Anticipation for a pivot by the Federal Reserve and a turn away from interest rate hikes sent U.S. bonds and equities surging from early November through mid-January. However, by then investors were largely concerned about new things, including geopolitical problems, which topped their list of concerns heading into 2024. Over the last two years, conflict has spread from Russia and Ukraine down through Israel and Gaza into the Red Sea and the Gulf of Aden.

In mid-January, violence reached the Indian Ocean after Iran bombed three nations, including Pakistan, in 24 hours. Pakistan promptly bombed Iran back. Then early in February after suffering casualties in the region, the United States military retaliated against Iranian-backed militias in Iraq.

Watching conflict spread from Eastern Europe to the Middle East and even to South Asia has clearly left many investors queasy. It’s also threatening to rekindle inflation. At a London conference of global investors sponsored by Goldman Sachs in mid-January, 54% of participants named geopolitical worries as their biggest concern, while 17% cited the U.S. presidential election, according to Bloomberg. Indeed, the prospect of a regional conflict going global remains a wild card that can’t be discounted. It’s prompted some to quip that markets have been partying like it’s 1939.

Over the last two years, the U.S. economy has wrestled successfully with inflation and defied a continual stream of recession forecasts, though few people seem satisfied with the post-Covid-19 recovery. There is also a feeling that the current economic strength can’t be sustained when the federal government is racking up massive budget deficits approaching $2 trillion. That was once considered unheard of during a peacetime expansion.

People almost everywhere will get to speak their minds on topics like these this year. An estimated 49% of the world’s population in 64 countries will be eligible to vote in 2024, so the world’s political leadership could look very different in 12 months.

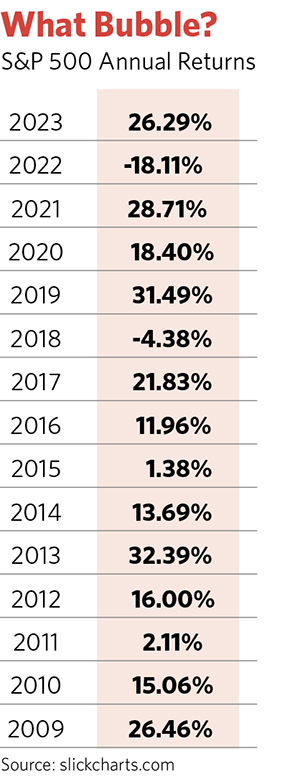

The rest of the world’s problems aside, the sun rarely sets on the U.S. stock market. American investors entered 2024 conditioned by 15 years of stunning returns, beginning with an S&P 500 that started at 666 in March 2009. Equities, goosed forward by easy monetary policy, saw a spectacular run-up, and that propelled the United States out of pandemic economic doldrums faster than other nations. The market’s lift also spawned an increase in wealth among the clients of financial advisors.

At present, the consensus calls for inflation to continue declining, for no recession to surface, for earnings to grow 8% to 10% and for the Fed to cut interest rates, notes Rob Almeida, global investment strategist at MFS Investment Management. While it’s quite possible that one, two or even three of these things might happen, all four occurring simultaneously seems like a superfecta.

What Recession?

Fed up with recession predictions that fail to materialize, Wall Street conventional wisdom has settled on the idea that the economy will enjoy a soft landing. Some, like Charles Schwab chief investment strategist Liz Ann Sonders and economist Ed Yardeni, have posited that the traditional business cycles have been shifted this time around by a series of rolling recessions as sectors from technology to durable goods and travel struggle in fits and starts.

Consumer strength has been fueled by successive fiscal stimulus packages from the Trump and Biden administrations, and it remains buoyant. Yardeni has noted that many of a wave of baby boomers recently reaching retirement are now taking their required minimum distributions from fat 401(k) accounts, and this is keeping the economy humming in ways it didn’t in the past.

