You know it’s a bad year for U.S. equities when a large-cap fund was up one-half of a percentage point through early November and your first thought is something like, “Wow, that’s great!” But so it goes in a year when that fund’s bogey, the S&P 500, was down 20% during that period.

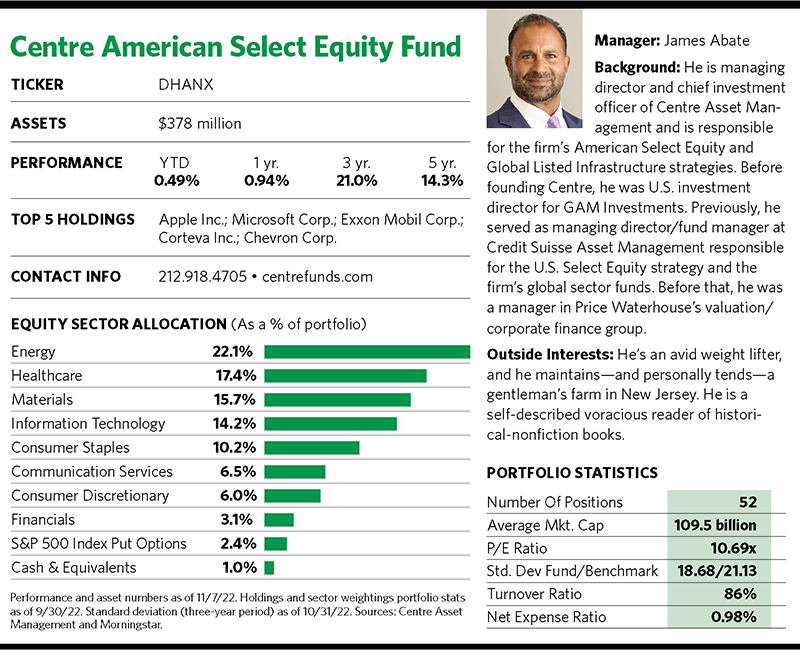

The fund in question is the Centre American Select Equity Fund, one of just two U.S.-listed mutual funds offered by Centre Asset Management LLC, a small investment shop in New York City. The company was founded in 2006 by James Abate, who serves as the portfolio manager of the American Select Equity Fund. (He also oversees the much smaller Centre Global Listed Infrastructure Strategies Fund.)

The American Select Equity Fund has garnered nearly $380 million in assets and racked up enviable performance numbers that made it the top-performing fund in Morningstar’s large-blend category during the one-, three- and five-year periods, and also for the year to date through November 7.

That doesn’t mean the fund always hits the mark. For example, it was in the bottom quartile among its category peers in 2019. But long-term holders of this fund have benefited from Abate’s bottom up-driven economic value added philosophy, or EVA, which looks at corporate capital allocations and seeks to identify rates of return on those allocations that exceed or fall short of costs of capital.

Or as Centre describes it, EVA is an investment approach focused on finding creators of shareholder value and avoiding value destroyers.

The fund comprises a high-conviction portfolio of roughly 50 stocks, and is positioned as a core growth fund with an emphasis on risk management and downside protection.

“It’s not only about stock selection, but it’s also about having a strong awareness about risk, particularly downside volatility,” Abate says. “We think of ourselves as the mutual fund that every hedge fund wishes they were.”

The fund employs hedges to help mitigate downside risk, which Abate says enables it to match the upside capture performance of its category while providing significantly more downside protection. According to Morningstar, the fund had slightly exceeded its category’s upside capture ratio during the recent three-year period and slightly trailed in the five-year period. Meanwhile, it provided massively better downside protection against the category as a whole during both time frames, with downside capture ratios that were 40 basis points less than the category during the three-year period and 30 basis points less during the five-year period.

Underlying Strategy

Abate attributes the fund’s success to the EVA strategy, as well as the position sizing within the portfolio and his ability to tactically use hedges.

“It’s an integrated approach, but first and foremost is the securities selection methodology,” he explains, adding that he has pounded the table about EVA for years through papers and books he has written on the strategy.

Abate posits that the vast majority of analysts still myopically focus on basic variables such as P/E multiples and earnings per share momentum. He doesn’t ignore these metrics, but instead incorporates them into a holistic approach that includes other fundamental drivers. “I come from a corporate finance and valuation background, so we take a long-term corporate financier’s view of every single business we invest in.”

The fund employs both quantitative and qualitative approaches. “The quantitative work is a must-have, meaning that we won’t look at a name unless it first passes our quantitative screens,” Abate says, adding that he’ll typically end up with 80 to 100 stocks that look attractive quantitatively before subjecting them to old-fashioned qualitative work to discern which 40 to 50 ideas to invest in.

