Steve Romick likes to use colorful metaphors to describe his investment process at the FPA Crescent Fund, which he has run since its inception 30 years ago. This go-anywhere fund invests across capital structures, geographies, sectors and market caps while targeting equities and fixed income along with a dollop of unconventional asset types.

“We are free-range chickens,” says Romick, who since 2013 has shared portfolio manager duties with Mark Landecker and Brian Selmo.

But the fund’s mulligan stew approach makes it hard to categorize. Morningstar, for example, puts it into its amorphously labeled “moderately aggressive allocation” category. The fund’s managers compare the portfolio’s performance against four different benchmarks—the MSCI ACWI (which stands for All Country World Index) and the S&P 500 for equities, and separate (but hypothetical) 60/40 bogeys with the 60% equity portion being either the ACWI or the S&P 500 and the 40% fixed-income portion tracking the Bloomberg U.S. Aggregate index.

“How do you benchmark a fund whose stated goal is to provide equity-like returns while avoiding permanent loss of capital?” Romick asks rhetorically. “We have lots of tools at our disposal beyond common stocks, such as preferred stocks, junior and senior debt, bank debt, convertible notes. We use some derivative notes periodically. We do some shorting.

“We look at the MSCI ACWI as the most traditional benchmark to compare us to since we became more global starting in 2011, but I think it’s also reasonable to look at a CPI-plus benchmark as well,” he continues, referring to the Consumer Price Index, plus a subjective equity risk premium added by the firm.

No matter the benchmark, Romick views his fund as the furthest thing from a closet index. “We just do what we do.”

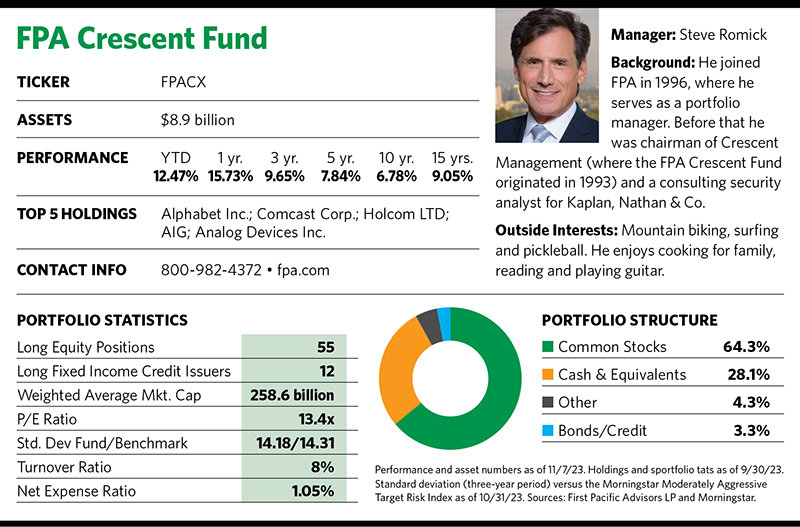

And what he and his team have done is provide positive returns, making their fund one of the top performers in its Morningstar category during the past 15 years, particularly during the past five years. More important, Romick says, the FPA Crescent Fund’s value-oriented approach has made money over every rolling five-year period during the past 30 years.

Base Case

Value investing is a core element at Los Angeles-based institutional money manager First Pacific Advisors LP—the “FPA” on the fund’s nameplate.

In a report from earlier this year, Morningstar analyst Chris Tate described the FPA Crescent Fund’s crew as absolute value investors who view risk as the possibility of suffering permanent loss, not underperforming a benchmark or peer group. He further stated that they favor securities trading at discounts to their estimated worth, names that can deliver high-single-digit or double-digit returns. The team is not afraid to load up on cash if it doesn’t find suitable opportunities.

“A lot of value managers forget about the upside and focus on the downside,” Romick says. “We think about upside in the context of the downside. We’re here to make money for people over time, but we don’t want to blow them up.”

That’s reflected in the fund’s risk/reward profile. According to Morningstar, the fund has a higher upside capture ratio and a lower downside capture ratio than its category.

Stocks typically represent the fund’s largest asset class allocation, and Morningstar notes that the valuations of the fund’s equities—in terms of price-to-earnings/book/sales/cash flow—are lower than the category’s average. Romick says that’s simply a byproduct of what the fund does and not a targeted goal.

“The thought process [on valuation] is to always seek a margin of safety in the investments we make. Look before you leap.”