Many retirees may be doing fairly well, though higher interest rates and inflation are frustrating younger Americans looking to buy their first homes. Still, on the spending front, hourly workers are benefiting from labor shortages, according to Kristina Hooper, chief global market strategist at Invesco. These workers can easily pick up extra part-time income from employers who can’t fill full-time positions. Some economists think expanded employment opportunities explain the surprisingly strong retail sales this past holiday season.

But beneath the surface, all the rosy statistics mask some troubling trends, many of them traced to debt. There are roughly half as many public companies as there were two decades ago and many went private or were merged via extensive financial leverage.

From Spirit Airlines, which says it isn’t contemplating bankruptcy, to Sports Illustrated, to trucking businesses like 91-year-old Yellow Freight and eight-year-old Convoy (a startup backed by Bill Gates and Jeff Bezos), more companies have encountered financial woes, including default, in the last year than most Americans realize. “In 2023, the number of companies in the U.S. with $50 million [or more] in debt that filed for bankruptcy was about 200, similar to what it was in the pandemic and in 2008,” Almeida observes.

Both the 2008 and 2020 economies were extraordinary by most measures. Last year differed only in the aggressive Federal Reserve tightening cycle, which many perceived as a return to economic normalcy. But amid the rate increases, most businesses that recently failed “collapsed under the weight of their own debt” and “presumably” falling revenues, Almeida says.

Given the economy’s ability to upset expectations, it’s reasonable to ask if major structural changes are taking place. Almeida notes that interest rates have existed for 5,000 years, and yet in the last 50 they’ve never been higher—or lower.

Monetary policy has been very effective at influencing financial markets, Hooper says, if far less powerful in its impact on the economy. Since the Great Financial Crisis, it has acted as the primary driver of the markets, so much so that Wall Street savants often talk about little else.

When supply-chain bottlenecks and labor shortages triggered a surge in prices in 2021, some observers like former U.S. Treasury Secretary Larry Summers predicted the Federal Reserve would need to keep interest rates and unemployment above 5% for several years to expunge inflation. The mere presumption that the central bank could control the labor market to that degree showed how much weight policymakers like Summers attach to its powers. But so far he has been dead wrong.

If, as many believe, the Fed officially finished its current stint of rate increases last July, that would mean the current unemployment rate, 3.9%, would be the lowest it’s been six months out than it was in the previous six hiking cycles, according to Invesco’s Hooper. Still, that debate over when and how frequently the Fed will cut interest rates this year remains contentious.

What happens beyond this year, in the next decade, will be more important for advisors and clients. Ed Yardeni of Yardeni Research has outlined some basic scenarios, looking in the rearview mirror 50 and 100 years back to describe the current era.

The first scenario he calls the “Roaring Twenties.” Here, “our basic premise is that a chronic shortage of labor is forcing companies to use technological innovations to boost their productivity growth, which started to improve last year, according to the government’s quarterly data,” Yardeni wrote in a client email on January 21. “As a result, inflation remains subdued in this scenario, while real GDP growth, real wage growth, and profit margins all get boosted.” He says there’s a 60% probability of this scenario coming to pass.

There’s a 20% chance of the second scenario. He dubs this one “the 1970s,” since several economists have compared that period to the last couple of years when inflation returned. Even though price increases slowed in 2023, he writes, “there is still a risk of a second inflationary energy shock as occurred during the 1970s.” This one, however, would be tied to geopolitical problems, including “Russia’s invasion of Ukraine in early 2022. If the conflicts in the Middle East continue to spin out of control, oil prices could soar again.”

In the ’70s scenario, “the Fed is forced to raise interest rates … and cause a recession,” an outcome that was quite believable a year ago. Equities in this situation would likely perform dismally. However, inflation indeed began to wane early last year, and the advent of AI has re-energized the stock market. Most important, the economy accelerated in 2003’s second half.

