Even as equities have rebounded from their March lows, the economic and jobs data are mostly unsettling, with volatility remaining high. At best, the market environment is murky, with most experts expecting it to stay that way.

Understandably, RIA executives are questioning how all this will impact profitability and valuations. While many could have fears bordering on the extreme, those feelings may not be entirely warranted.

That’s because most wealth management portfolios contain a mix of equity and fixed-income investments, and as a result have not experienced the same type of declines as broader market indexes. What’s more, it’s important to point out that the industry standard practice is to value firms based on their rolling four-quarter performance.

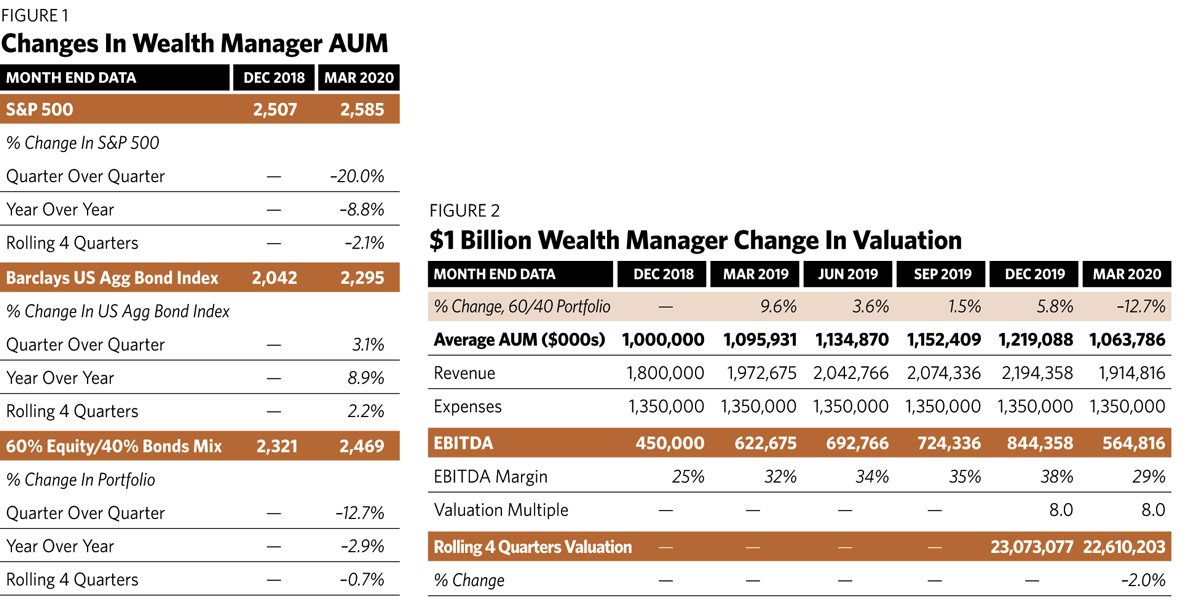

Using this method, an investment portfolio comprising 60% equities and 40% fixed income was down only 0.7% during the first quarter (see figure 1). This paints a different—and more reassuring—picture than a quick glance at the S&P 500 during the same period.

With that in mind, what would this mean for a hypothetical $1 billion RIA? Even though assets under management may have declined through the first three months of 2020, the firm’s valuation would decline by only 2% (see figure 2).

Still, most executives are loath to accept drops of any kind, even if they are not as extreme as many would have assumed. Indeed, for many, a decline in performance under any circumstance requires a new strategy.

And while that may sound like an extreme viewpoint given the current environment, every firm owner should keep their options open to reduce costs and improve profitability in case the economy does not pick up as fast as most would like.

The following breakdown provides a broad framework to find areas to cut costs during this economic downturn. The typical RIA devotes about 50% of its revenue to compensation and another 25% to non-compensation expenses; it has a profit margin of about 25%. Here are some potential considerations.

Compensation

The most painless way to curtail expenses is to put a freeze on hiring and terminate raises. Sadly, though, this crisis will force many firms to take more drastic action. Nevertheless, it would be unwise to make any cost-cutting move without thinking through the long-term implications.

Consider, for instance, the tight market for talent that existed within the RIA market before the coronavirus crisis. Firms that reduce head count must realize that capable professionals who are laid off now will be in demand once the economy improves. Justifiably, they may not be eager to come back to work for someone who, in their view, turned their back on them.

Non-Compensation Expenses

These include everything from marketing to professional services to rent and utilities. Some of these costs are unavoidable—it may be impossible to cut technology expenses since firms need to protect their operational systems and remain efficient.

Other expenses will be easier to reduce, including costs that at one time may have been considered fixed, like rent. If we have learned nothing else from this shutdown, it is that clients are willing to meet via videoconferencing platforms. Some even prefer it. Depending on the market, a more modest office space could save thousands each month.

Profits

For the highest performing firms (those with EBITDA margins of 30% or more) the best thing to do may be to simply accept less profit in the short term. That will undoubtedly lower a company’s valuation, but it’s likely to keep employee morale and client satisfaction high. Every successful business goes through transitions where it makes more sense to invest in the future, and this is likely one of those instances.

The Takeaway

The reality is that RIA valuations may fall, though as we’ve shown, not by as much as many may assume. And while there are ways to minimize some of the pain, firm owners/executives should consider those decisions very carefully.

The good news is that the industry will come out of this just fine. Weathering market cycles is a reality of any business, and RIA founders know that better than most. Even older owners who may be looking for a way out understand that this too shall pass.

Finally, it is important to realize that RIAs were stronger than ever going into the downturn and, as a result, have never been more professionally managed, efficient or as well-capitalized as they are now.

This certainly does not mean that all RIAs are invulnerable to economic challenges, but it does suggest that the industry can endure these downturns better than ever before.

Carolyn Armitage is a managing director with Echelon Partners, a Manhattan Beach, Calif.-based firm that provides M&A advisory, valuation, consulting and investment banking services to registered investment advisor firms across the country.