Tiger Global Management placed first in a world hedge-fund ranking and quant powerhouse Renaissance Technologies was ousted, another sign that trading conditions favored human stock-pickers over algorithms.

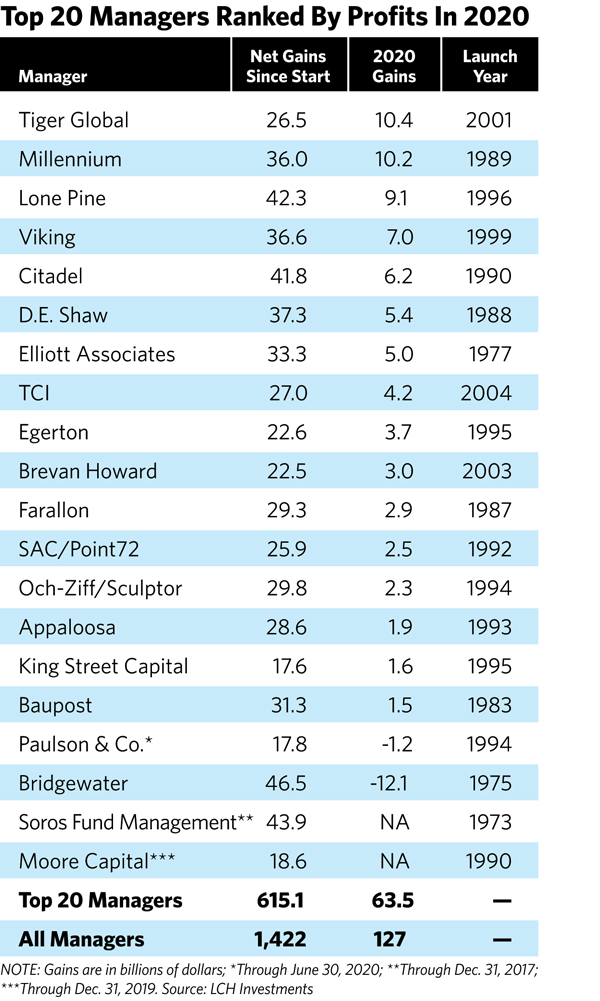

The industry reaped $127 billion last year, with some of the biggest firms dominated by human traders racking up record profits, according to estimates disclosed Monday by LCH Investments, a fund of hedge funds. Chase Coleman’s Tiger Global generated $10.4 billion for clients, after fees, and Izzy Englander’s Millennium Management was a close second, with $10.2 billion.

Renaissance, founded by billionaire mathematician Jim Simons, fell from the ranking of 20 firms after some of its public funds lost more than 30% last year. In 2019, it placed third on LCH’s list, which focuses on managers with most total profit since inception and is designed to favor the largest and oldest hedge funds.

The ranking reflects the most-prominent theme of a tumultuous year, with hedge funds making or losing huge sums of money as the Covid-19 pandemic ravaged the globe and central banks unleashed unprecedented stimulus to contain the economic carnage. The biggest of them all, Ray Dalio’s Bridgewater Associates, incurred $12.1 billion of losses.

The ranking reflects the most-prominent theme of a tumultuous year, with hedge funds making or losing huge sums of money as the Covid-19 pandemic ravaged the globe and central banks unleashed unprecedented stimulus to contain the economic carnage. The biggest of them all, Ray Dalio’s Bridgewater Associates, incurred $12.1 billion of losses.

“In navigating the especially volatile markets of 2020, talented individual managers with vision and flexibility performed better than programmed machines,” LCH Chairman Rick Sopher said in a statement.

His firm’s annual survey is just one way to look at the industry’s profitability, as it may exclude newer or smaller hedge funds that outperformed everyone in the top 20 on a percentage basis.

The 20 managers in the ranking oversaw about 17% of global hedge funds assets and produced roughly 43% of the $1.4 trillion in profit the industry has generated since inception, according to LCH.

This article was provided by Bloomberg News.