Romick and his team use equity valuations mainly as a way to seek protection, so they’ll pay a reasonable price for growing, sustainable businesses with good management teams that use capital wisely and produce substantial cash flow.

They make projections on a company’s earnings expectations over the next five to 10 years, and build their models on a base case, low case and high-case framework.

“In a base case we want to make some money; on a high case we want to make a lot of money,” Romick says. “We figure the base case is more likely than the low case, but if the low case occurs it won’t blow us up.”

Episodic Opportunism

There’s an obvious question for managers of a go-anywhere fund: How do they zero in on portfolio ideas when their investment universe is whatever’s available?

Romick uses the term “episodic” to explain the investing approach. The team listens for bad news in any sector that creates dislocations and mispriced assets.

“To use the wind metaphor, we’re looking for the wind in our face, because that’s what’s creating the opportunity that one day could turn around and be wind at our backs.”

He believes that one such wind-in-the-face sector is commercial real estate, where the rise of remote work has hurt occupancy rates and rents. He says his fund is building positions in a couple of firms with top-notch real estate portfolios and solid management teams with significant inside ownership. The FPA Crescent managers also have their eyes on certain asset-backed mortgage securities they hope to buy if prices reach an attractive level.

“The bad news in the commercial real estate sectors gives us the chance to do our work and buy when people are selling. We’ll see if we get the opportunity to buy those ABM securities,” he says.

America’s Cup

One of the fund’s features is that it’s nimble in making allocations. It has held common stocks in a historic range of 27% to 74% of the portfolio, whereas the bonds/credit category has ranged from zero to 34%, and cash and equivalents from 5% to 58%.

“We can allocate quickly when we see opportunities,” Romick says. “In 2008-2009 our high-yield exposure went from single digits to 34% in about four months. We’re not seeing that [favorable] risk/reward today.”

Indeed, the fund’s 3.3% weighting toward the bonds/credit category is currently at the low end of the historic range. In turn, the fund’s cash allocation had risen to 28% as of this year’s third quarter.

Romick says the fund’s increased focus on global stocks since 2011 prompted the managers to shift from the S&P 500 to the MSCI ACWI as their primary benchmark for the fund’s equity allocation. The former index is still used primarily to measure the fund’s pre-2011 performance. As of the third quarter, the fund’s geographic allocation was 62% domestic securities, 34% international developed names and 4% emerging markets.

Romick points out that the fund’s stock selection process has changed through the years. “A lot of the old businesses we used to like” … he says before abruptly stopping and then shifting in another direction … “at the end of the day we need growing businesses. We like some wind in our sails. We’re not looking for gale-force winds to compete in the America’s Cup, but we don’t want to be out there in the calm. And we also don’t want to be thrashed against the rocks.”

For that reason, the fund has turned to some big names in the technology sector. Among the fund’s recent top 10 holdings were Google’s parent company Alphabet, Analog Devices and Meta Platforms.

The fund has a very low turnover rate of 8%, which is surprising given its variegated portfolio containing securities in different asset classes that seemingly require substantial fine-tuning to stay on course.

“Our turnover can be low when we find horses like Google that we can ride for a long time before they go to the glue factory,” Romick says. The fund initiated its position in the company in 2011.

In late October, Alphabet’s stock took a big hit after it announced less-than-expected revenue in its cloud computing division. For Romick, that’s a distraction that doesn’t dim his positive long-term outlook on the stock.

“In 10 years Alphabet will probably still be Alphabet and will have more success than we suspect in some areas and not as much success in others, but net-net it’ll be a more profitable business 10 years from now than it is today.”

The “Other” Category

The fund usually has a small allocation (less than 5%) to its “other” asset class. This can include illiquid, nontraditional investments, as well as short positions, including pair trades. The fund did such a trade with a couple of automakers when it went long Renault but shorted its strategic partner Nissan.

Other vehicles in this category have included private credit, a position in container ships, and some total-return swaps in the cannabis space.

“We do it as a basket position,” Romick explains. “We take the position that in five years these things should be worth three to five times what they’re trading now.”

He says his fund tends to do best during periods of dislocation, and not as well when the market rises parabolically. “Our downside protection tends to be better, and that’s what drives our returns,” he says, emphasizing that the fund’s calling card is its ability to generate positive returns over long market cycles.

“We’re not trying to knock the cover off the ball every quarter,” Romick says. “We don’t want to talk about quarterly returns; we look at things across full market cycles.”