Even as equities have rebounded from their March lows, the economic and jobs data are mostly unsettling, with volatility remaining high. At best, the market environment is murky, with most experts expecting it to stay that way.

Understandably, RIA executives are questioning how all this will impact profitability and valuations. While many could have fears bordering on the extreme, those feelings may not be entirely warranted.

That’s because most wealth management portfolios contain a mix of equity and fixed-income investments, and as a result have not experienced the same type of declines as broader market indexes. What’s more, it’s important to point out that the industry standard practice is to value firms based on their rolling four-quarter performance.

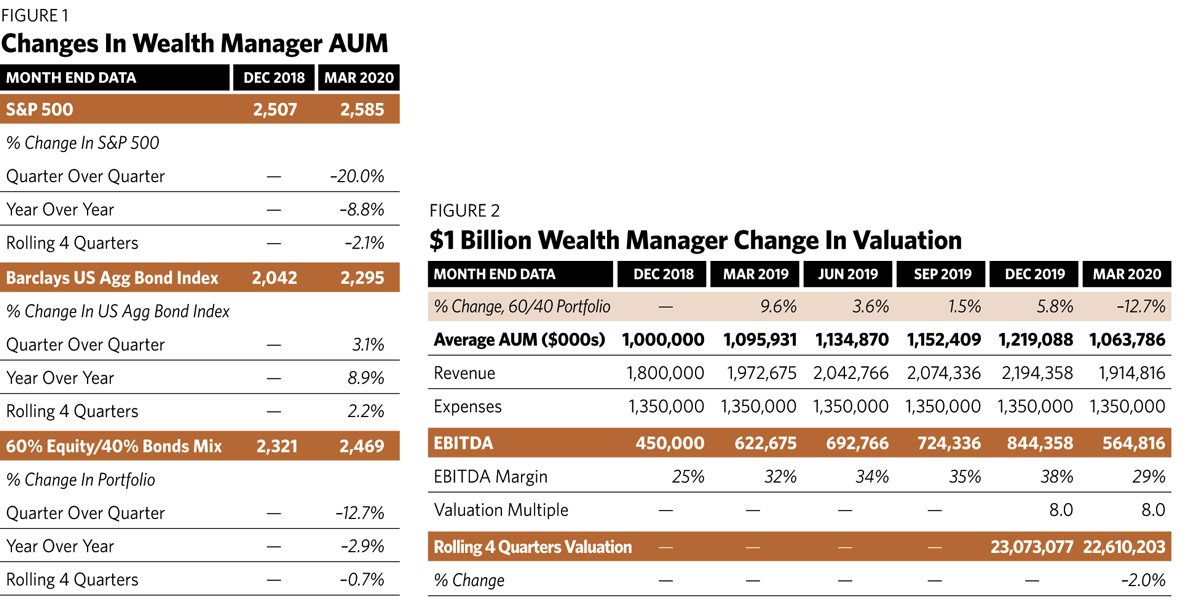

Using this method, an investment portfolio comprising 60% equities and 40% fixed income was down only 0.7% during the first quarter (see figure 1). This paints a different—and more reassuring—picture than a quick glance at the S&P 500 during the same period.

With that in mind, what would this mean for a hypothetical $1 billion RIA? Even though assets under management may have declined through the first three months of 2020, the firm’s valuation would decline by only 2% (see figure 2).

Still, most executives are loath to accept drops of any kind, even if they are not as extreme as many would have assumed. Indeed, for many, a decline in performance under any circumstance requires a new strategy.

And while that may sound like an extreme viewpoint given the current environment, every firm owner should keep their options open to reduce costs and improve profitability in case the economy does not pick up as fast as most would like.