selling the news" at work here, too. The S&P Financial Select Sector Index was up about 75 percent from June 2016 to the January 2018 high and up almost 30 percent just from September of last year to that late January high (see chart 2 below). A pause to catch its breath was probably going to have to happen at some point, and no real technical damage has been done to the group. In short, we're not too concerned about it right now.

Overall, we continue to remain constructive on the stock market as long as the 2018 lows hold. The S&P 500 is quite overbought on a very short-term basis, but the averages and breadth readings are not yet hitting the extended levels that typically signal a move has completely run out of steam. So, while we could see stocks give back some of their recent gains in the near-term, we are just not seeing major red flags right now. And this morning futures are pointed slightly down, though not by much. As we wrote yesterday, we'd now prefer the S&P 500 to stay above the previous 2675 resistance level that should now help act as support. We also might be seeing a major breakout in commodity indices, but more on that tomorrow.

Andrew Adams, CFA, CMT, is senior research associate, market strategy at Raymond James.