In the ’70s scenario, “the Fed is forced to raise interest rates … and cause a recession,” an outcome that was quite believable a year ago. Equities in this situation would likely perform dismally. However, inflation indeed began to wane early last year, and the advent of AI has re-energized the stock market. Most important, the economy accelerated in 2003’s second half.

In the January 21 email, Yardeni outlined a third scenario: a 1990s-style stock market bubble exacerbated by Fed policy (this, too, won a 20% chance of happening). In this worrisome case, the Fed grows “concerned that inflation is falling below 2.0% and responds by aggressively cutting interest rates, even though the economy continues to perform well.”

That could spur a “melt-up” in the stock market, a surge led by technology stocks. “The resulting valuation bubble bursts when the Fed is forced to raise interest rates, because asset inflation shows signs of precipitating another round of price inflation,” Yardeni concludes.

His stock market target is for the S&P 500 to finish this year at 5,400, so one can only imagine how far a melt-up might take equities.

Debt Catches Up

Voices of dissent say the central bank is likely to remain more hawkish than the prevailing view suggests, and view as unrealistic the notion that the Fed would cut rates four to six times in 2024. Macro strategist Jim Bianco, founder of the Chicago consulting firm named for him, raised eyebrows earlier this year when he told Bloomberg he thought the bond market could be dead wrong and that a surprisingly strong economy could send the 10-year Treasury bond yield back to near 5.50%.

The huge fourth quarter rally in bonds priced in five or six rate cuts later this year (it gave back some gains in January), and Bianco calls these assumptions “wildly optimistic.” In his view, investors should be thinking about rates headed higher later in the decade.

Like Bianco, Loomis Sayles’s vice chairman, Dan Fuss, says his team thinks the economy will remain resilient and avoid a recession. “I don’t know how we get a rate cut in March unless the economy really falls off or a war breaks out,” he says. And by a war, he’s referring to one that cuts off Saudi oil, not a continuation of the skirmishes proliferating across the Middle East.

Even if it’s “almost heresy” for a longtime bond fund manager to say it, Fuss concedes he favors stocks “slightly over bonds.” That’s because “corporate spreads” over Treasurys are “so low I don’t see them staying that low.”

High-yield bonds have been a favorite at Bondbloxx, a fixed-income exchange-traded fund firm, especially as the business cycle turned buoyant in the face of recession expectations last year. JoAnne Bianco, an investment strategist at Bondbloxx, says conditions continue to be strong for high-yield issuers; the firm doesn’t anticipate an increase in defaults this year.

One bond market participant who shares Dan Fuss’s and Jim Bianco’s skepticism about lower interest rates over the long term is Jeffrey Gundlach, CEO of DoubleLine Capital. But he’s also more negative about the economy in general. He says the leading economic indicators index has been misleading in the current cycle because it’s heavily weighted to manufacturing indexes, and these industries got very weak just as services industries like travel enjoyed booms, he said on a January webcast.

Unlike most institutional investors, Gundlach isn’t impressed with the strength of U.S. employment, which is already shrinking in many cyclical sectors. “The labor market is the last to go,” he said. “Once [unemployment] goes up, it can go up pretty dramatically.”

It’s the national debt situation that has Gundlach’s attention, as $17 trillion, or about 50% of the total, expires in the next 36 months. Many of those Treasurys were issued in the last five years with coupons of 1% or less.

Gundlach finds the economy weaker than many of his rivals do, but like Jim Bianco he anticipates a day of reckoning for the U.S. Treasury as it is forced to sell trillions in debt every year. He believes a recession is closer, too. In the next one, the market isn’t going to see a bond rally, he predicts. The Fed will want to keep interest rates lower to keep interest expense under control, as interest is currently 15% of the total federal budget.

“Rates could go down to 3%, but they won’t hold,” he told webcast attendees, adding that we might see rising rates and an inflationary reaction to the next recession.

“Medicare is projected to go bankrupt in eight years by their own trustees and Social Security in 10 years,” Gundlach says. “It’s our grandchildren’s problem or our children’s problem. It’s our problem.”