Wishful thinking is never a great investment strategy. But in the current macroeconomic environment, which has recently seen the end to a 40-year bull market in bonds, interest rates bottoming out and then rising again, inflation coming back in a major way for the first time in generations and threats to what had been a long period of globalization, retail investors can be forgiven for wanting to go back to the tried and true.

So it’s worth asking the question: Is it safe? Is it time for investors to reallocate their portfolios to a traditional 60-40 (equities/bonds) balance?

The Wall Street Journal recently came out quite bullish on this idea, declaring that the 60-40 investment strategy is back. They cited a March survey from the American Association of Individual Investors, which found that investors have increased their bond exposure to their highest level since 2021, while their stock exposure has edged down but still remains above historical averages. The respondents had about 65% of their portfolios in stocks, 15% in bonds and 20% in cash.

But is this the right call?

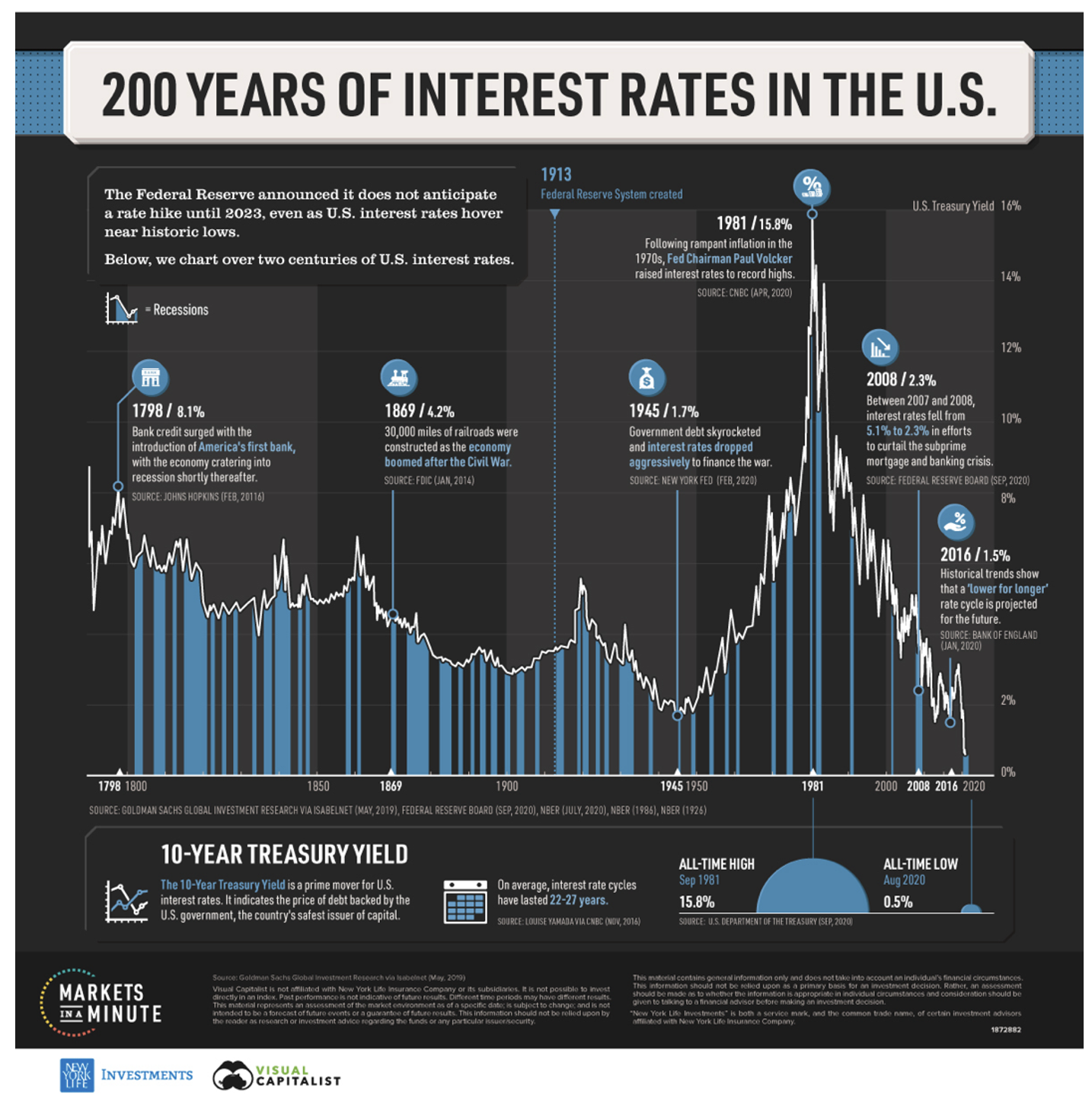

The Journal story includes a chart that shows 60-40 returns since 1991. But for most of this time, 60-40 had a wind in its back, as interest rates declined significantly and steadily since the late 70s.

As we all know, in 2022, rates went up substantially for the first time in a long time. This is because inflation, which the Fed had initially thought to be transient, was actually very real. As a result, the Fed embarked on a series of rising rates moves to attempt to bring inflation back down to an acceptable level.

And when you look at a 30- or 40-year chart, 2022 looks like a big aberration, especially since 2023 is off to a good start, in terms of the equity markets.

But the fact is that equities behave differently than bonds. Certainly, most of us can agree that buying equity on dips for 60% of your portfolio makes good sense. Equities, in aggregate, have a very long track record of going up over time.

But what about bonds? Bonds don’t have the same track record, and private investors should not expect that bonds will appreciate in price over a very long timeframe. Yes, interest rates rose significantly in 2022, but they remain below historical averages and are still a fraction of the level seen in the late 1970s (see chart). Given this longer-term lens, investors should be aware that the shock absorber protection we have relied on during times of market dislocation perhaps can’t be relied on going forward. Will bonds provide the buffer we have grown to expect, or will there be times that look more like 2022?

Certainly, bonds are more attractive than they were in 2022, and the Journal’s call may ultimately prove correct, but it’s just too soon to know whether 2022 was truly an aberration or a sign of things to come.

The Prudent Retail Investor Should Continue To Consider Uncorrelated Strategies

And that is my point. Guessing which way the financial winds will blow is never a great strategy. And in the absence of certainty, the prudent investor should always have a caveat emptor mindset—buyer beware.

In other words, those investors who are considering diving back into 60-40 strategies at this point need to be careful of the longer-term risk. After all, the macroeconomic forces that have driven the rise in inflation and rates are arguably still quite unpredictable. What’s more, it is certainly possible that rates have bottomed, and we will not see rates close to zero again for some time, if ever.

For advisors that are navigating these more complex terrains with their clients, they should consider diversifying client portfolios with investment options that have low or no correlation to stocks and bonds and have a track record of delivering positive performance in periods of dislocation. This way, their portfolios can continue to be buffered against market dynamics, which may—or may not—lead the prudent investor back to a 60-40 allocation.

While there are few liquid options that can provide this type of diversification, risk protection and non-correlated performance, two options are global macro and trend following programs. Both strategies behave a lot like the fixed income component of a traditional 60-40 portfolio. They are designed to generate long-term returns while at the same time deliver downside protection in periods of market dislocation. Unlike traditional investment approaches, these strategies are agnostic to market direction, and expand their toolkits to include FX and commodity markets where risks of inflation, volatility spikes, equity sell-offs and other shocks can be harnessed as opportunities.

We believe this is an effective way for investors to broaden their portfolios by incorporating systematic macro and trend following strategies.

William Marr is senior managing director of the Wealth Management Group at Welton Investment Partners.