“I like to say it took me 30 years to develop the quantitative framework, and literally one minute a day to run it. So the vast majority of time is spent on the qualitative research and looking at the data,” he says.

He explains that the fund’s qualitative work involves identifying certain variables that add value. It can be a simple thing like a company’s inventory levels, or it could be the company’s focus on its margins or its capital investment strategy for dividends. In many cases, he will narrow it down to a particular element he thinks will move the stock higher or lower.

“We take a longer-term view and try to own companies as they hopefully reach an inflection point where we can buy them at the bottom, and ride them for however long that fundamental momentum and wealth creation last,” Abate says.

Not All Fertilizers Are The Same

One of the holdings he highlights is Corteva, a seed producer spun out of DuPont three years ago. He says people misjudged the company’s ability to expand its margins because they were distracted by the lagging effect of seed pricing. Many materials companies have seen strong price increases in their products this year, he notes, but people missed that with Corteva because seeds are typically prebought by farmers six months to a year in advance and at prices contractually agreed to.

Abate thinks the company will likely be able to sell its seeds at higher prices going forward and improve its profit margins. “That will be more impactful to Corteva’s earnings in 2023 than it will be in 2022,” he says. “And we think that has some persistence.”

He also likes Exxon Mobil, not just because oil prices have zoomed this year but because they could stay high for the foreseeable future. Abate started buying shares of the company in August 2020 after it had greatly reduced its capital spending on new projects following the twin blows of the oil price plunge in the mid-2010s and then the Covid-induced price collapse in 2020.

The company has recalibrated its business to prioritize free cash flow and debt reduction rather than drilling new holes. “So what they’re doing with the money is supporting the highest dividend we’ve seen, the biggest share repurchase program we’ve seen,” Abate says, adding that this has led to a big reduction in the financial risk the company encounters from cyclicality.

From an EVA standpoint, this all results in wealth creation for shareholders (though some of those gains are being depleted by higher gasoline and heating oil prices). Abate notes that this period of reduced capital investment in new projects means that the current supply-and-demand imbalance causing higher oil prices likely won’t end anytime soon.

“We’re pretty confident pricing will continue to be a benefit for Exxon and most every other energy company,” he says.

As for unloading positions, Abate says he looks for company-specific clues rather than top-down information to dictate when to sell. He points to Mosaic, a potash and phosphorous miner that was a top-10 holding as late as this year’s second quarter.

“Our outlook on potash and phosphate, including some of the capacity additions made there and pricing, is a big reason why we’ve taken our profits out of Mosaic after being in very early in the agricultural names,” he says, adding that his viewpoint on nitrogen, where portfolio holding CF Industries Holdings is a leading producer, is much more favorable.

Hedging Bets

Abate says he selectively hedges the portfolio by buying put options. “We’ll only tactically hedge when our assessment of market risk is elevated. We’ll only use puts on the S&P 500, or in a specialized manner like we did coming into this year [when] we used Nasdaq-100 options for a portion of the portfolio.”

The Nasdaq options came in handy with the fund’s tech heavyweight holdings, including Apple, Microsoft, Amazon.com and Alphabet. Abate says these companies were attractive investments thanks to their EVA improvement, but he was uncomfortable with their high valuations coming into this year. He wanted to hold on to them while trimming the risk posed by such valuations.

“As we entered the year we felt the best way to hedge that valuation risk was to buy Nasdaq-100 put options on the portion of the portfolio dedicated to the FANG-type stocks,” he explains. “If your mandate is like ours where we aim to deliver an asymmetrical upside to downside capture ratio, the hedges will help when you need them.”

The fund has a high reported turnover rate of 86%. Abate says he and his partner, senior analyst Braho Omeragic, don’t run it for tax efficiency but for tax awareness.

“We’re very cognizant of capital gains distributions,” he says. “We will take losses, so we try to be tax efficient in that way. There have been years when we didn’t have any capital gains distributions, and 2022 is likely to be another year where we don’t have a capital gains distribution.”

Centre Asset Management might have a small presence in the U.S.-listed fund market, but the strategies underpinning its Select Equity Fund and Global Listed Infrastructure strategies funds are marketed overseas in the form of UCITs distributed by Sanlam, a South African diversified financial services company that owns a 20% stake in Centre. Abate says Centre is wholly independent of Sanlam, which provides operational and distribution support so he can focus on managing funds rather than managing a business.

“We don’t want to spread ourselves too thin,” he says. “We make vanilla and chocolate ice cream in two wrappers: one for U.S. investors and one for offshore investors. All we’re trying to do is make the best vanilla and chocolate ice cream, that’s it.”